Hi, this is Clément from HUB612 👋. Parram is a weekly newsletter about (underrated?) trends, topics, and perspectives on the Fintech Market. Today, I’m talking about neobank for teenagers!

Two weeks ago the issue of this newsletter was about fintech for kids and I really appreciated digging in this sub-market. The segment is still largely not addressed for clear reasons. But recently, loads of actors launched new offers and products.

That’s why today I’m sharing you a memorandum about Kard, a verticalized neobank for teenagers, but not only.

Disclaimer: I’m completely unaware of what’s happening from the inside, but this doesn’t stop me from having a point of view on their business ✌️

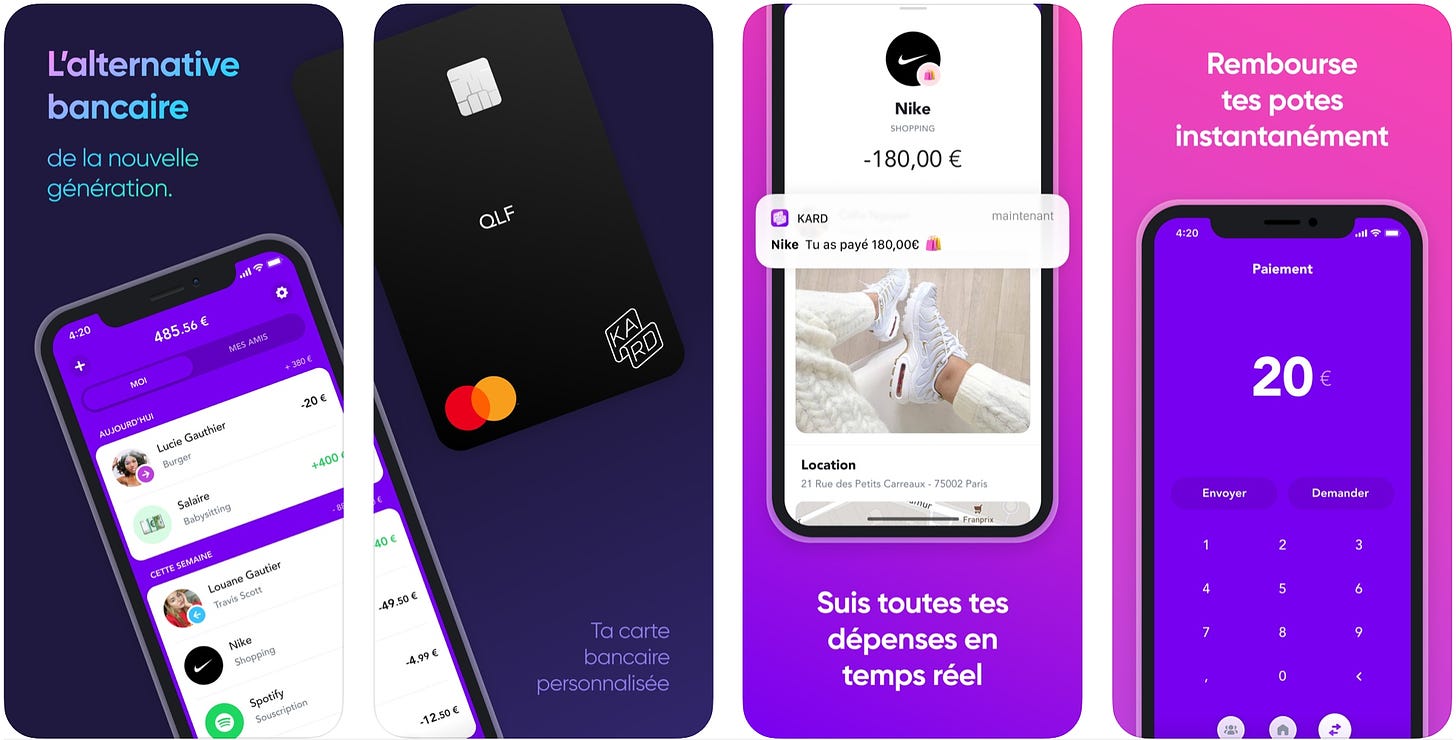

Kard is in between a neobank app and a social network for teenagers. Created as an alternative to traditional banks which still unaddress and misunderstand this generation, Kard reinvents the bank's codes to provide a cool and streamlined experience for its users. Aside from the fast onboarding and access to a bunch of financial features, Kard mainly differentiates itself in providing a financial social network where generation Z can share, react, and discuss together.

___________________(👎: Problem | 👍: Awesome | 🤔: Question) __________________

Need

Young people's access to banking services is globally quite low. For instance, even though access is getting easier, only 15% of teenagers in France have a payment card.

For people under the age of 18, opening a bank is actually hard. Indeed, to do so, you have to sign a contract to open an account. And contracts signed by minors create complexities. Yet, banking options are already available for minors (joint accounts, custodial accounts, prepaid cards, ..).

Most of the time, what happens is that children inherit the bank from their parents. According to Le Monde, 3/4 of the 16-29-year-olds kept the family establishment. In response to that, incumbents have developed a range of offers to acquire new customers. They usually use the same technical stack as for adults but with an adapted offer to children with very reduced or waived fees, welcome bonuses, .. And they prefer to focus on the buyer (the parent) rather than the users (the children).

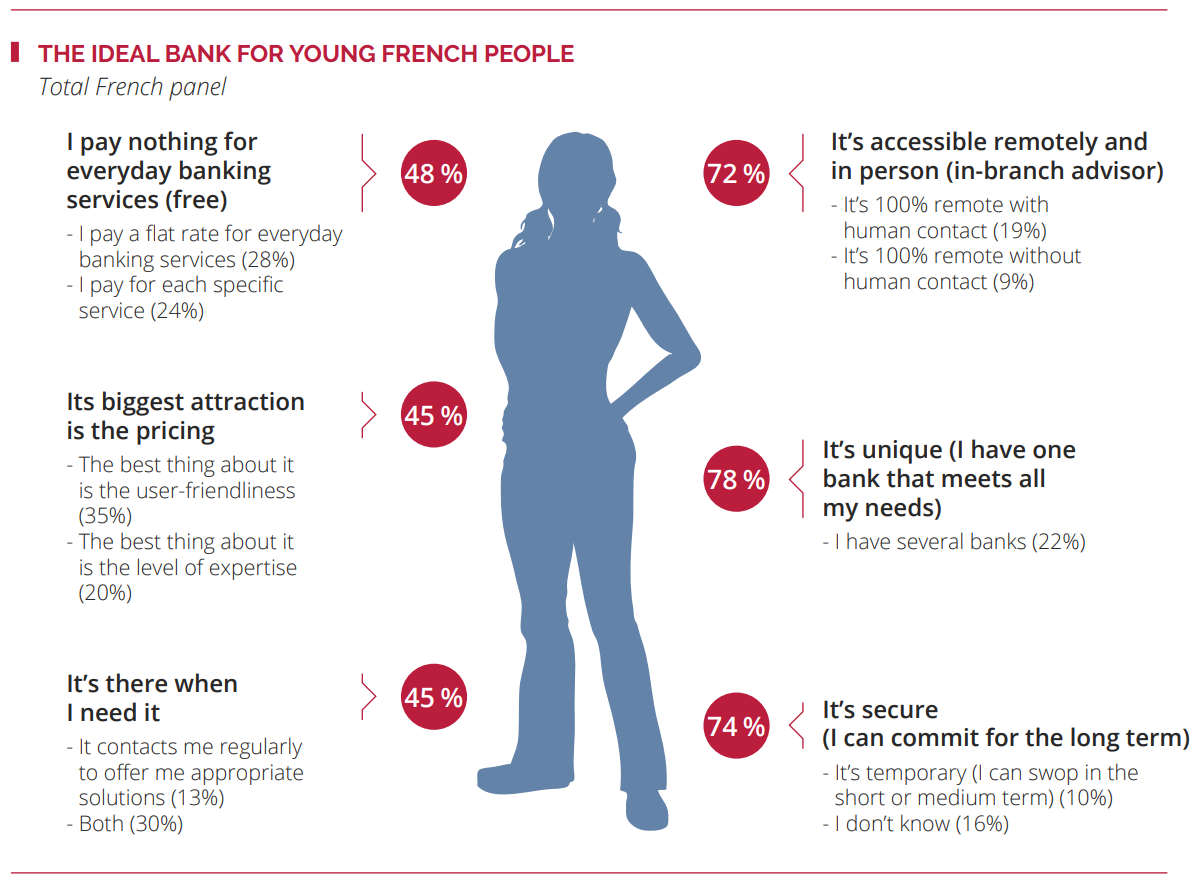

Nonetheless, an interesting study from Olivier Wyman mentions that the younger generations are the least loyal customer segments and tend to switch banks very easily. On top of that, the study mentions that they don’t see their interactions with banks as a relationship but rather as a transaction. I see unsatisfied clients here!

