Hi, this is Clément from HUB612👋

I hope you all had a great summer. I took a small break, but I now back on tracks now the weekly issues will be back in your mailbox. This week I'm talking about Decentralized Finance.

Each week I cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.I hope you find it usefull! :)

Following the 2017 ICO boom, decentralized finance (DeFi) has had a rapid and steady development and emerged as Ethereum’s next big use case. Some people like to call it Open Finance, as decentralization is a means and not an end in itself (but please be careful not to confuse this concept with open finance as an extension of open banking).

DeFi is an open-source and decentralized financial ecosystem built on top of the Ethereum blockchain. It appeared as an alternative to traditional centralized finance which historically (i) lack transparency (ii) is centralized, notably in terms of decision power (iii) has low interoperability (iv) ..

Put it simply, DeFi is a global and open alternative to every financial service you use today (savings, loans, trading, insurance, .. ) accessible to anyone in the world with a smartphone and internet connection.

The benefits of DeFi are diverse:

It’s permissionless. DeFi enables people who otherwise don’t have access to financial services to take part in the global economy. (see how) It’s the

It gives access to other forms of capital. Latin Americans grasped the significance of cryptocurrency at an early stage. Living in struggling economies, hyperinflation, and capital controls, many people throughout Central and South America started turning to cryptocurrencies as economic conditions worsened in 2015. Here, DeFi gives people like those in Latin America an alternative. For example, they could store their wealth in DAI, which is meant to mirror the value of the USD

You can put your money at work. DeFi allows you to put that money to work. For example, DeFi Dapps like Compound and Dharma let you deposit assets like DAI and USDC, which are then lent out to borrowers. Another way to see Compound and Dharma is as high-interest “savings accounts”.

It’s non-custodial. DeFi users are the only ones to own their funds.

DeFi apps are composable. Composability generally means that stuff is built to work together in a variety of ways. In DeFi, it means that in the open-source world of DeFi, all projects are built with existing bricks (exactly like lego, that’s why it’s called money lego). Entrepreneurs start building their projects by combining existing bricks and then add their layer of innovation.

..

