Hi, this is Clément from HUB612 👋🏻.

Parram is a weekly newsletter about (underrated?) trends, topics, and perspectives on the Fintech Market.

I hope you are doing well. The lockdown is lifted in France, the coming days are going to be weird for everyone. While we wait for better days, here are the Fintech news that caught my attention last week🔍

Ok, maybe it’s photoshopped :)

2020 Berkshire Hathaway Meeting

Last week, Berkshire Hathaway Chairman and CEO Warren Buffett hold a loooooong (5 hours) conference. Interesting talk in which he shared his vision on the USA’s history, the markets pandemic which considerably affected the Berkshire Group ($ 50Bn net loss), and a lot more.

He’s confident that the American economical miracle will prevail after the crisis the world is currently facing. To be noted, his holding Berkshire sold all his shares related to aerial transportation! #RichardBransonVibes

NB: The internet made Warren Buffet a meme. Simply because of the cool slides he made 😂 Check this out!

Creating an Unprecedented Digital Financial Services Giant: Before, During & After COVID-19

FT Partners, an investment bank focused on Fintech held a webinar with two big neo-bank players: Chime CEO Chris Britt and Revolut CEO Nik Storonsky

Both briefly talked about their background, the initial vision of their company, the impact of the Covid-19, and where the future of their business and industry.

You should see how different those two founders are, the contrast is notable! I’ll focus on Nik here. He pragmatically explains their global paiement business line was stricken by the crisis and that there are 55%-65% fewer transactions since mid-march. What makes them breathe is the fact they have a lot of business lines, allowing them to keep pursuing their growth. The topics which are booming: crypto, trading, savings account, ..

When you look at other classic retail banks, Revolut growth in such time is baffling!

📧 Feel free to flick me an email if you have any exciting news you’d like me to share! I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌🏻