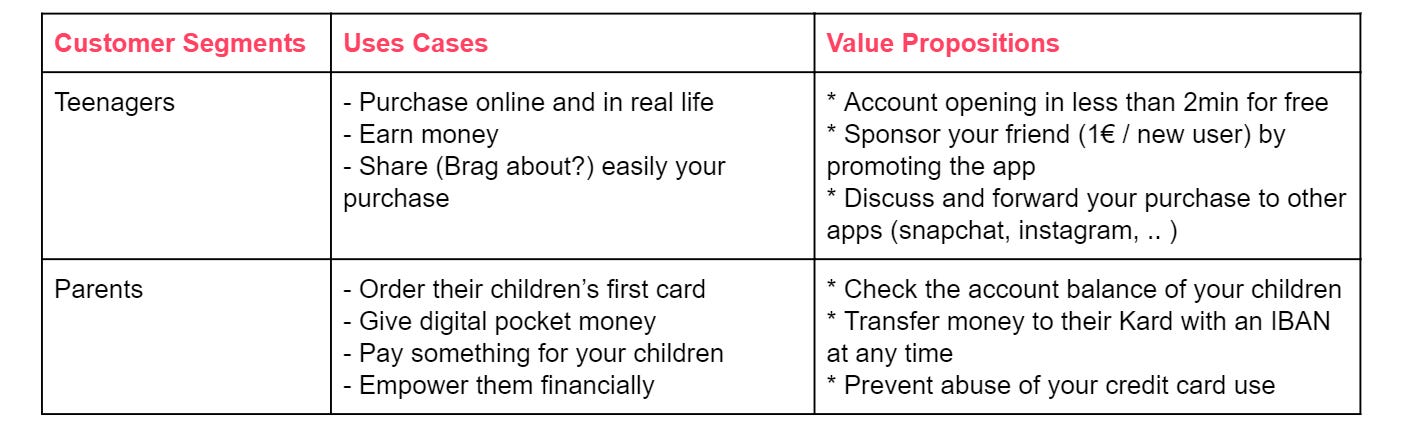

In my opinion, here are the main types of customers and what they see as valuable in Kard:

🤔 : I perceive a bottleneck at the registration/approval of the parents. Even if they convince a new user to use Kard, they still have to convince the parent. I’m wondering how they tackle this double acquisition and what is the conversion rate (#account validation by the teenagers/ #account creation). Back in September 2019, Kard said 80% of parents have approved the first-wave of accounts, which I found surprisingly high!

Also, the pitfall of these financial applications (bank app, PFM app, .. ) is not to notice that young people are still too detached from these financial topics. The false answer is to present financial education as a good way to take this market.

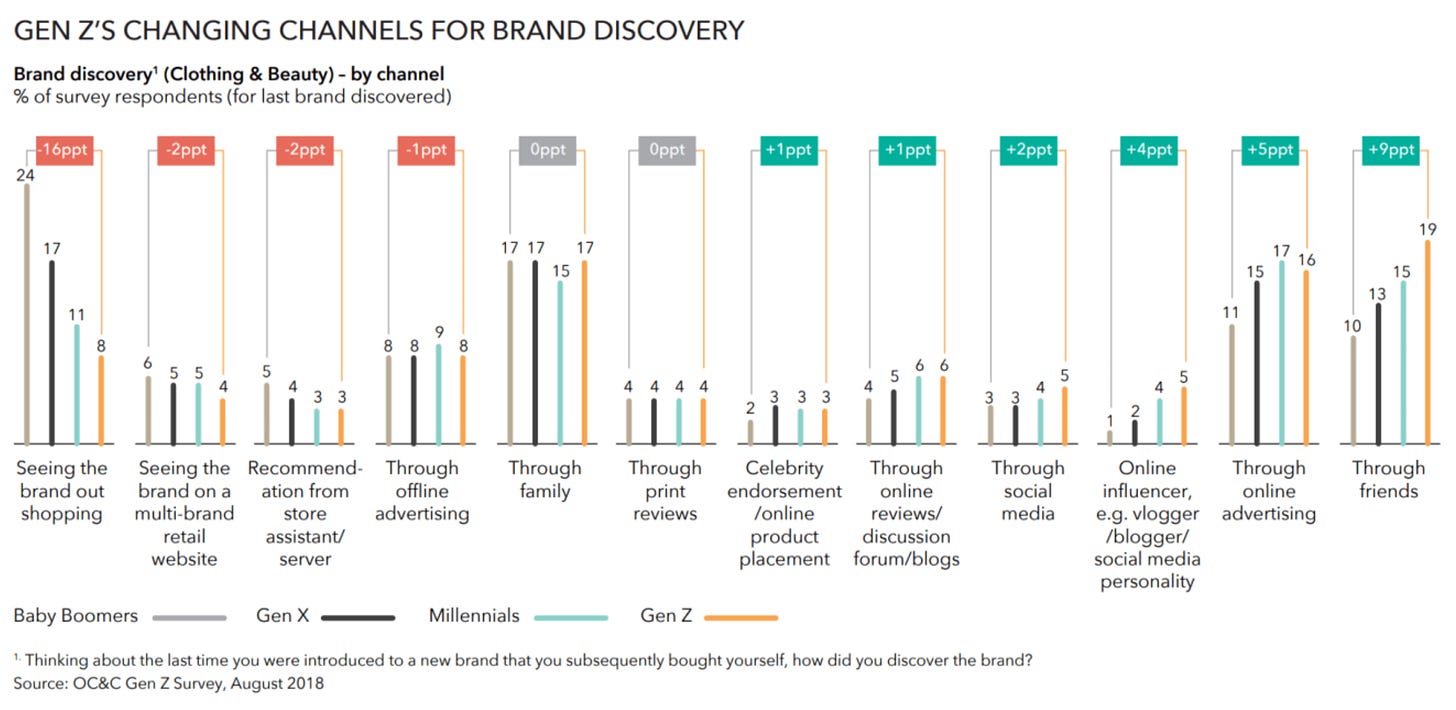

Actually, as I mentioned in a previous issue about Fintech for Kids, the Gen Z is expecting the following:

Rapidity of execution

Transparency

Being part of a community

A brand that resonates with them

👍 : Kard understands that being just a bank app is not sufficient. As their CEO mentions it, they are closer to a snapchat / zenly than a financial app. The app is used on a daily basis through community features

Market

The global Gen Z Spend in 2018 was estimated at $3.4 trillion. It can be decomposed of $2.4 trillion in direct spend (either earned or money received from parents/ guardians/relatives, e.g. allowance/pocket money) plus $0.9 trillion through influenced spend ( household spending where Gen Z influences either the amount spent or the items bought).

This market is by definition being renewed as time goes by, but we can notice that the global population slowly increases. Which expands, directly and indirectly, the size of the market. The whole point is about capturing those new volatile customers.

The dynamics of the market are the following:

👍 : First, let’s be clear. This global market isn’t unbanked, it’s pre-banked.

I mentioned that young people's access to banking services is still globally quite low. But the time to market seems to be good enough to see a surge in terms of offers for those young customers. Compared to the failure of Papayer (N26 first product dedicated to teenagers) to address this market back in 2013, now :Online purchase is the new norm and subscription-based model is largely accepted. Teenagers are snacking contents, goods, and services at a rapid pace and repeatedly, increasing the need in digital payment solution

More and more community applications have been built, reshaping the interactions between teenagers (Snapchat, Yubo, Tiktok, .. ). They want to see and to be seen, they want to react

👍 : Those customers are digital natives (96% own a smartphone). They trust the technology and by this extent are less reluctant and are fearless about their personal finance management

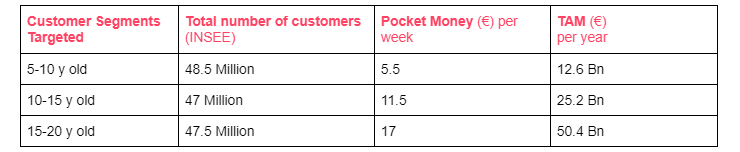

According to INSEE (the national statistic bureau of France), there are 143 million Europeans under the age of 20. Leveraging on the great study from GoHenry about, I can estimate the average pocket money amount of those customer segments and thus the potential of the European market.

We can see that a pile of money is transiting between parents and teenagers.

Teenagers across Europe earn pocket money, ad-hoc gifts, and payments for undertaking household chores (making their bed, washing dishes, .. ). Yet a large part of which is still paid in cash.

👍 : However, the Gen Zs are gradually moving away from cash usage to online cash instead (more awareness + trust in technologies = more adoption). This is a huge opportunity for financial actors to absorb this financial flow.

Product

Kard is an app and a personalized card that teenagers can obtain from their 12 y old, through a double KYC (theirs plus the 3min parents KYC). This gives teens total autonomy and a practical way to receive pocket money.

