Fintech for kids

Parram | Fintech Market Review

Hi, this is Clément from HUB612 👋🏻. Parram is a weekly newsletter about (underrated?) trends, topics, and perspectives on the Fintech Market. Today, I’m talking about a demographic gap that generates opportunities. Let’s talk about fintech for kids and teenagers!

“Aren’t you too young to have a bank account?” - “Ok Boomer”

Financial services keep changing, getting re-invented thanks to entrepreneurs.

A slew of news players recently intent to access some niche market, but highly valuable, such as the kids and teenagers market. Intermediated by the parents, the youngest ones have an incredible spending power over their parents. Really?

Let’s dig into this market to see how those underage kids are driving the future of the financial services market.

📧 Feel free to flick me an email if you have any exciting news you’d like me to share! I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌🏻

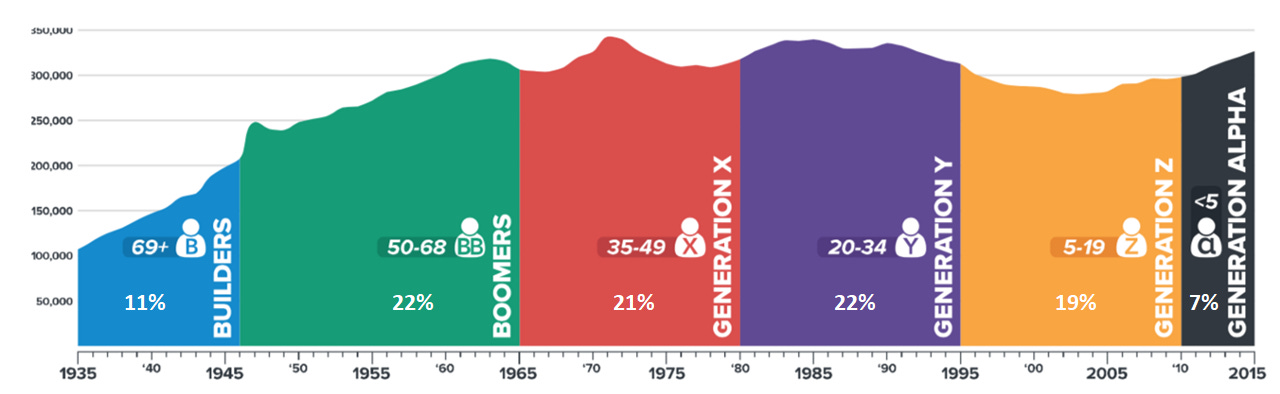

The youth economy englobes kids and teenagers who are part of what is generally called generation Z and generation alpha. As you may guess, each generation is characterized by a different look at our society, experiences, and expectations. Different labels are set from time to time as we retrospectively see generation gaps appear.

Great papers, articles, and blogs try to depict how is it to be a teenager or a kid nowadays, a tough job to know actually. Here are a few take away on consumption, and implication for companies, that are emerging in a powerful confluence of technology and behavior.

Access becomes a new form of consumption. For the youth economy, consumption means having access to the product, and not necessarily owning it.

Products have become services, and services connect consumers.Consumption becomes a means of self-expression, and the purchase is no longer driven by the goal of fitting in with the norms of groups. Kids and teenagers aspire to their own singularity

Young consumers increasingly expect brands to “take a stand.” They want to resonate with a brand that has a clear stand of specific topics (or causes) so that they can associate themselves with it.

#1 : This niche market is tough to crack, many have failed

You may consider it’s a long time ago, but in 2013 the founders of N26 first started creating an app called Papayer associated with card for teenagers. Their first attempt was a failure, but the very intuitive application they’ve built, which allows parents to monitor their toddlers' payments, was appealing. Ultimately, the founders re-used a huge part of Papayer to create the neobank as we know it today, addressing a much larger market.

Though, digital banking adoption has considerably increased thanks to N26 and other actors. And as some players already trusted the market with a general offer, a few actors try to verticalize themselves on specific niches.

What I see as challenging in this market is :

A double acquisition strategy. The users are the teenagers/kids but the buyers are the parents. Each of them has certain expectations toward digital banking, and it can be hard to please them both.

