Build your Fintech

Market Review #5 | IaaS for Fintech

Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Launching a startup is not easy. Especially if you are building a fintech whose goal is to reshape financial / insurance services. Technological and regulatory moats usually prevented new players from entering these markets.

But the whole narrative has changed notably since startup has started to offer infrastructures and governments have legislated on open-banking and data protection.

A look at the current Fintech Narrative

Something is going on

As a Fintech/Insurtech investor, it’s my job to support and finance bold entrepreneurs aiming at reshaping financial and insurance services.

One thing I’ve noticed is the acceleration of startup creation in these markets. And I’m not the only Clément to spot that!

Indeed, the number of fintech startups grew tremendously over the past years, so has the financing and the number of fintech investors.

You may wonder what growth drivers create such dynamics? Let’s take a closer look.

Unbundling Financial Institutions

The first wave of fintech innovators mainly came after the banks. Those were dissatisfied with expensive products, secretive business, slow digitalization, and poor customer experience. As a result, we’ve seen them unbundling banks.

This is the home page of Wells Fargo and it outlines the top startups picking apart every piece of the bank.

Usually, these entrepreneurs would reshape an experience, a product, or a service that felt outdated and unsuited for customers. And that was just the tip of the iceberg

'“I have often described banks as being museums of technology.”

- Ronit Ghose | Global head of banks research Citi

Eventually, those entrepreneurs understood that the issue came not only from the product manufactory but also from the bank’s tech stack. The core banking felt completely outdated and looked like a complex entanglement of third players. This led to suboptimal interoperability, slow and redundant processes, and most importantly — limited scalability.

For a fintech startup to launch ten years ago, the only way was by partnering with incumbents, as it would have taken months if not years to create their own core banking, obtain their license to operate, build their payments services, comply with regulation, .. You see here the moats incumbents were lying on.

“Think of a company like Airbnb. Imagine if the founders had had to go to investors and convince them to give the company millions of dollars just to build the infrastructure to prove that yes, there’s a massive market where we all want to stay in strangers’ homes. It might have turned out differently.”

- Angela Strange | General Partner a16z

N26 is also a good example. They’ve started leveraging Wirecard’s core and license (a German Bank), it then went to get fully licensed and build its own core banking. But this took time.

To have a digital revolution in fintech, it actually requires to have a modular, fast, and scalable approach toward the banking infrastructures. And this is what’s happening now!

