Hi, this is Clément from HUB612 👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

This caught my attention

Speed is everything?

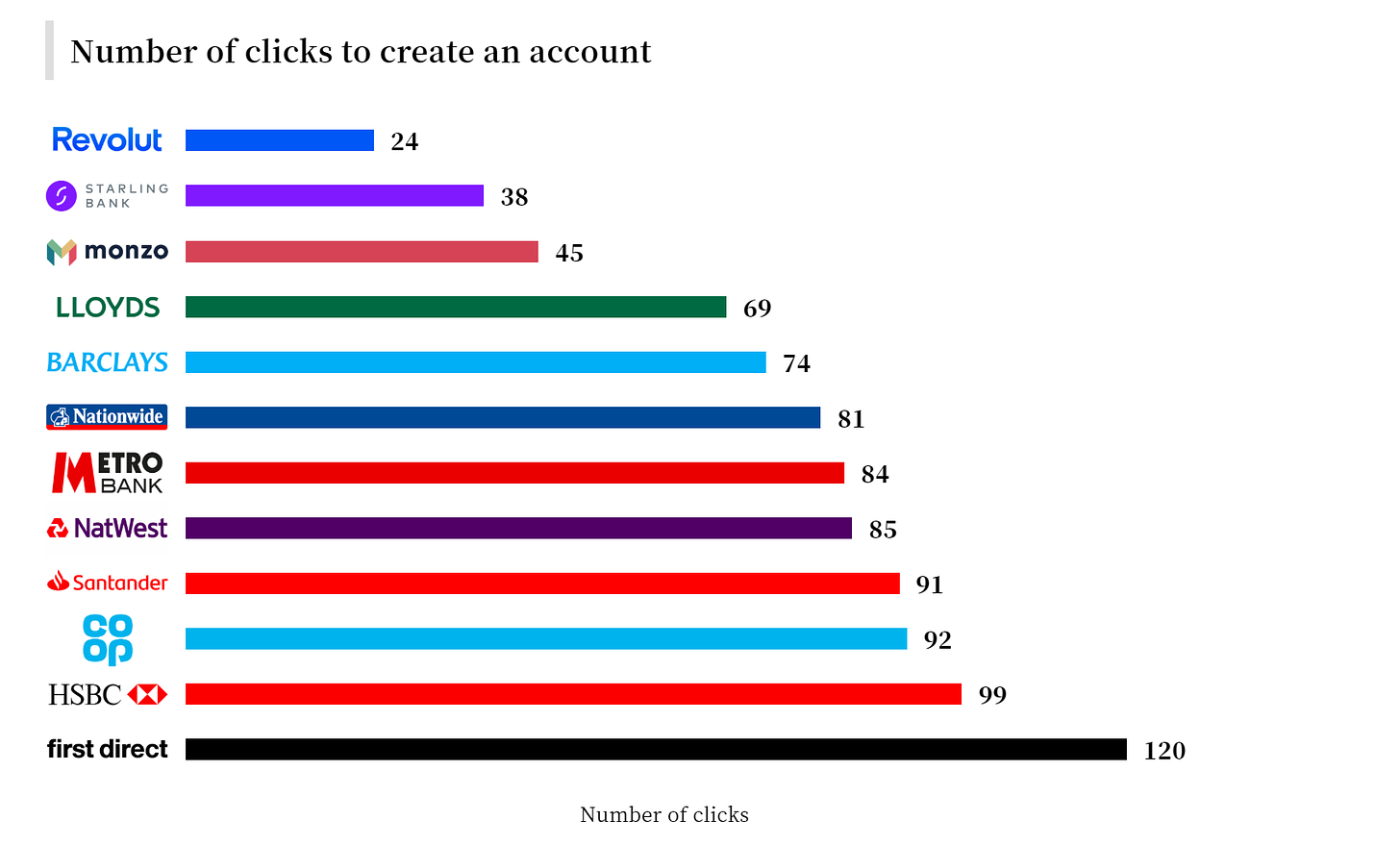

I came across this article from builtfrommars about the experience of opening a bank account. On average, a client stays with its bank for 17 years, which is incredibly high, and probably considered to be too much effort to switch.

The launch of news digital banking players in the past years and the large adoption of it makes you wonder if it is really easier to open an account with them.

Clearly, news entrants made significant improvements over account creation. But the article makes you think that fewer clicks aren't always best. So speed is indeed everything but not at the expense of a bad experience later on (miscommunicating a feature, missing customer information, .. )

Where can I get those PPT Skills?

It’s always a great pleasure to discover SoftBank’s earnings presentation since the analyst in charge of producing the slide deck has some skills!!

In this annual presentation, SoftBank implies that the epidemic will be deadly for a few unicorns out there. SoftBank must know quite a lot about it since they’ve written down the value of 47 of the 88 investments in its Vision Fund.