From a demographic point of view, there is a constant renewal of customer which is tough for two reasons. First of all, the acquisition must continuously be re-evaluated as the behaviors of new customers keep changing. Secondly, the churn is important as young customers can be generally volatile notably when they hit their 18y old

#2 : The spending power of the youth economy is by the way, incredibly huge

According to FinTech Futures, Gen Z today represents 30% of the world’s population and will be a third of global consumers by the end of the next decade. Their spending power is already high both directly (some of them just turned 18+ and work or others have pocket money) and how they influence spending by their parents. FinTech Futures estimate that the total spending power of Gen Z today is $3.4 trillion. It’s hard to make it tangible, but this represents an amount of money ready to be used by the youngest

#3 : Privacy is driving the market of young consumers

The youngsters don’t want to be monitored. Yet, there are not financially educated. Parents are part of the equation but shouldn’t be too invasive. Otherwise, you may not have product adoption!

Kard CEO, a vertical neobank for teenagers, acknowledges the risk of not targeting parents but considers it as a great competitive advantage. He thinks that most parents are reasonable enough to give their maturing children a little independence to become financially educated. After a short onboarding, parents only have a view on the total balance of the account of their child. Kard gives the latitude expected from the teenagers under the supervision of the parents. Interesting!

#4 : Banknotes are prehistoric. Everything is now digital.

The shift toward digital in the past decades completely changed the paradigm of personal finance management of the kids & teenagers. Now there a much more data-oriented approach, allowing a deeper understanding of their behavior and consequently better services.

Banknotes used to be the predominant way of payment a generation ago, now contact-less payment is the new norm. But what about tomorrow’s consumption, saving, investment?

Digital currencies are on their way, as China rolls out a pilot test of digital currency across four cities. Surely this will give us soon a taste of what financial services could be in the next decade.

#5 : They are the future consumers

For most countries, teenagers can’t open a bank account until they come of age. However, you can open a joint account as a minor with a parent or legal guardian as an account co-owner. And some banks do offer accounts tailored for minors.

Incumbents are being mimicked by Neobanks which are coming after the same clients with the same strategy. Revolut recently launched Revolut Junior, a dedicated app for Junior with limited features. Interestingly, they convert Junior consumers to normal Revolut consumers when they hit 18y old. Retention is key!

All financial actors are analyzing carefully the behavior and expectation of this new generation. For instance, as I mentioned in a previous newsletter, at BBVA, the bank is intrigued about how currently most popular games built and grew successfully such digital offerings.

“When I think about the bank of the future, I often think about my sons and how they play Fortnite with their friends”

- Derek White former Global Head of Client Solutions

It’s no longer about think about finance, it’s about understanding the codes that drive this generation: privacy, community, singularity, ..