Learnings

#1 - Toolset for fintech wannabees

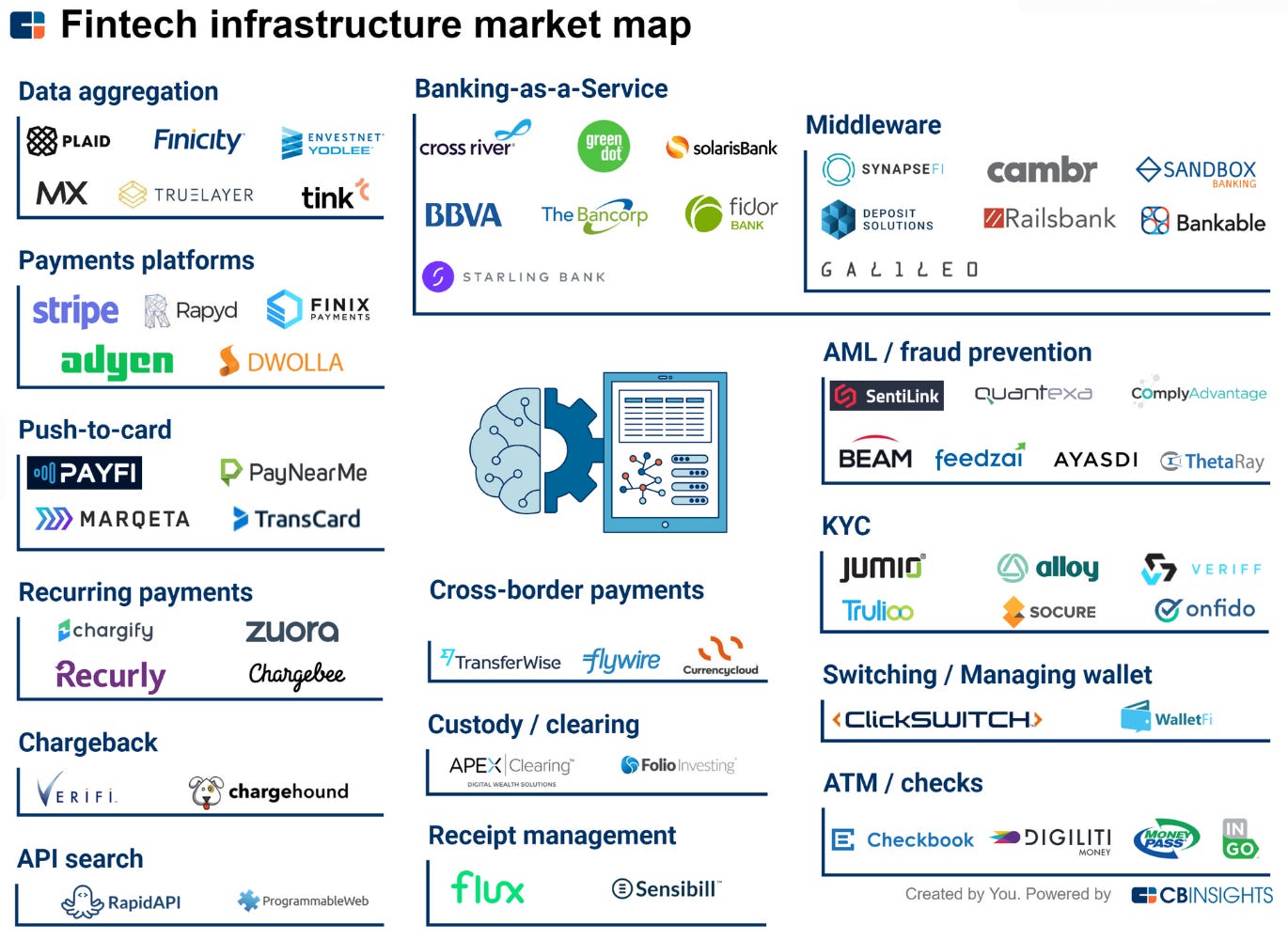

Creating fintech is now about building layers. It starts with a license (see hereunder), then you pile up fintech infrastructure according to the startup you plan on launching. We’ve arrived in an era of commoditization of fintech infrastructure (much needed), or in other words Infrastructure as a Service (IaaS).

Everything is easier to connect since the APIs have been largely adopted in the Financial sector. We could only find 3 API in 2005, and later in 2017, we counted 2375 APIs in the sector. This allows better communication/collaboration between players and has been strongly accelerated with the open-banking movement.

The more interesting part of this toolset, it’s that everyone can rapidly prototype something new. You don’t have to wait for months/years to be up-to-date with compliance, your tech-stack, .. You need a KYC for your service? Take a license as you go and do not build it from scratch!

This will considerably accelerate the time-to-market of most fintech startup launching from now. Allowing new players to rapidly access a market and test/iterate their value proposition. This is something I see at HUB612, the deal-flow for pre-seed investment seems to get bigger and bigger :)

#2 - Regulation & Compliance as a service

Regulation in this sector is fundamental as it subjects financial institutions to certain requirements, restrictions, and guidelines, aiming to maintain the stability and integrity of the financial system. Four things are happening:

Open-banking

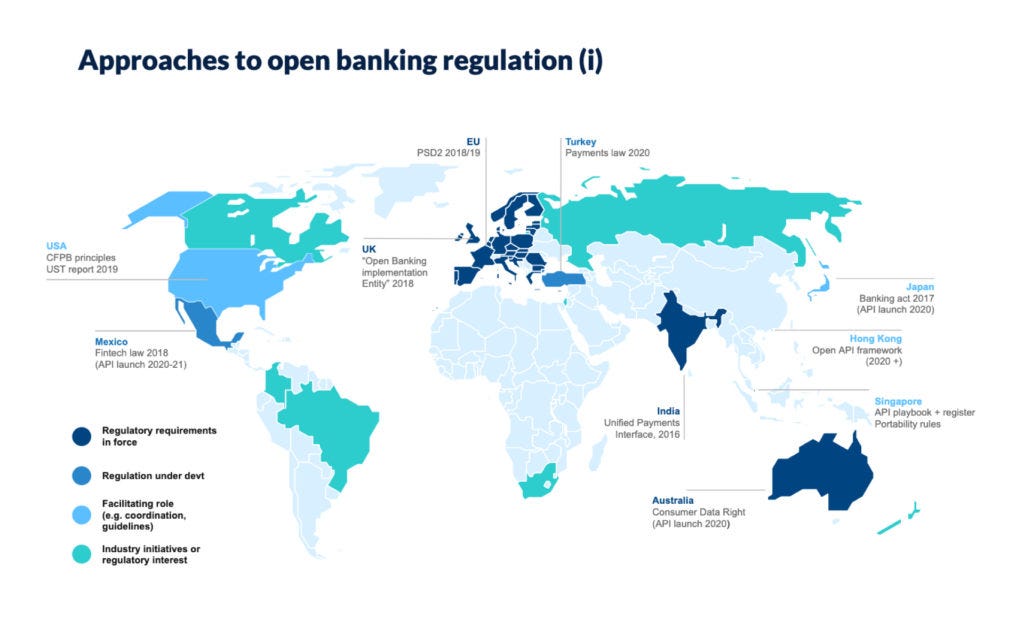

The vision on open-banking may be different regarding where you are on the planet but the number of player leveraging on open-banking keep increasing.

For instance in Europe, with PSD1 & PSD2 (both Payment Services Directive), regulators have created a fertile ground in Europe for fintech growth. It forces banks to open up their systems to fintech. This results in a wide range of new products/services offered to customers and corporates (streamlined lending, business loans, automated accounting, new payment methods, ..).

Data Regulation

In Europe, the GDPR (General Data Protection Regulation) is a legal framework that requires businesses to protect the personal data and privacy of European Union (EU) citizens for transactions that occur within EU member states. All companies dealing with EU citizens’data are covered by GDPR, especially banks, insurance companies, and other financial companies.

It is a very high standard to meet, requiring that companies invest large sums of money to ensure they are in compliance. If a company doesn’t comply to GDPR or if authorities determine it took insufficient measures to protect personal data, it may end up in a 20M Euro or 4% of total annual revenue fine (outch).

NB: Other data privacy regulation are set, like CCPA

Amid all this turmoil, companies like InCountry or OneTrust now offer data privacy residency as a service for companies willing to comply with local regulations on data protection. Thus, something that may have been perceived as a pitfall for startups actually got waived away with pay-as-you-comply services.

By the way, the data protection market, which covers everything from cybersecurity to disaster recovery and compliance, will reportedly be worth $120 billion by 2023.

Cybersecurity

Cybersecurity was at the center of the 2018 priorities for the European Commission and European Central Bank. It’s extremely important for all companies developing their business, especially for young corporations, to protect customer information. As mentioned in a previous issue about cybersecurity, even SMEs are highly targeted.

Hopefully, a wide range of cybersecurity companies has developed the services needed by others to ensure data protection (1Password, ..), prevent fraud (Smyte, Castle, .. ), and manage cyber-risks ( Wiretap, Cyence, .. ). It should be seen as an opportunity rather than an obligation for a startup to launch as still very little take this topic very seriously.