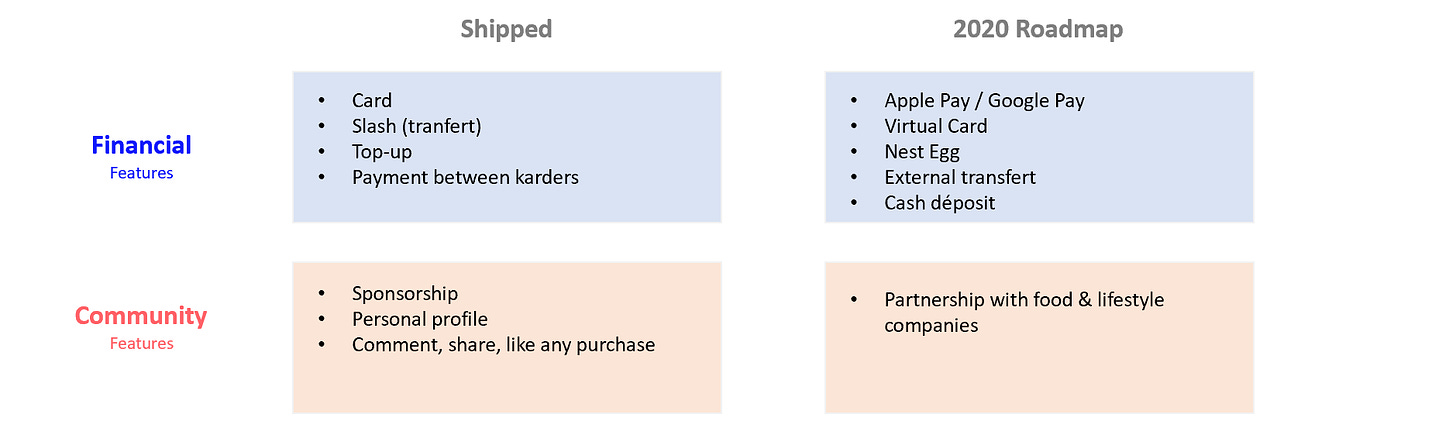

👎 : The app is way behind other well-established competitors in terms of features. Lots of teenagers are expecting features such as contactless payment with Apple Pay / Google Pay, Virtual Cards, digital nest egg, external transfers, .. This must affect their retention and user activity. I’m not blaming them, I guess they must be working like hell to deliver those expected features!

The interesting approach Kard has is its focus on teenagers rather than on parents.

According to Jason Dorsey (branded as the #1 Gen Z and Millennial Speaker and Researcher), this generation has always had access to new services such as Uber, Netflix or Spotify, which have each created new standards of "normality". He also considers Kard is very well positioned to create this standard for Generation Z and its new way to interact with money.

👍 : I strongly believe that neobanks should be much more integrated in our mobile usage. Kard bets on being more a Snapchat than a banking app, which I find appealing. The virality of Tiktok notably came from how easy it is to share and interact over the content. I think it’s a good start to see community features being shipped (send likes, share expenses, post comments, ..) this will considerably increase user activity and user stickiness over the product.

From what I saw from their customer review :

👍 : The sponsorship program must be working quite well and the amount significant enough as most of the comments are users sharing their code (mine is CLEPAR, feel free to join!). Kard playbook is to convince you to recommend the service to your friends. Kard users are even called Karder, this seems like a reachable status

👍 : The onboarding seems frictionless for both the teenager and parents. (sorry I’ve not checked the second one :/)

To go further, here are my takes:

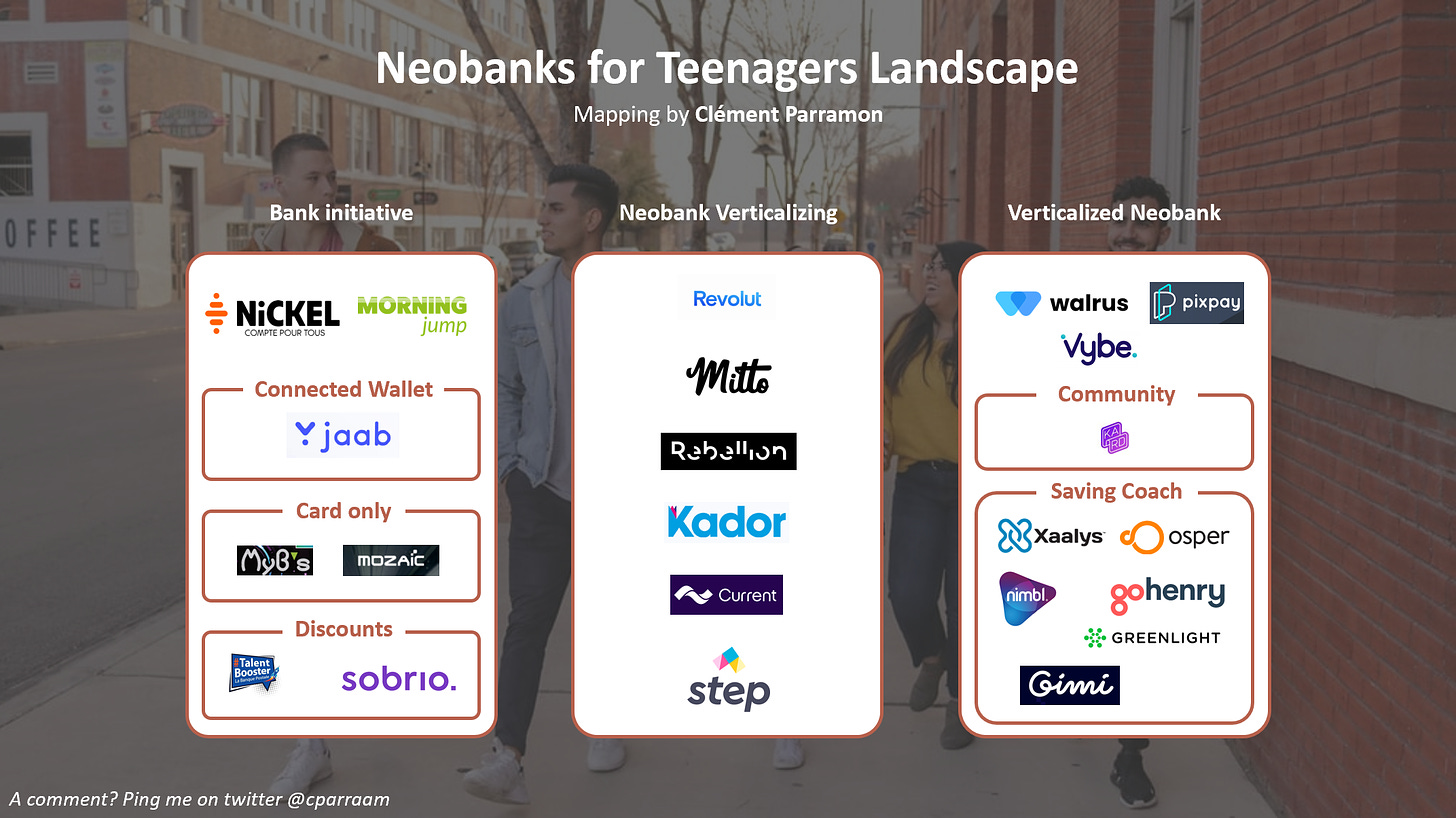

👍 : They are currently an agent of the electronic money institution Bankable (UK) which is portable in Europe (for rapid expansion), unlike Trezor used by its European competitors (Xaalys & Pixpay).

Though, they expect to start a gradual migration of a few accounts to their own core banking system at the end of the year, in order to move away from Bankable. This is key in their business model as this will allow them to gain flexibility on the integration of financial products and partnerships🤔 : The product has to evolve with its users and in my opinion, this is an issue that Kard has to tackle. Indeed, expectations can be really different from 12y old to 25y old users. Especially when they hit 18y old, they suddenly have many more topics of interest (loan, financing, investment, ... )

Team

Well, at first I landed on this interview of Scott Gordon (CEO of Kard) where Stéphane Soumier starts the discussion by noting that Scott has a hero's name. (I can’t deny that)

After checking the LinkedIn profiles of the three founders, I could find out that:

👍 : Two of them are repeat entrepreneurs (CEO & CTO) and have worked for great companies: Stuart, Tiller System, ..

🤔 : The founder-market fit is not obvious. Only the COO has worked in a bank

👍 : The CTO is a board member of several companies (Sqreen, Bearer, Hull, .. ), this is a positive signal either in term of business development, strategy and network

Also, I found out that:

👍 : Jean-Pascal Baufret both chairs at their Board of Directors and Qonto’s Board. This must be quite insightful for their development

👎 : The CEO keeps working for 2 companies he co-founded? Well that seems time-consuming

👍 : They claim they had several 9th-grade interns which I find a good playbook to keep understanding what drives their targeted customer segment. I like to see a company being built as close a possible to its users

👍 : They’ve been capable of hiring 20+ people (mostly senior engineering) from great startups: Uber, Nubank, Skyscanner, Airhelp, .. They’re good at recruiting!

Marketing, Distribution & Sales

From what I see, they are successful in attracting customers. They had 150k+ in their waiting list when it still was up. They created a rarity around the product that the team was afraid of. They say their CAC is close to zero.

