What's up in Fintech?

#1 NOW | News Of the Week

Photo by JJ Ying on Unsplash

Hi, this is Clément from HUB612 👋🏻.

Parram is a weekly newsletter about (underrated?) trends, topics, and perspectives on the Fintech Market. Hereunder, you’ll find Fintech news that caught my attention last week 🔍

Feel Free to subscribe!

Sure it is! Even though you may think finance is complex, either on the customer or entrepreneur side, I hope this newsletter will make it fun for you! :)

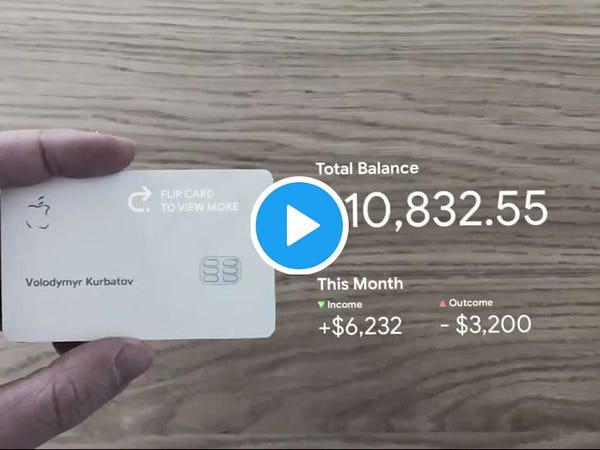

I really appreciate the various AR creations of Andreas. Here, he interestingly displays a new way of interacting with financial information. What do you think?

For the moment, a card seems to be the only enabler to challenge incumbents from the sector. Shouldn’t we look for other support?

📧 Feel free to flick me an email if you have any exciting news you’d like me to share! I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌🏻

News #1 - Microsoft announces Money in Excel powered by Plaid

🔗 https://blog.plaid.com/microsoft-announcement/

Plaid, recently bought by VISA for $5.3 Bn, partnered with Microsoft in an Open Banking approach. They co-launched Money in Excel which is a personal finance management (PFM) tool that can connect directly to your bank accounts. Access to the service is included in the standards subscription of Microsoft. It transforms a long time known software in a fintech application.

My takes on this:

For the moment the service targets individuals. The PFM market is already crowded with plenty of mobile app aggregators that already have a stable base of users. The market is niche but growing (extending value proposition).

I’m personally interested by the value proposition of such product. Money in Excel can use the desktop screen to its advantage and should probably be much more focused on long-term finance management in opposition to weekly check-in.

The strategy of selling to SMEs should be in their roadmap ? As they currently provide dedicated Office 365 Suite to SMEs, and seeing that Microsoft is empowering its tools with partnerships, it would make sense to bundle an offer for a wide range of needs: payroll, expense management, ..

News #2 - Paypal, Intuit & Square approved to offer loans to small businesses through coronavirus relief program

In reaction to the covid-19 wave in the USA, and as a part of Congress’s $2 trillion coronavirus stimulus package, a Small Business Administration’s $349 billion paycheck protection program (PPP) has been set (but already consumed). It provides aid in the form of forgivable loans for small businesses that keep all employees on their payroll for at least eight weeks. To do this, the U.S. Treasury partnered with different actors like Paypal, Intuit and Square to roll-out their PPP .

My takes on this:

Wonderfull reaction from both the state and the corporate in response to the choc facing the covid-19. The surge in jobless claims is clearly slowed down with such execution velocity.

The extremely fast reaction from Paypal, Intuit, and Square gave them a clear competitive advantage upon other lenders. Indeed, in regards to Square, Bloomberg says that Square’s program is first being offered to users of the Square payments platform, but the company said it plans to extend it to other borrowers once processes start moving more efficiently. Interesting way of getting news customers.

Always remember that every challenge there is an opportunity.

News #3 - Goldman Sachs is taking another step into retail banking with an installment loan product

Named after the first name of the bank's founder, Marcus "by Goldman Sachs" entered the market with a simple savings account and an online loan offer in 2016. Their offer tries to differentiate them from other banks and financial service providers with notably an attractive interest rate of 1,7% for customer deposits.

Since then, deposits reached 60 billion at the end of 2019 (+70% YoY), and they provided up to $7 billion in loans to new customers. They are trying their best to step into retail banking. From wall street to main street !

Apart from their partnership with Apple and the launch of the Apple Card, they've recently launched a Point-Of-Sale (POS) consumer credit service. The aim is to offer, at the physical checkout (maybe also virtual?), 100% financing of the purchase to be paid, between $750 and $10,000, for a period of 12 or 18 months. It thus constitutes an alternative to the credit card, with some specificities, such as fixed conditions, duration and rates (between 11% and 26%) and no other costs.