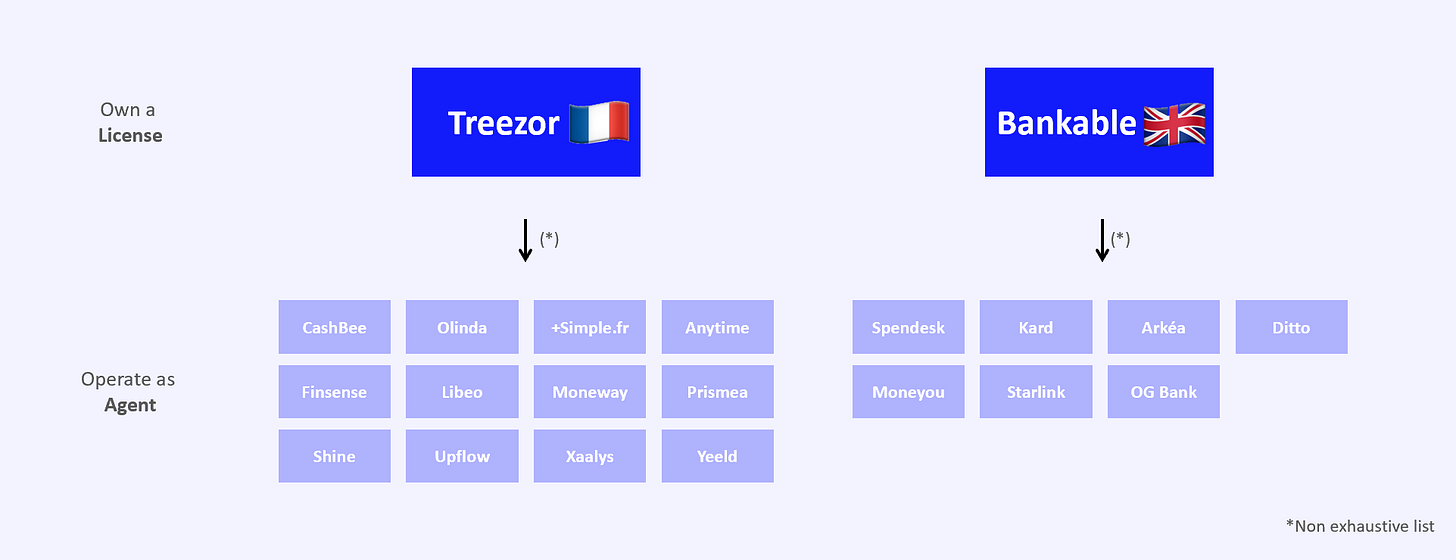

Obtain a license or operate as an agent

Around the world, all credit institutions must be authorized by a regulator in order to carry on their activities. For instance, it is illegal to carry out banking or insurance activities without being licensed.

Each country in Europe has its own local authorities. They will ensure the proper functioning and guarantee of companies offering financial services.

In France, we find 2 authorities (ACPR & AMF). They are in charge of issuing approvals, but also of supervision and controls in the environment.

On the banking side, the ACPR (Autorité de Contrôle Prudentiel et de Résolution) is the authority in charge of this sector. Concerning investments, it is the AMF (Autorité des Marchés Financiers) that oversees this part of the financial sector.

To obtain a license, you have to show to the regulator that you are not kidding about money. Everything is analyzed, right down to the economic model of the applicant for a license. This process takes a lot of time and may hinder startup creation.

In the European Union, to tackle this long but necessary procedure, payment service providers are regulated by a directive (PSD1 / PSD2) allowing new players to operate as an Agent under the responsibility of the startup licensee

The whole point of this is about buying time, and not to be stopped in the starting blocks. Most famous BaaS (Banking as a Service) providers are solarisBank, Bankable, Treezor, Cambr, ClearBank, ..