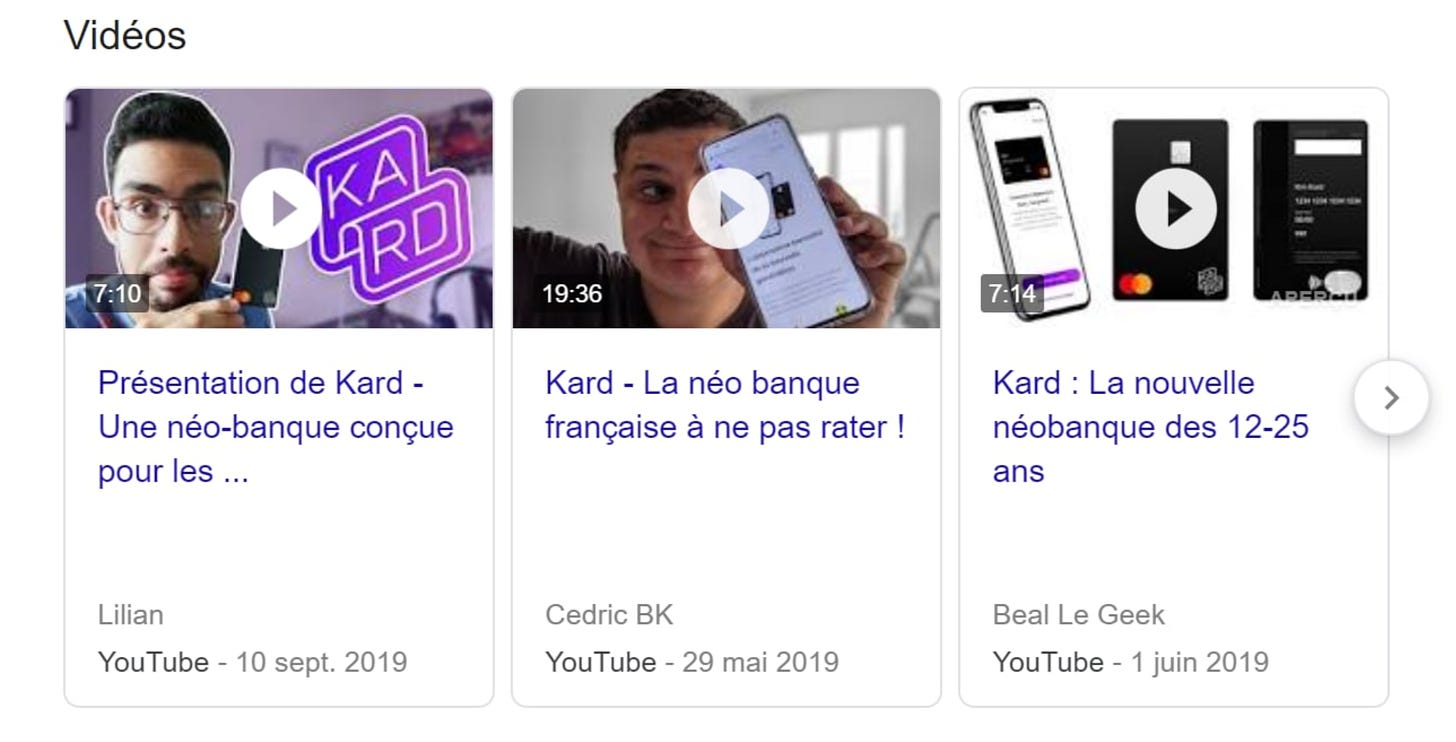

They try to engage teenagers as much as possible. Either it is through their sponsorship program, the communication on their social network (Instagram, Youtube, .. ) with their codes they any teenager can relate to, or ambassadors ⬇️

🤔 : Yet, the main struggle is probably the retention of such customers. They are extremely volatile. I’d love to see in detail their cohort analysis to appreciate how good are their playbooks. The last two months must have been a serious blow for them as the global paiement business line was stricken by the crisis and that there are 55%-65% fewer transactions since mid-march for most of the neobanks. The number of users is what increases the valorization of neobank over its competitors, thus I understand their wish to launch across Europe. But are those customers staying?

Traction & Business Model

It’s difficult to have an opinion on this from the outside.

They had between 200k and 250k clients in France in February 2020. Knowing their France addressable market is about 6.5m (from 12y old to 25y old) of which only 15% have a payment card, they reached 25% max of the French Market in 1.5 years?

If the service is free, are we the product?

They collect interchange fees for each payment between a merchant and their customers. Though, those fees are quite low in France (0.20%)

They have launched brands partnership with Uber Eats, meaning they receive commissions

Kard specified on Instagram that they are working to integrate Apple Pay. But it is important to notice that Apple requires banks to give it a cut of the interchange fees associated with Apple Pay feature. And it doesn't allow banks to recoup these costs from their customers. This must hit Kard margin!

👎 : The unit economics remains unknown. But the revenue streams seems very low

The company is betting on a diversification of the product they can offer to the teenagers. How far is the breakeven point?