Worth reading - The News

News #1 - Shopify Reunite announcements

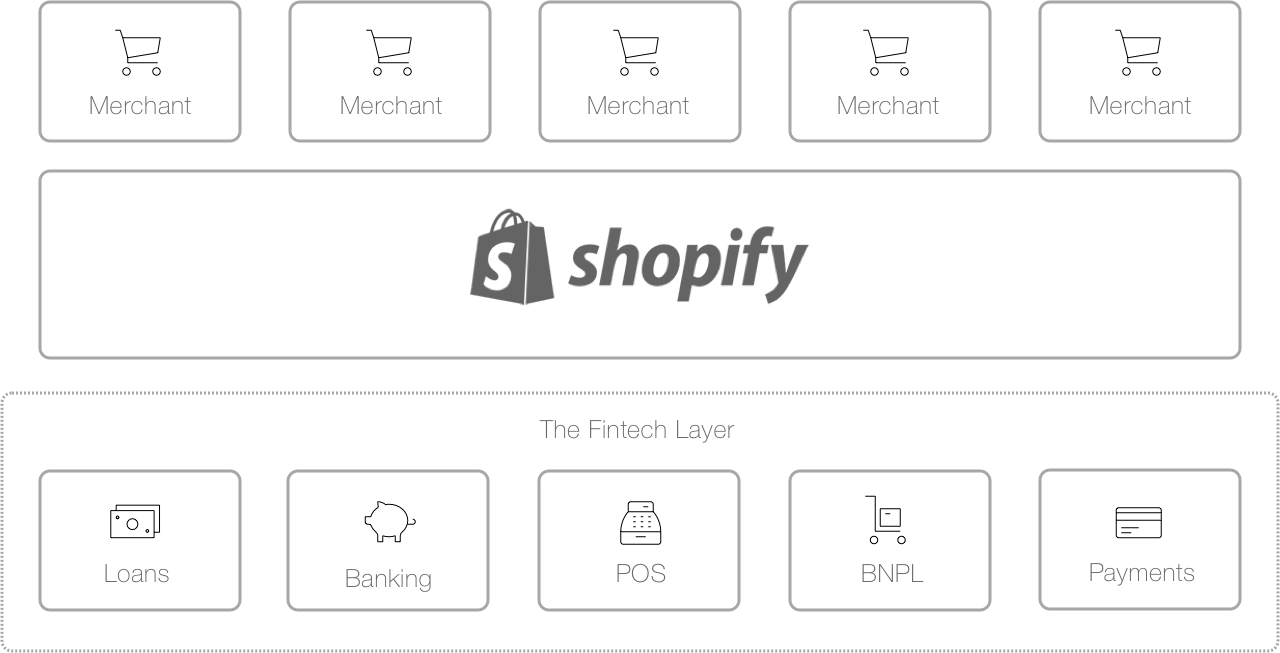

Shopify is a cloud-based Saas that allows you to create a website and use their shopping cart solution to sell, ship, and manage your products. Before Shopify, it would have taken months to set up a transactional website. Now you can do it in minutes.

They held their annual conference, where they announced the expansion of their financial services offerings to merchants with the launch of two new products: Balance (a banking product) & Buy now Pay Later (BNPL).

What do I think about it?

Well, this is something big. In recent years, we’ve seen consumer platforms embedding fintech features. It makes sense as it is a logical organic extension of their activity of empowering merchants. Shopify, which used to be a non-financial player, suddenly move into their consumer’s financial lives.

The diversification intensifies. The first layer is based on payments (Banking, Point of Sales, Buy now Pay Later, Loans, .. ). In a near-future, we could expect Shopify adding second a much-needed layer for company insurances

News #2 - Intagram: from “Like” to “Buy.”