#3 - Break it apart, build upon it

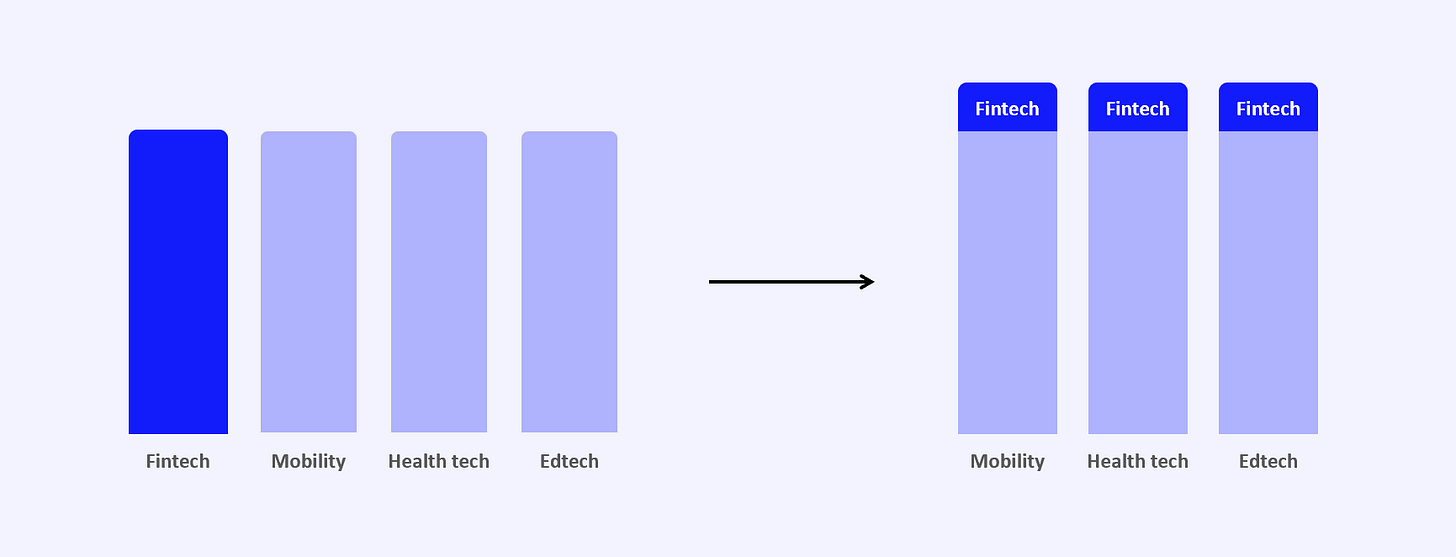

Interestingly, startups are in a race toward end client relationships. The first product launched on a specific vertical is just a hook to acquire customers and begin building trust and brand name. From that on, more startups have started to diversify their offering with other financial products. We see them rebuilding. And eventually, they will have similarities with traditional banks (and their large range of products).

Those startups, solving unrelated problems will probably race against each other in a not so distant future (or at first create business partnership), as consumer platforms when they offer will start to overlap.

Everyone is thrilled

Dusting financial institutions

Regulation changes and new players are pushing incumbents to replace legacy systems or adapt them to fit current needs. When you know that 75% of the bank’s IT budget is used for maintenance, it makes your wonder where innovation can take place.

Thus, even if those actors are reluctant to change, it’s in fact a much-appreciated shift as they will spend less time on maintenance and more in launching new products (cool!).

Also, there has been a lot of development in the capital market infrastructure providers (pipes and plumbing of global finance). I let you check what is happening there :)

The logical evolution of corporations

A tremendous number of companies will, in the coming years, leverage on financial services to better serve and retain their customers, and drive more margin.

You can spot some low signals here:

Airbnb's Host Protection Insurance provides up to $1 million USD for liability

Uber allows its drivers to make savings

Shopify extending their layer of financial services (soon an insurance layer?)

..

There is no doubt that the rise of financial IaaS for everything, from data aggregation to KYC, will at least push every other sector to think how they can control the money they've traditionally lost to incumbents financial services vendors.