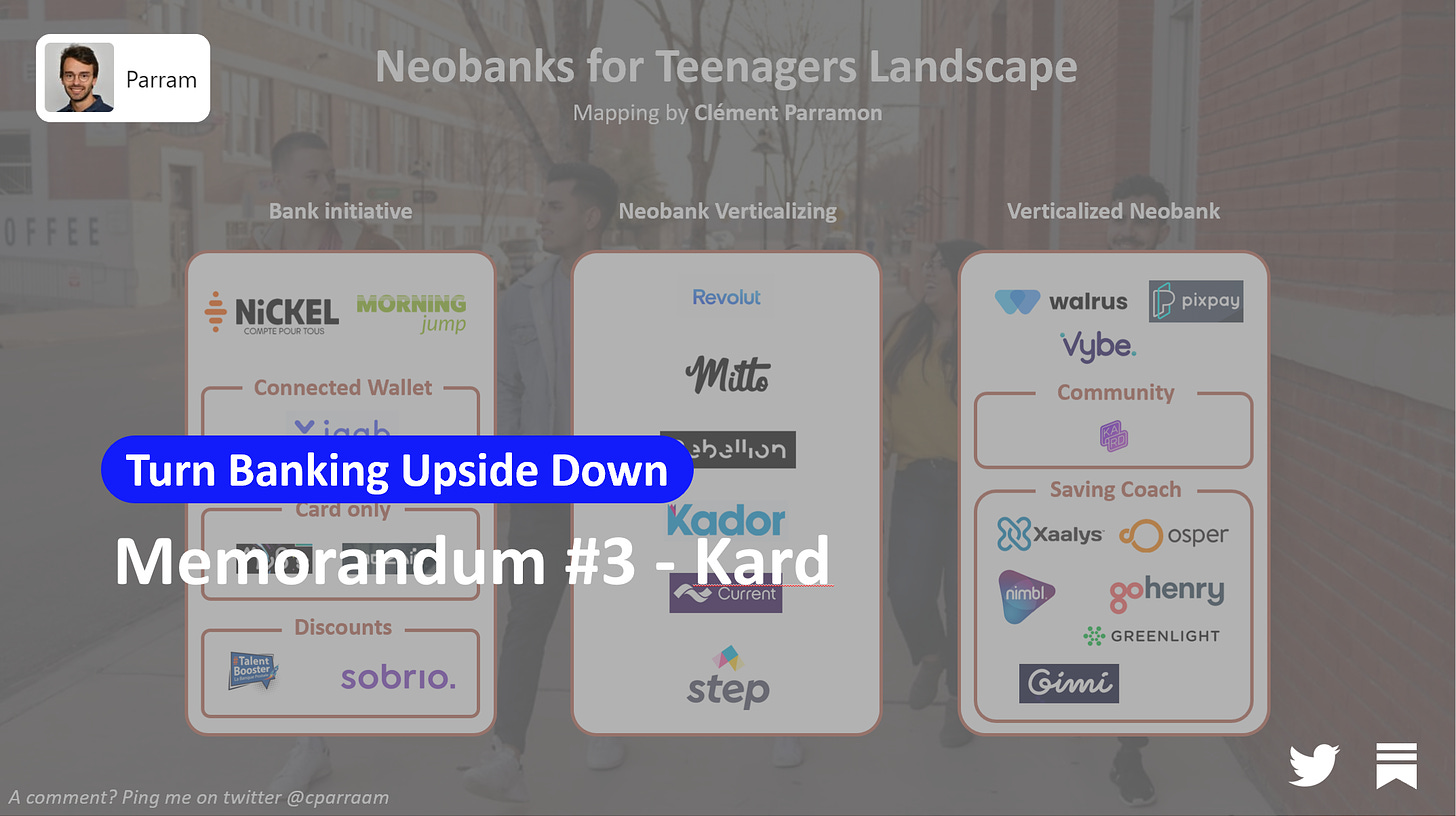

During my research, I haven’t identified any mapping on such a sub-market. I thought it was an interesting exercise to make one from scratch. Here is my first draft!

Of course, I’m missing a lot of companies. Please, ping me if you want me to add you to the list! I’ll keep updating it :)

# News 1 - They’ve raised €3M

They raised 3 million from Kima Ventures and business angels such as Francis Nappez and Jean-Pascal Beaufret in Mai 2019

# News 2 - They roll out plenty of new features this year

“Teenagers came for the vibes and stayed for the product'“. In a nutshell, Kard has to work on both to attract, engage, and retain their customers.

Something wasn’t clear enough? Check the glossary for some explanation :)

I hope you like this new format! Feel free to talk about the newsletter to your peers ;-)

Please do not hesitate to provide me feedback on what I’m creating every week, what I missed, what I got right, what was a discovery for you, what is still unclear, ..

❤️❤️Drop a heart if you’ve learned something❤️❤️

📧 Feel free to flick me an email if you have any exciting news you’d like me to share! I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️

Great memorandum!

I really wonder what Kard long-term strategy is. I may be wrong but I don't believe there is an interesting market around banks and teenagers. The core business model of banking is based on loans (and I hope Kard isn't betting on a world where the European higher education system becomes as expensive as the anglo-saxon one). Thus if you can't make money on loans, then you try to make money on payments, which is a paytech model and not a banking one.

In my humble opinion, the only move they can make would be to acquire at a next to 0 CAC teenagers that will eventually become high net worth individuals / high consumers of financial services and products. In studies made by firms such as Exton Consulting, it is crystal clear that most of the revenue of insurers and banks come from a tiny portion of their clients (Pareto law). But these clients, once they are working and investing, have a huge CAC (several hundreds of euros). So Kard endgame could be to build a very attractive customer base that they would later sell to an incumbent.