News #1 - A first digital bank victim of Covid-19 : RBS’s neobank Bó

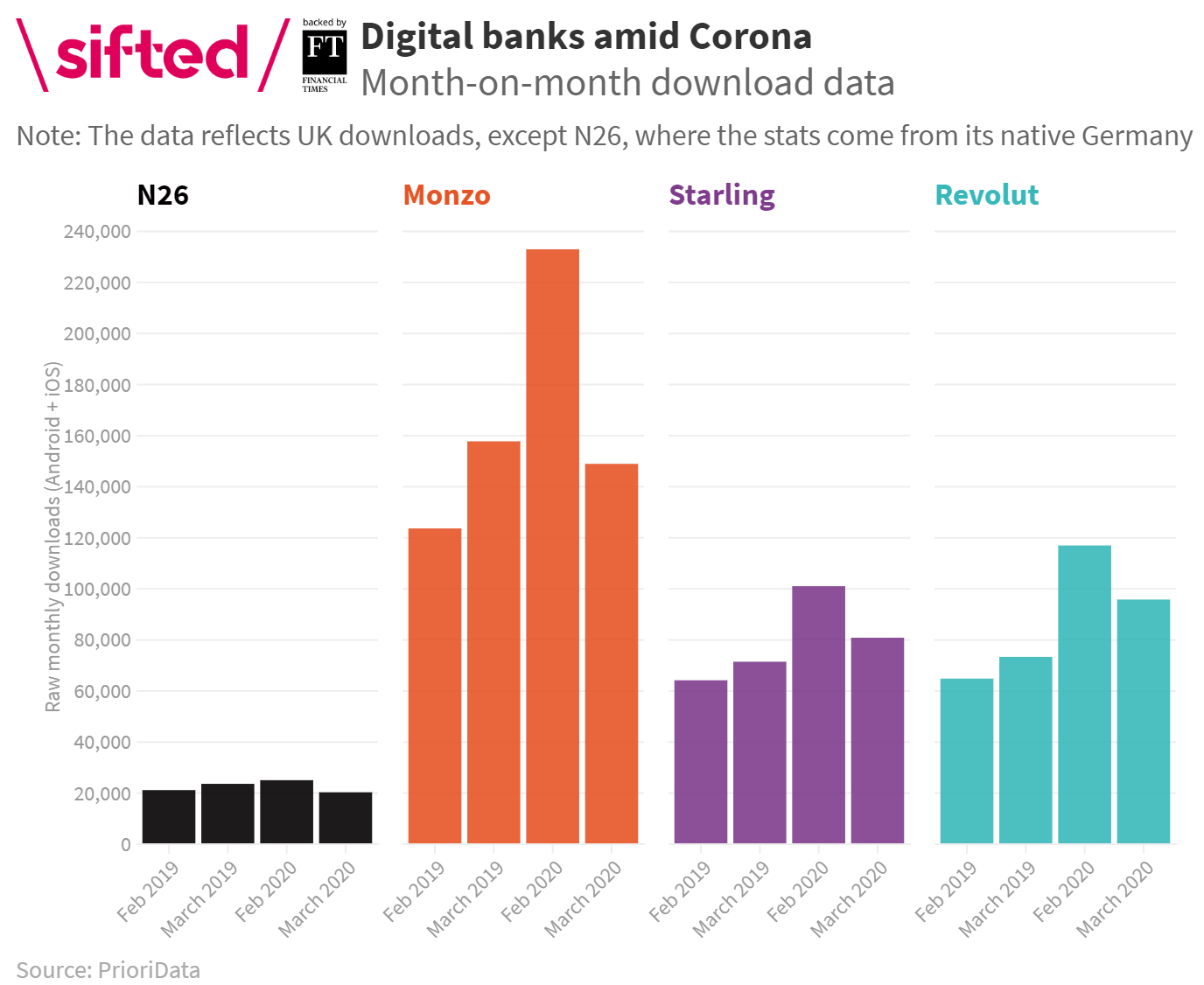

Retail banking apps (neobanks) are currently suffering from the COVID-19 as fewer consumers use their app and card to make purchases. According to sifted, Monzo, Revolut, Starling, and N26 saw their growth rate dropped down by between 18% and 36% in their native markets. For instance in Europe, the number of daily users has significantly reduced among almost all neobanks except in Sweden where the less severe lockdown absorbs the choc.

In December 2019, one of Britain’s largest banks RBS tried to compete with other well-established players (Monzo, Revolut) on a digital retail bank offer by allocating over £100m to launch Bó. As you may guess, the timing could have been better.

After six months of operation, the bank had around 11 000 customers, which is a fraction of what Revolut and Monzo had in UK territory. RBS decided to pull the plug on its digital retail bank.

My takes on that:

It’s hard to penetrate the U.K.’s digital banking market which is already crowded and mature with little to no differentiation. There was no clear unique selling proposition. Why would the clients choose Bó in the first place?

Here how I see the situation:

Politics (Bó’s chief executive Mark Bailie stepped down in January) + Tech flaws (still bug fixing three months after launch) + Low Customer Engagement + Few customer feedback (Store Rating very low or fake review) = Expected FailureRBS has just proven how complicated it is for banks to have internal initiative. It seems very hard to replicate a tech startup culture among a big corporation.

News #2 - Robinhood raises funds (again!)

Robinhood is a consumer investing app that introduced millennials to equities, options, and crypto trading at no charge. The startup has currently 13M active users and is leveraging on the increasing amount of savings stocked because of COVID-19.

They’ve just raised an impressive series F of $ 280m at a $ 8.0 bn valuation, led by existing investor Sequoia Capital.

My takes on that:

Robinhood is a great example of the influence of a new player on the incumbent’s business strategies. Indeed, by disrupting the discount brokerage space with commission-free trading, the startup forced a large number of incumbent retail brokers to change their policy. I love to see that happen!

According to Techcrunch, the valorization is slowing down. But, it seems that the current situation Robinhood is facing is rather comfortable. The savings boom is notable. In March 2020 they saw “more than 10x net deposits” when compared to the monthly average they set in the last quarter of 2019. They must capitalize as much as possible on this unexpected episode to obtain a great exit opportunity (a bank/neobank acquisition?)

Nevertheless, the surge in active users led to repetitive shutdowns of the service. Pointing out the fragility of the infrastructure when it comes to scaling. That is a critical subject to tackle asap.

News #3 - Revolut is hunting others players

According to the Financial Times, Revolut is looking to use some of its $500m recently raised to buy rival technology companies, that are currently hit by the COVID-19.

My takes on that:

It is coherent with what a skewer of VCs commented about the future of Fintech, we are about to see a consolidation of the market. Both for expansion or diversification of the business lines.

Thus, we can expect Revolut to get closer to local actors well established to expand their geographical footprint. Could we see Revolut buying Chime?? Indeed, N26 and Manzo are struggling to get into the US market, while Chime already owns 60% of the neobank market share in the US (as measured by monthly active users).

On the other hand, we can foresee Revolut having an appetite for travel aggregators as Nikolay Storonsky indicated his interest in creating a card for travelers with a continuum of services. The traveling industry has been considerably hit, this is the best moment for Revolut to do his shopping!

Stilt is launching a free US bank account and a card for immigrants

Agicap just raised € 15M a round led by Partech. Existing investors BlackFin Capital Partners and Kima Ventures also participated in the round. I did a memorandum a few weeks ago, check it out!

Samsung heading toward launching its own debit card, in partnership with personal finance company SoFi. Aside from Samsung pay, the firm is also developing a “mobile-first money management platform”

N26 raises another $100m in series D extension

A CEO of a blockchain advisory firm got hacked by teenagers. Cybersecurity is especially important in finance

Partech closed the fundraising of its new investment vehicle named Partech Entrepreneurs III. Dedicated to seed investment, the €100m fund has already seeded 40+ companies in different sectors: health, work, commerce, finance, mobility, and computing

I hope you like this other format! Feel free to talk about the newsletter to your peers ;-)

Please do not hesitate to provide me feedback on what I’m creating every week, what I missed, what I got right, what was a discovery for you, what is still unclear, ..

The next issue will include a lexicon!