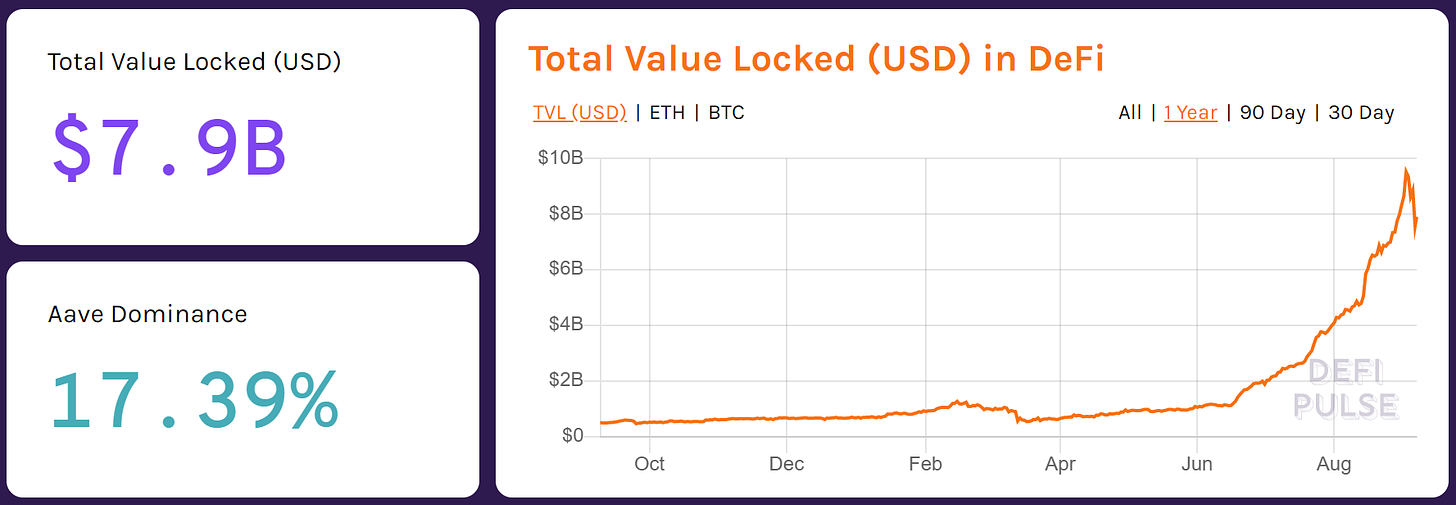

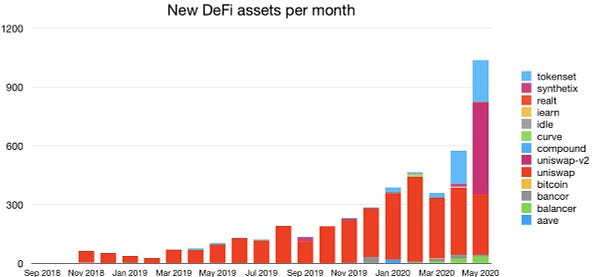

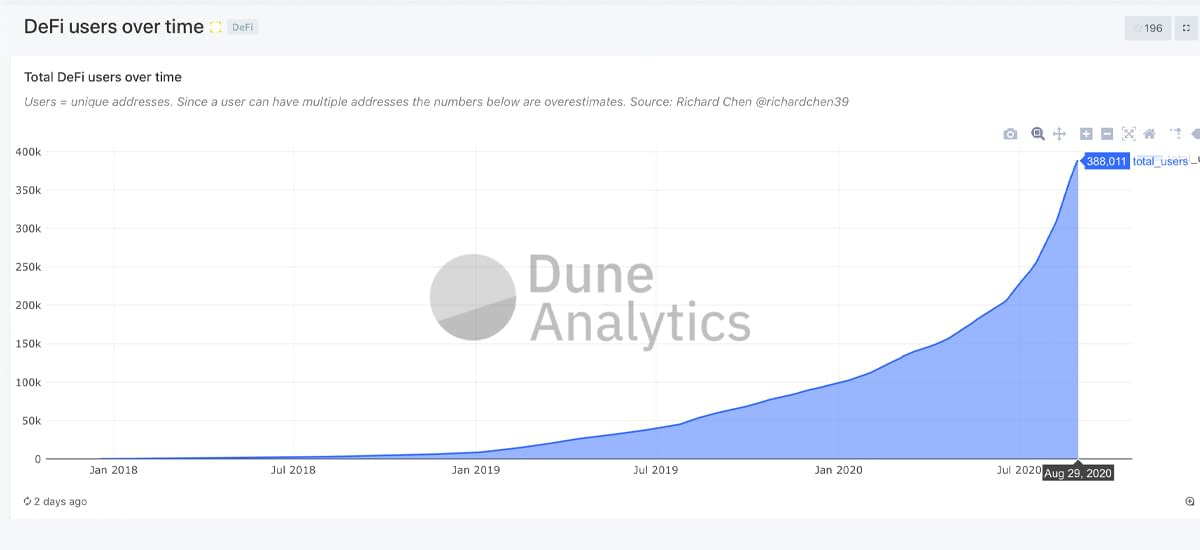

Current DeFi Explosion

Here are signals of a DeFi bolting. In the past months, there was an incredible wave of capital inflows to DeFi projects. When looking at DefiPulse, the decentralized finance leaderboard listing all the different protocols in DeFi, we can see a clear surge in value (USD) locked in (x8 in 2months !!).

For the curious among you, Uniswap protocol 24h trading volume was higher than Coinbase for the first time ever. Many small DeFi-related tokens, especially governance tokens, emerged. Before they’re listed on centralized exchanges, they typically launch on Uniswap as it does not require the approval of central entities.

This is notably due to:

Liquidity pool (check here in detail) & market makers: The idea behind the liquidity pool is to motivate people who have the liquidity (market markers) to make it available to other traders, using smart-contracts to achieve three unique things:

Full and automatic transparency on the use of funds,

Automated management (the supplier has nothing else to do but deposit assets, market making is done automatically - this is called Automatic Market Making or AMM),

Automated distribution of rewards to liquidity providers (transaction fees, but also the famous governance tokens).

Yield farming

This wave has recently been completed by the distribution of new rewards to liquidity providers: governance tokens. The first project to popularize the concept and provoke the wave of "yield farming" was the Compound loan protocol with the COMP token. Owning COMP tokens allows you to vote on the strategic decisions of the Compound protocol and entitles you to a share of the fees collected. Compound started distributing it free of charge to those who provide liquidity on Compound, on a pro-rata basis, in addition to the usual rewards. The value of this token has grown quickly, and a lot: it is now worth more than $160, whereas it was relatively easy to get a few units a day at first. This has created a draught, with a huge cash inflow on Compound whose volumes have really exploded.