#6 : Monetization is key

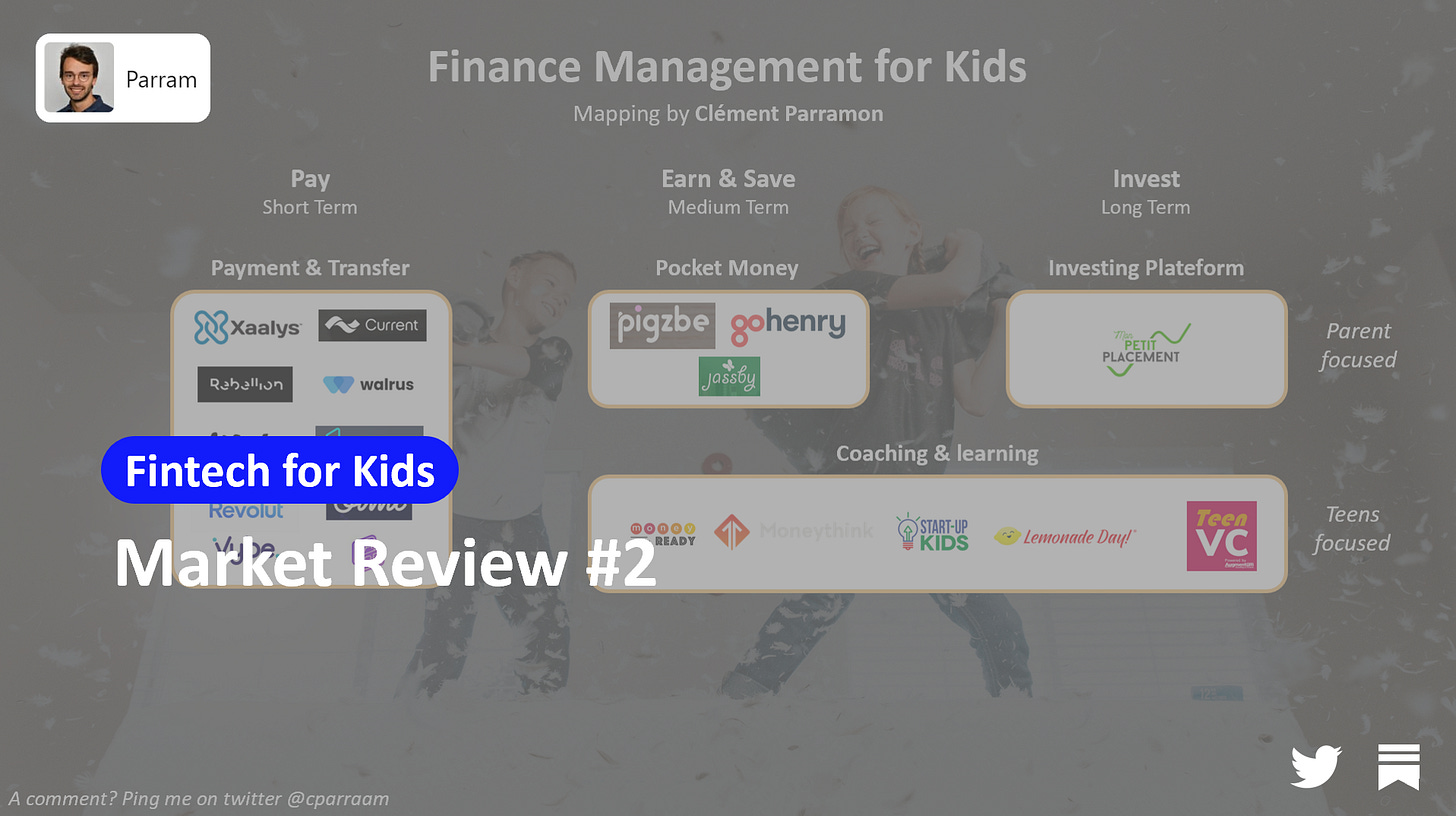

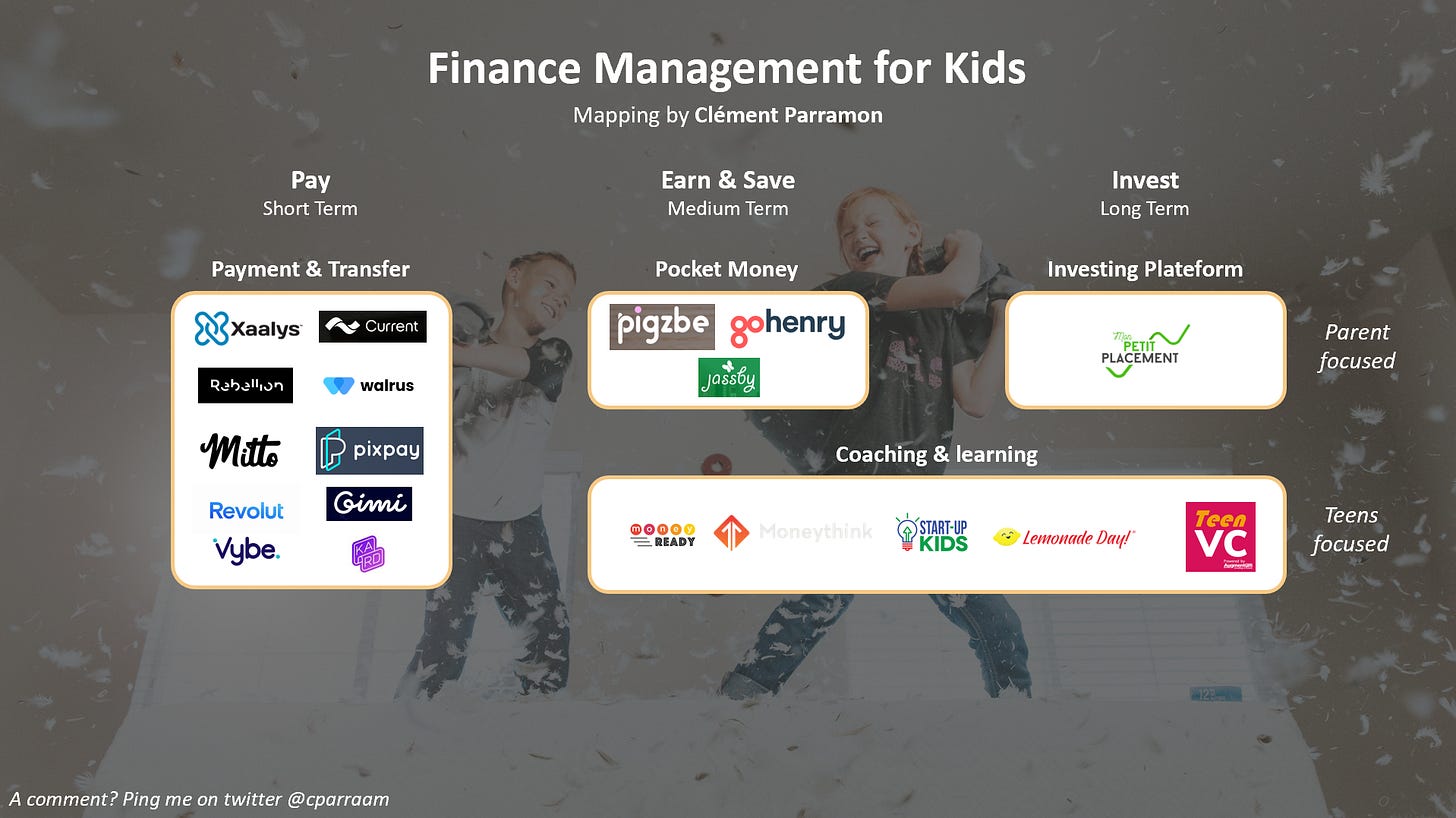

Companies are currently trying to find the right business model. It really depends on the focus they have. Are they focused on parents or children? (see mapping hereunder)

If focused on parents, it’s probably going to be a subscription fee. But when it comes to children, you have to be more creative. Then comes customization, cross-sell, brand partnership (ex: uber and Kard), ..

Furthermore, you need the lowest cost of acquisition(CAC) of a customer. That’s what companies are trying to tackle by leveraging on their community. Here above the example of Kard which is super close to their community. Basically, their community managers are 18y old, and they know the codes to talk to teenagers.

From that, they’ve pushed two ideas to get a low CAC :

1) they’ve previously set a waiting list. Access to the app was restricted to a certain number of users. Only the ones at the top of the ranking were being offered their card.

It created enthusiasm over the product which led to 100 000 registration on the list!

2) an ambassador program is live. Users can recommend the app to other teenagers to get 1€ per new onboarding. Really effective and viral as the average purchase of a teenager is pretty low, the amount gathered can rapidly be substantial.