My takes on this :

Bad timing! Since it’s a POS financing product, we won’t get much feedback on the product anytime soon :/ But it’s interesting to see a 150 old incumbent building a retail strategy from scratch! For now, let’s consider it as an investment because Marcus bank has already cost $1.3Bn.

It’s nearly impossible to determine what the market is going to be post-COVID-19. Habits will surely change and I think the demand for a loan will surge! Good timing to prepare a hypothetical return to normal by putting in place Goldman Sachs solution? I have no doubt about the company having the financial power to reach/build a large network of merchants for its solution.

News #4 - Fitbit makes contactless payments standard on new wristband model

Following the acquisition of Fitbit by Google in Q4 2019, Google planned to gear up with Wear OS, its operating system dedicated to smartwatches. The growing interest of GAFAM in Fintech (see the previous News ⬆️) is notable. Now Fitbit wearables allow you to load your credit and debit cards to your wallet in the Fitbit app, then use Charge 4 to tap and pay for purchases on the go!

My takes on this:

Even though Fitbit accounts for 11,3% in the smartwatch wearable at Q3 in 2019, the move is bold. The pay-as-you-go behavior is a growing trend and it makes sense for google to push forward the use of google pay which accounted for 16,9% in 2018.

The logical enhancement of wearables goes toward health tech / sports tech, fintech, entertainment, and productivity-tech. Among the wide range of features embedded, the NFC payment is for many still a “nice to have but I don’t see the point of using it” but I assure you it will be a must-have! Either it is with your smartphone or wearables.

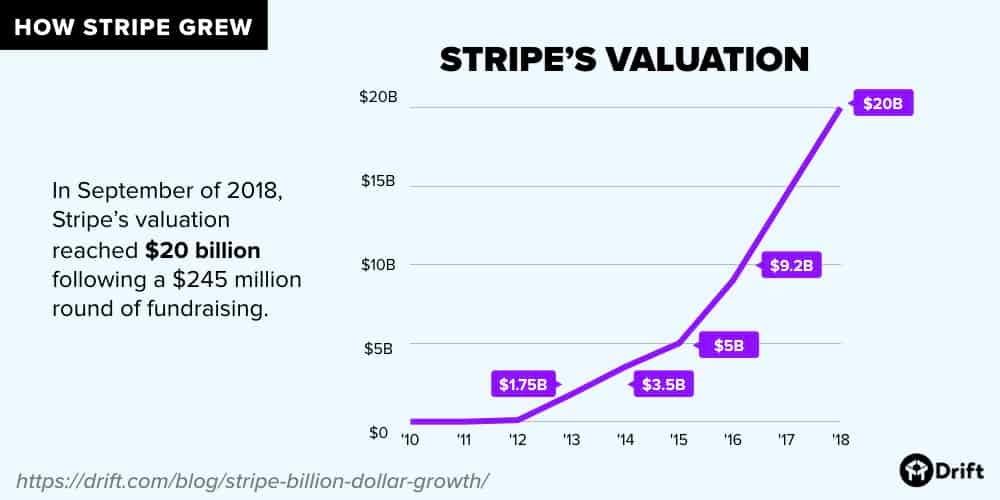

News #5 - Stripe raises $600 million at nearly $36 billion valuation

🔗 https://www.axios.com/stripe-fundraising-600-million-1f1f38b6-fde6-4316-b111-2f3b0e868ab7.html

Welcome to the minotaurs club? If reaching a $1Bn valuation makes you a unicorn, raising $1Bn in fundraising makes you a minotaur! The ambition of Stripe clearly is huge. The two brothers clearly nailed how to set payments up-and-running on a website quickly and easily (an interesting read about their ongoing journey).

My takes on this:

It seems a few investors keep investing in those times, and that’s great! This is actually an extension to Stripe’s Series G round, which closed last fall on $250 million.

Though online purchase is doing great since the global lockdown, clearly Stripe benefits from it. His clients are typically Zoom, Instacart, Doordash, ..

According to John Collision (CEO of Stripe) they made $1 bn in revenue since March 1 !!Clearly a good timing for Stripe. They’ve recently launched Stripe Capital, which offers credit to small businesses. You might guess where this is going? Stripe should win new merchants as the recovery ensues.

Google launching a smart debit card

PagoFX, startup from the Santander Bank, expand its money transfert app to UK