Satisfied customers

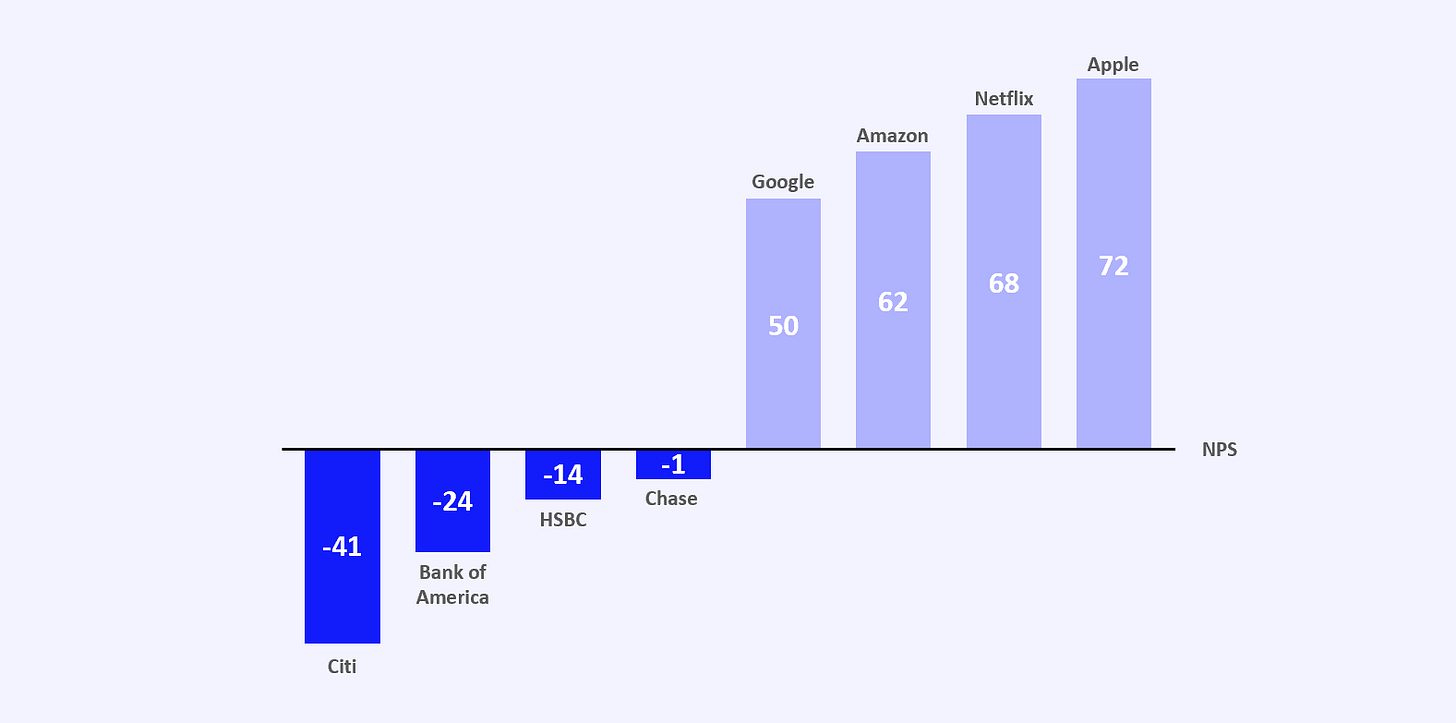

NPS: net promoter score, measuring customer happiness

Today, customers are extremely unhappy regarding their experiences with financial services. The uprising of new players reinventing experiences and the dusting of incumbents will surely add value to existing services customers are usually paying for. We can expect seamless and frictionless experiences!

The adoption rate of neo-banks is a strong signal of how fast things can change is this market.

Did I miss something huge?

There is a lot happening out there in Banking, Fintech, Financings, Exits, M&A, ..

I there something worth reading, Do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :)

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌🏻

Great article, thanks. I emjoy reading it. In the diagram above what are the examples of EdTech and HealthTech companies who leverage on financial services?