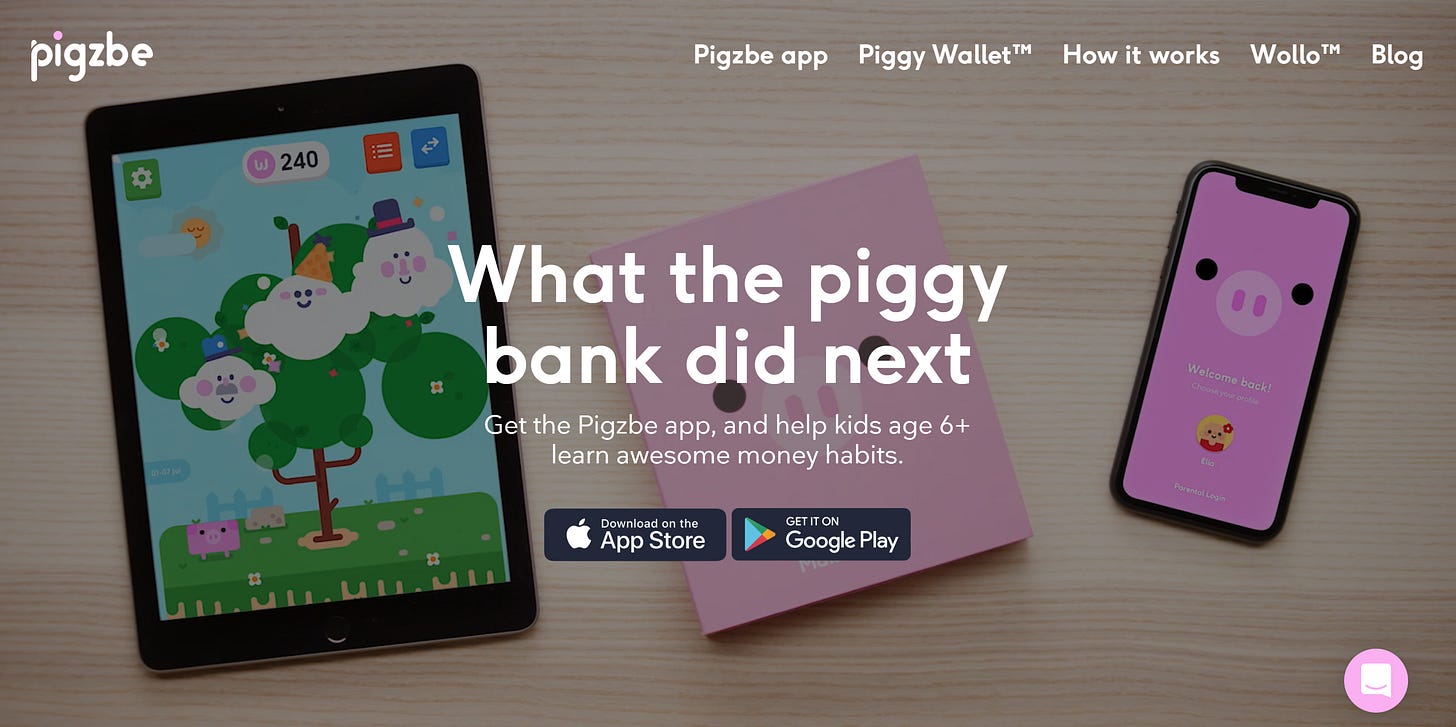

#1 : A piggy bank and its digital currency

Pigzbe is a colorful cryptocurrency wallet and interactive app, powered by a “family-friendly” token called Wollo. The hardware wallet allows kids to collect and store Wollo, while the app features games that revolve around saving and spending.

I’m personally intrigued by this kind of tech product. I’m not in the customer segment targeted so it’s hard to tell, but I’m wondering why chores should be rewarded with digital tokens and how parents would be convinced to make the purchase?

#2 : Investment and entrepeneurship for kids

A London-based VC Augmentum Fintech made a free digital education platform where teenagers around the world can learn about Venture Capital and entrepreneurship. I kinda like the idea, where entrepreneurship is encouraged from an early age. This can still be an exciting activity for kids, with a lot of learnings! Just watch this Britain show where two sisters pitch their project, I’m quite impressed!

As I made research, I thought it was an interesting exercise to make one mapping from scratch. So that it gives you a better understanding of what is being built on this niche market. Here is my first draft!

Of course, I’m missing a lot of companies. Maybe you have a thought on this topic?

Please, ping me if you want me to add you to the list! I’ll keep updating it :)

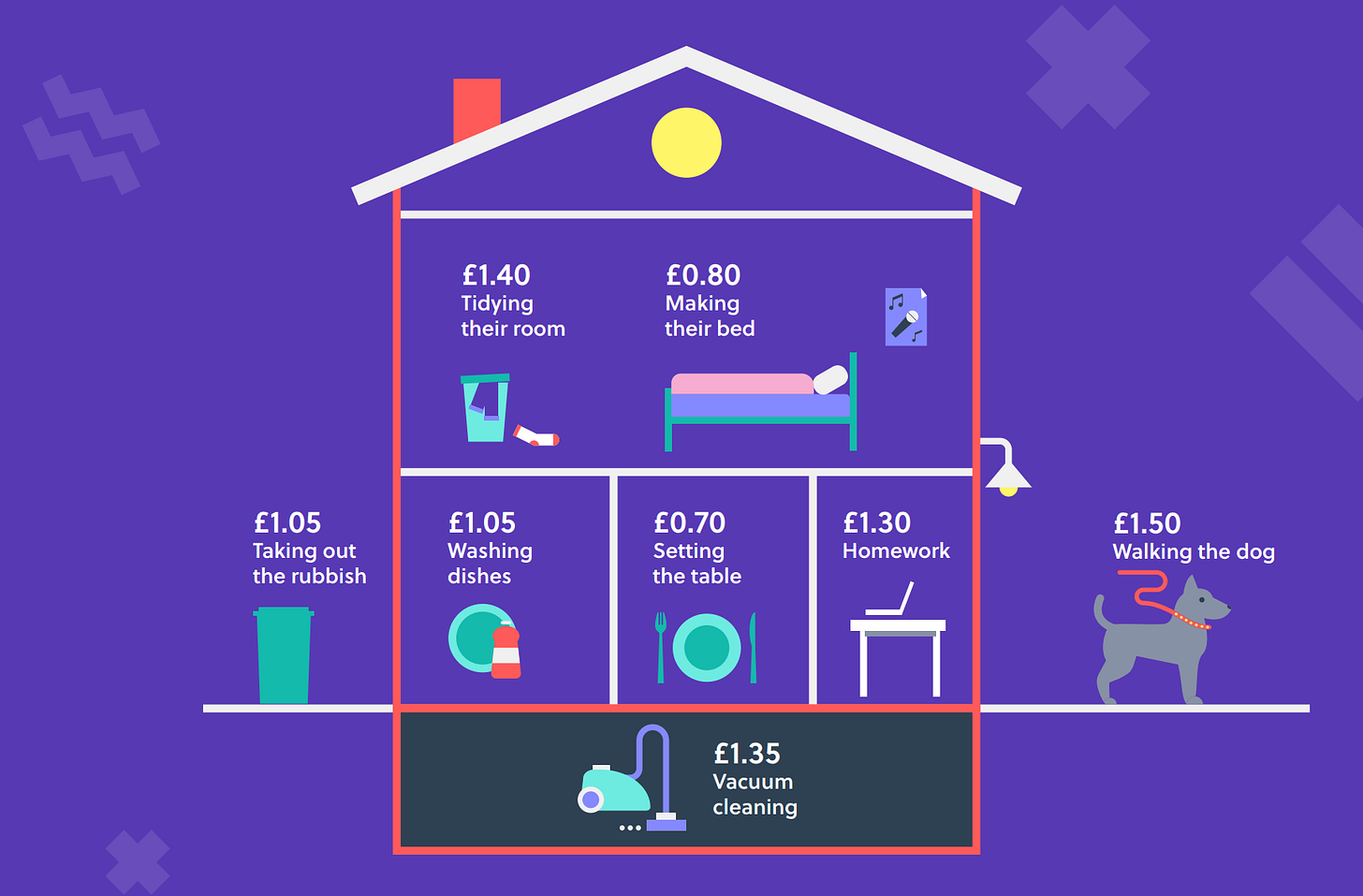

Go Henry Report

This report is a Gold mine (Thanks @alexandre for the intel)!

The startup has analyzed the financial habits of 75,000 British children aged 6 to 18. By doing this, they’ve represented how much the children earned and how, when, and where they’re spending (or saving) their money. The upper graph explains how much a child is making by doing certain chores (Making the bed and taking out the rubbish seems the best return on efforts!)

Harry Potter at 40: Would he be a financial wizard?

“Sadly, Harry didn’t have the chance to learn money skills from his parents. The fact that they put his inheritance in Vault 713 (his birthday in reverse) is not a great first lesson. Although a safe place to store a fortune, cash is not a great investment. “

Financial Times - Article here

A great read about financial education in the case of Harry Potter, left with a legacy but zero knowledge on how to manage its financial asset. It highlights the importance of personal finance management and education at the youngest age.

I hope you like this other format! Feel free to talk about the newsletter to your peers ;-)

Please do not hesitate to provide me feedback on what I’m creating every week, what I missed, what I got right, what was a discovery for you, what is still unclear, ..

Very interesting, thanks a lot Clément! Truth be told, I have still mixed feelings about this market. There is clearly an opportunity for the paytech segment of the fintech market. As to the wealth management / investing segment, I believe the only opening here is with parents, helping them to save to finance their kids' higher education degree (especially in the UK and in the US). As for the coaching/learning part, it's quite new to me but I've always thought that the combo edtech + fintech is an interesting one. I can't wait to see where this one goes!