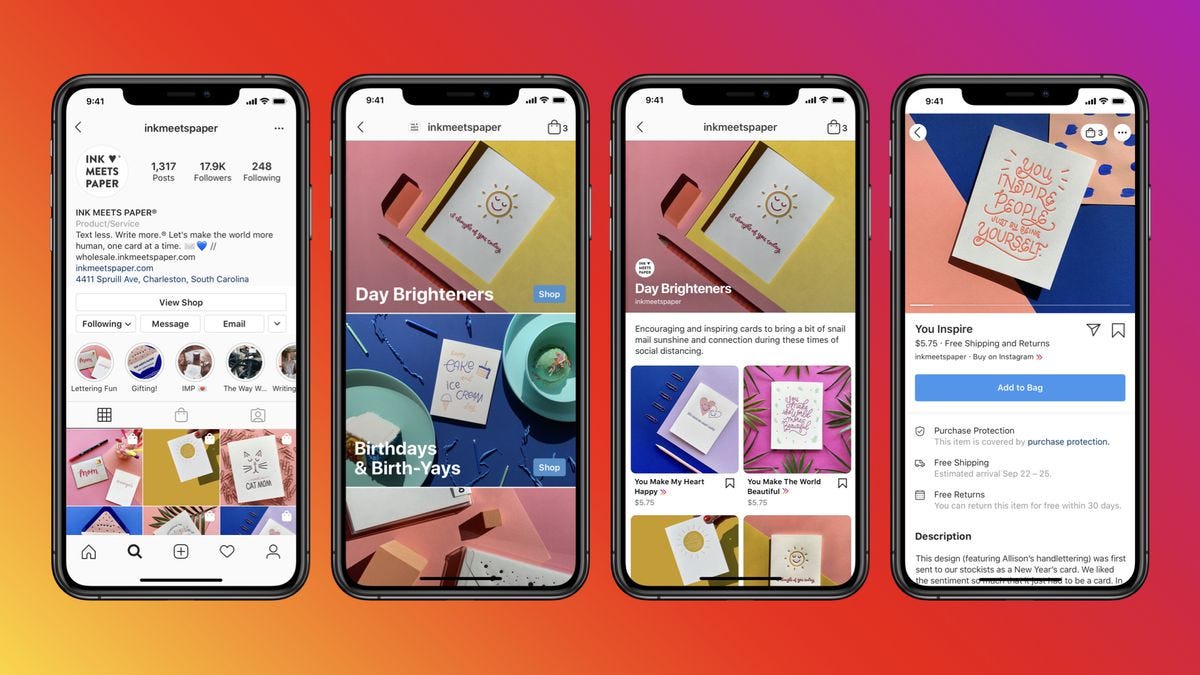

Mark Zuckerberg (Facebook CEO) announced a big leap in e-commerce for Instagram. Though, it’s not the first chapter of Facebook’s years-long attempts to become a shopping destination (“Buy” button, Craiglist-like Facebook Marketplace section, ..).

Mark announced a set of new features aimed at making Instagram (and Facebook) a true shopping destination. Today if you try to buy any product, you are most of the time redirected to some online shop. Instagram was losing big buy doing so. In the near future, people will purchase directly from the apps. Either from posts/stories or from a dedicated shopping tab that will be added.

My takes on that:

The pandemic pushed the adoption of online shopping, Facebook’s move is about capturing more traffic and keeping it in the app.

It locks customers into the app rather than sending them to other stores. It will increase the perceived value of Instagram and increase engagement and retention rates on those apps.

Instagram used to be a filter app, now it is the digital showcase of most companiesThis will push companies on Instagram to buy even more adds (if it was not already the case). And in the current situation, this could be beneficial for Instagram as we’ve seen an important pullback in online advertising

News #3 - Insurance for Mobility

The micro-mobility players have been strongly affected by the COVID. A lockdown meant fewer people riding e-scooters, thus unexpected losses in this Q1/Q2 2020.

As a result, we’ve seen a consolidation of actors, new fundraising, and now we see partnerships between industries. Together, Lime and Allianz have launched a comprehensive insurance program that automatically provides Lime riders with two types of insurance: Personal Accident Insurance, and Liability Insurance, at no extra cost. This means that riders can step onto a Lime e-scooter and ride worry-free knowing they are protected.

As an e-scooter rider, here are my takes:

As you may know, Paris city has launched a call for proposal, in order to choose 3 e-scooters operators among the 15+ operators currently live in the city. The City of Lights, where the number of scooter races is one of the highest in the world is crucial for every operator. Interestingly, this battle has become some kind of innovation center, pushing every-operators to differentiate for the others.

Last week we’ve seen the co-branding of Blabla ride (Blablacar + VOI Technologies) to foster cross-mobility. There is also Pony pushing their green footprint and shared-ownership .. The market of micro-mobility is extremely active!Insurance players are new to micro-mobility. For them, it’s a playground where they are building new offers that fit new mobility usages. Multi-modality is still an untapped market. (Also, neo-insurers are already settled on this market.) The purchases of micro-mobility vehicle surged in the past 5 years, this explains the interest of those insurance players

The COVID led cities to encourage the use of bikes and other micro-mobilities. In France coup de pouce initiative (which I thankful for !) and new bike lanes has created great momentum in micro-mobility adoption.

More Reads

Instagram now is starting to offer more ways for creators to monetize

Are Neobanks overvalued? Monzo faces near 40% valuation drop in latest fundraising

Dutch National Bank and Bank of France to lead way in digital euro development

WeChat will Invests $70 Billion in Fintech, Including Blockchain and AI over the next 5 years

Did I miss something huge?

There is a lot happening out there in Banking, Fintech, Financings, Exits, M&A, ..

I there something worth reading, Do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :)

If you’ve enjoyed it please show some love to the thread on Twitter ❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌🏻