Hi, this is Clément from HUB612👋

Little late for this issue. I’m curently re-building the newsletter for the best! If you have specific expectation, feel free to connect :) Here we go!

Each week I cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum. I hope you find it usefull! :)

Too long, didn’t read/listen?

#1 - What is the European Payments Initiative?

On July 2, sixteen European banks (including six French ones) unveiled the main features of a large-scale joint project. Its name: European Payments Initiative (EPI).

Its objective is to offer a solid and sustainable pan-European payment standard to replace Mastercard and Visa.

What’s cool

Concretely, the aim is to set up a European system based on two products (i) a new-generation bank card, with a digital wallet, (ii) instant money transfer, with person-to-person (P2P) payment solutions. Tomorrow, a European merchant will be able to benefit from instant transfers after a credit card purchase

Standardize procedures to simplify the processing of transactions and data

Its investors promise increased security in the management of personal data

When does it start?

The start of the PPE experimentation phase is planned for 2022. Confident, the initiators of the project are aiming for 60% of European monetary exchange volumes within five years.

My takes:

🤔 The roadmap is ambitious. The needs of banks and domestic electronic banking systems are far from being aligned. And some banks, particularly German and Italian ones, are still reluctant, often for reasons specific to their market.

"The European Payments Initiative will have to address the fragmentation of European retail payments and should encompass all euro zone countries and possibly the entire European Union,"

Fabio Panetta | Member of the ECB's Executive Board.🤔 Initially, 20 banks were part of the project. Yet, the current economic difficulties related to the pandemic will surely impact the discussion around each participant’s investment in the project (planned investments amount to "billions of euros")

👍 The context is promising as the European Commission is has placed European sovereignty at the forefront of their concerns. (Europe rely too much on American & China players)

(More here)

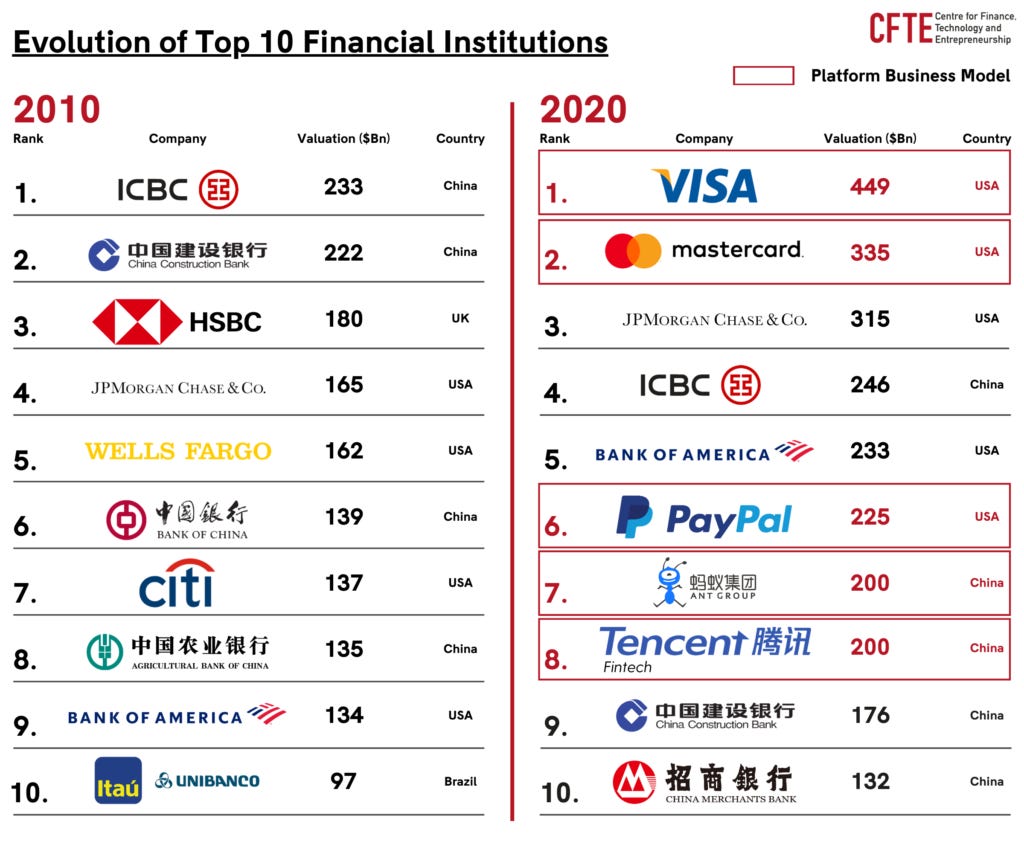

#2 - Digital Platforms are rising in finance

Over the last decade, technologies have tremendously changed the face of the world’s top financial institutions.

A McKinsey research has shown that “digital attackers” (or simply put: new challengers) are bleeding incumbents by leveraging on platforms. What are platforms?

Platform is a digital framework that creates the means of many-to-many connections and that defines the terms on which participants interact with one another (more here)

Platforms accelerate time to market for others

A few months ago, I wrote about how you could now build your own fintech. I pointed out that historically, building a fintech was a capital intensive and time-consuming mission. Now, enablers have eliminated barriers to launch by providing a toolset for newcomers (Regulation as a Service, PSP, KYC, ..).

Platform business models are allowing financial institutions to leverage network effects leading to increased efficiency in their operations and the possibility of tapping into new markets, ..

Overlooking the topic, I can see that many business leaders do not fully understand platforms and how they fit in their industry structure. The McKinsey study mentions that (i) only 3% of established companies have adopted an effective platform strategy (ii) more than 30% of the global economic activity – some $60 trillion — could be mediated by digital platforms in six years’ time.

Keep an eye on this!

(More here)

A snack between two meetings

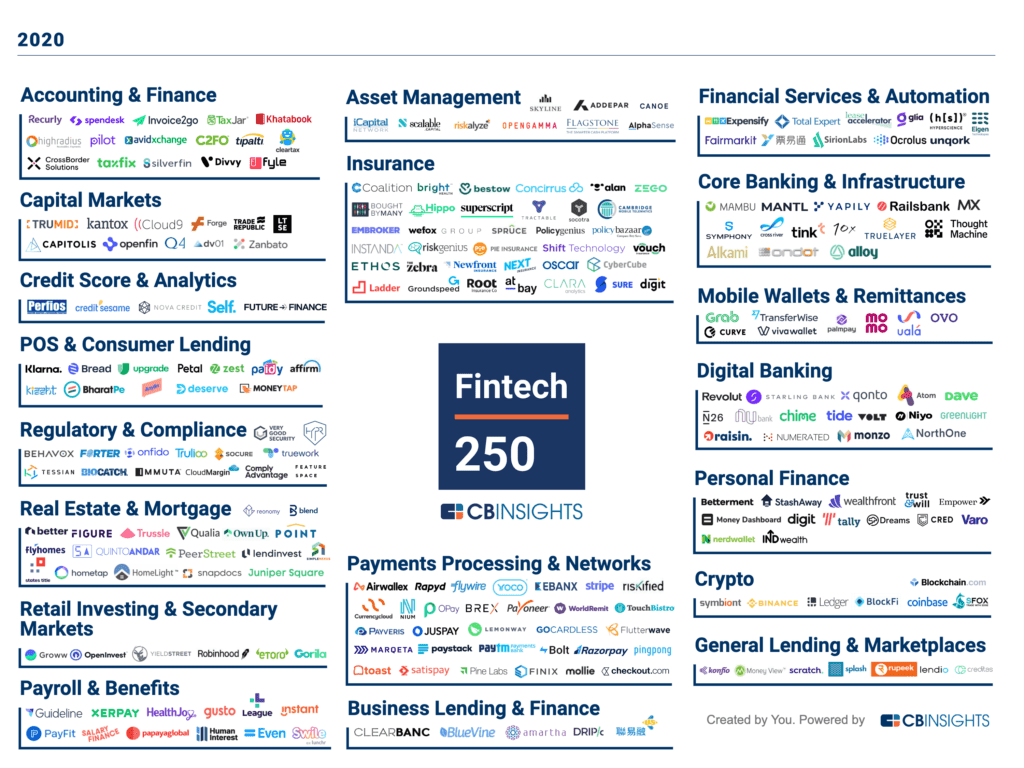

The Fintech 250: The Top Fintech Companies Of 2020

CB Insights has unveiled the third annual Fintech 250! The 250 top private fintech companies using technology to transform financial services are displayed under global categories.

Here are a few highlights from this report:

Unicorns: 32 of the 250 companies (13%) are valued at or above $1B as of their latest funding round.

Top VC investor: Ribbit Capital is the most active investor in this year’s Fintech 250 companies. Since 2018, Ribbit has participated in 45 deals to this cohort of companies

Top deal of 2020: Grab raised a $856M Series I in Q1’20

..

(More here)

Fintech Events

It’s now time to physically meet! Over the end of the years, I’ll try to be as much available as possible. If you are there too, please ping me! I’ll probably cover the content in a coming issue.

InsurtechConnect (17 Sept)

Fintech R:Evolution (15 Oct)

?Am I missing big Fintech events I should attend?

More Reads

DeFi

Platforms

Did I miss something huge?

There is a lot happening out there!

If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues (wait, there’s more!)

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️