Who are the players

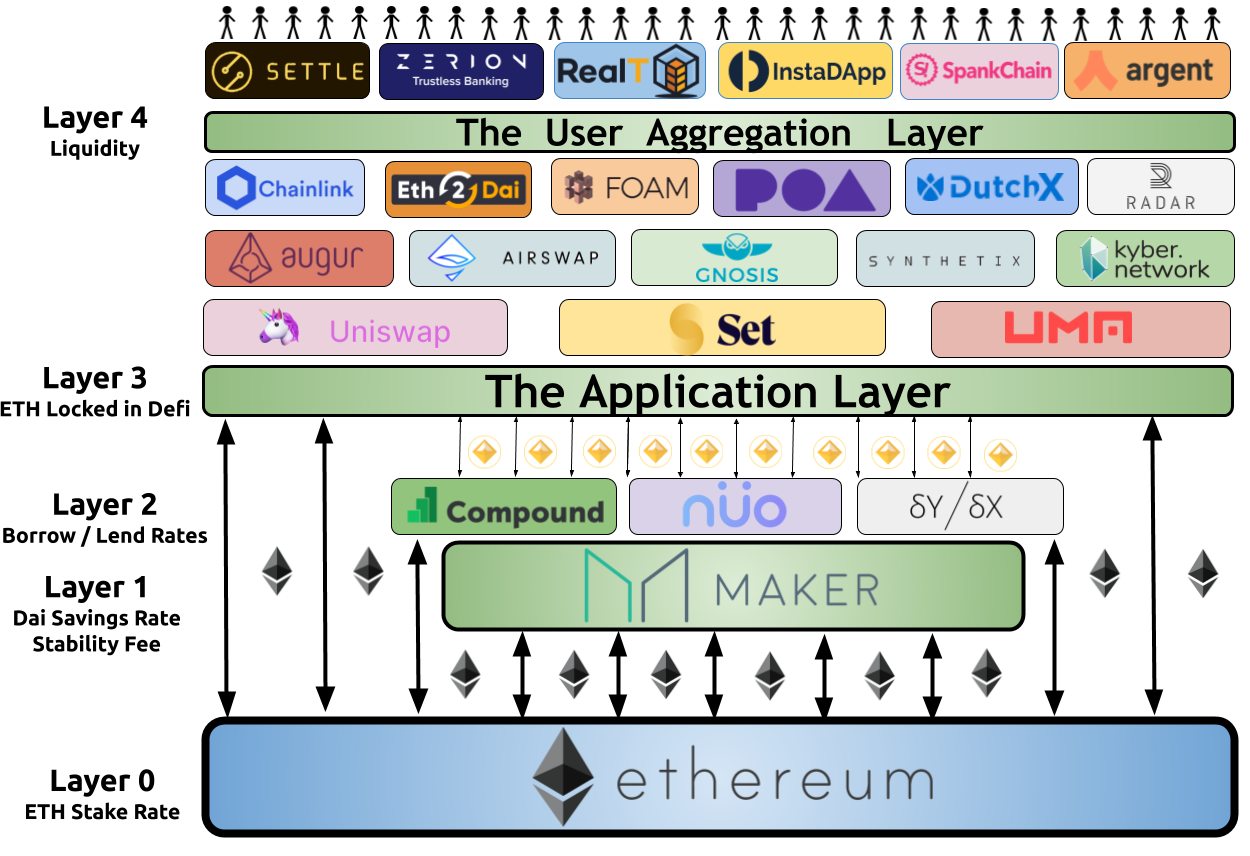

The digital Finance Stack

As mentioned earlier, the DeFi ecosystem is composable. You can see every project as a lego construction. In fact, the Ethereum economy is a set of layers that build on top of each other. Each layer provides the foundation and the stability for the layer on top of it to express itself effectively.

The stability of each layer adds to the potential to the layers above it. This is why Ethereum development is so crucial that we get right. (Of course, it shows the proportionate importance of building MakerDAO compared to building Ethereum).

Here, you can see the birth of a vibrant ecosystem of financial applications. Each layer has its own objective, metrics, and importance over the ecosystem.

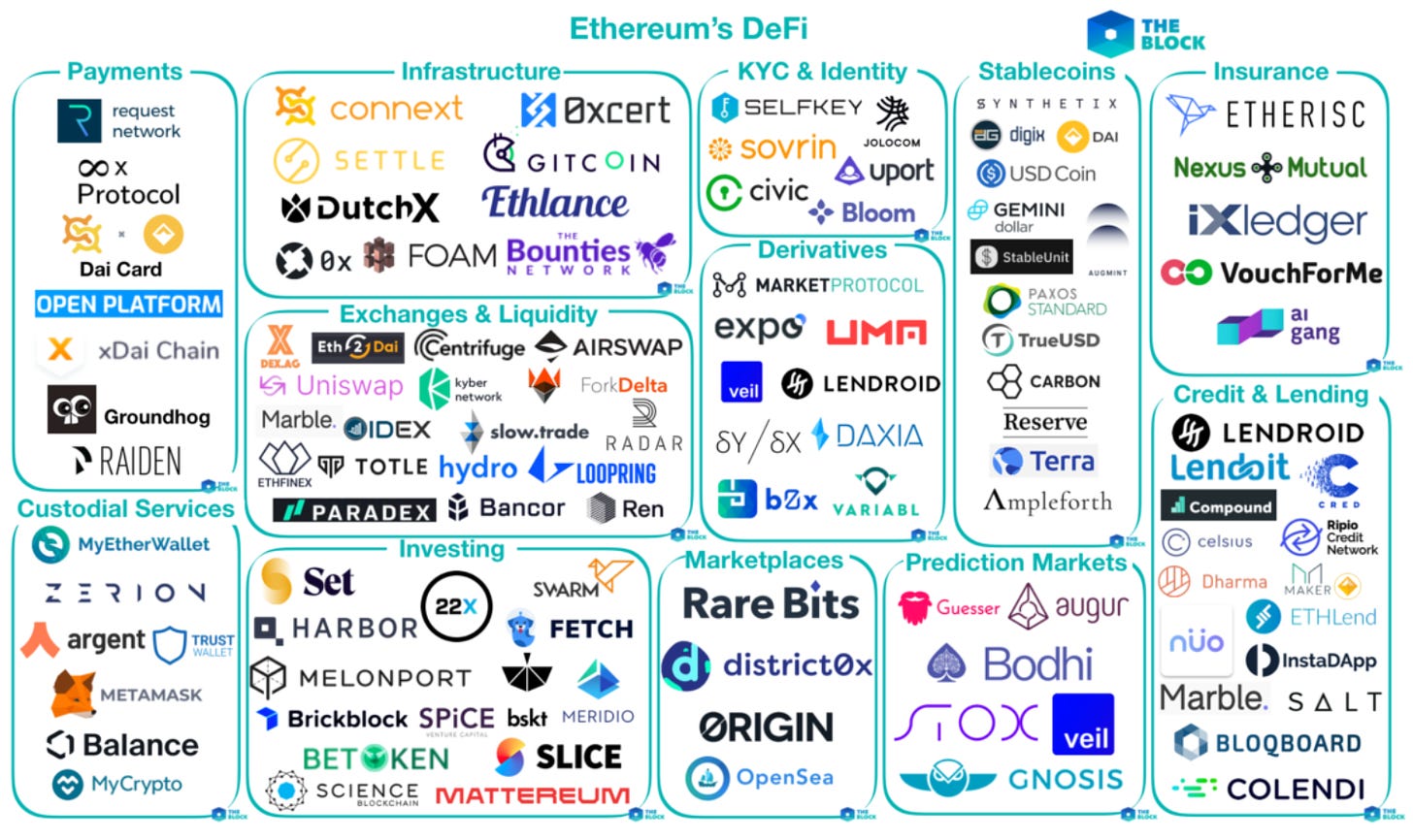

Who’s there

Slowly but surely, a wide range of actors are building a global ecosystem. From the infrastructure to DeFi financial assets.

In less than a year, we’ve seen tremendous developments over the Ethereum for DeFi financial assets:

Spot trading - Uniswap, Kyber, Ox

Money market - Compound, Aave, Maker

Margin Trading - DyDx

ETFs - TokerSets, Balancer

Options - Opyn

Futures - Futurswap, OpiumExchange

Fixed-income products - Yield Protocol

What about the users? Actually there are already there!

Yield plant or risk plant?

User and developer niche

Even though the number of users is increasing rapidly, DeFi is still very niche. Efforts will have to be made to simplify user access and user experience (see private key management, which hinder adoption).

The ecosystem is built by a growing number of DeFi developers. Ethereum is still top dog for developers (x4 more devs than the next ecosystem which is bitcoin), but there were less than 1200 in 06.30.2019. It’s still a nascent ecosystem.

Insurance for technical risks

The difficulty for institutional investors to insure themselves against technical risks. For Max Bronstein, Marketing Manager of Dharma, "one of the biggest obstacles today is the lack of insurance products [in particular]. The inability to insure against risks related to smart contracts. Institutional investors are uncomfortable with the idea of putting in money in receivership if there are no compensation payments related to the technical flaws".

Grey zone

Vagueness regarding regulatory issues and in particular the obligations related to KYC / AML is either an opportunity or a future threat.

I’ve also seen that decentralized networks are still not ready to receive these significant flows, and that transaction fees (ETH) have grown tremendously => See Median Gas Price

In my opinion, DeFi is today an open-air financial laboratory that is offered to us and it is fascinating to observe. Keep an eye on it!

Did I miss something huge?

There is a lot happening out there!

If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues (wait, there’s more!)

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️