Hi, this is Clément from HUB612👋

Did you know that there are as many pets as there are inhabitants in France? This surprising statistic attracted my curiosity and led me to dig into the pet industry. I think it’s an overlooked industry, and it deserves a better coverage (got the pun?).

Each week I cast light on different topics related to Fintech & Insurtech through either it is through 1) Market Reviews 2) News of the week 3) Investment Memorandum. The format might evolve soon! I hope you find it usefull! Please feel free to provide feedback :)

The pet care industry

Pet care is referred to as taking care of pets staying at home as a family member. Those little (or big) companions help us with emotional support, reduce stress level, increase social activities, and more.

Pets can come in a wide variety of sizes, breeds, and species. They also help us in an extraordinarily diverse range of activities. For instance, a dog can (i) assist a shepherd in monitoring a flock of sheep (ii) help in therapies at the hospitals, nursing homes, and care centers to engage with patients and help them more sociable (iii) hunt (iv) compete in dressage competition ..

The most important aspect of pet care is to ensure that your pet is loved, has proper socializing, and is well-trained.

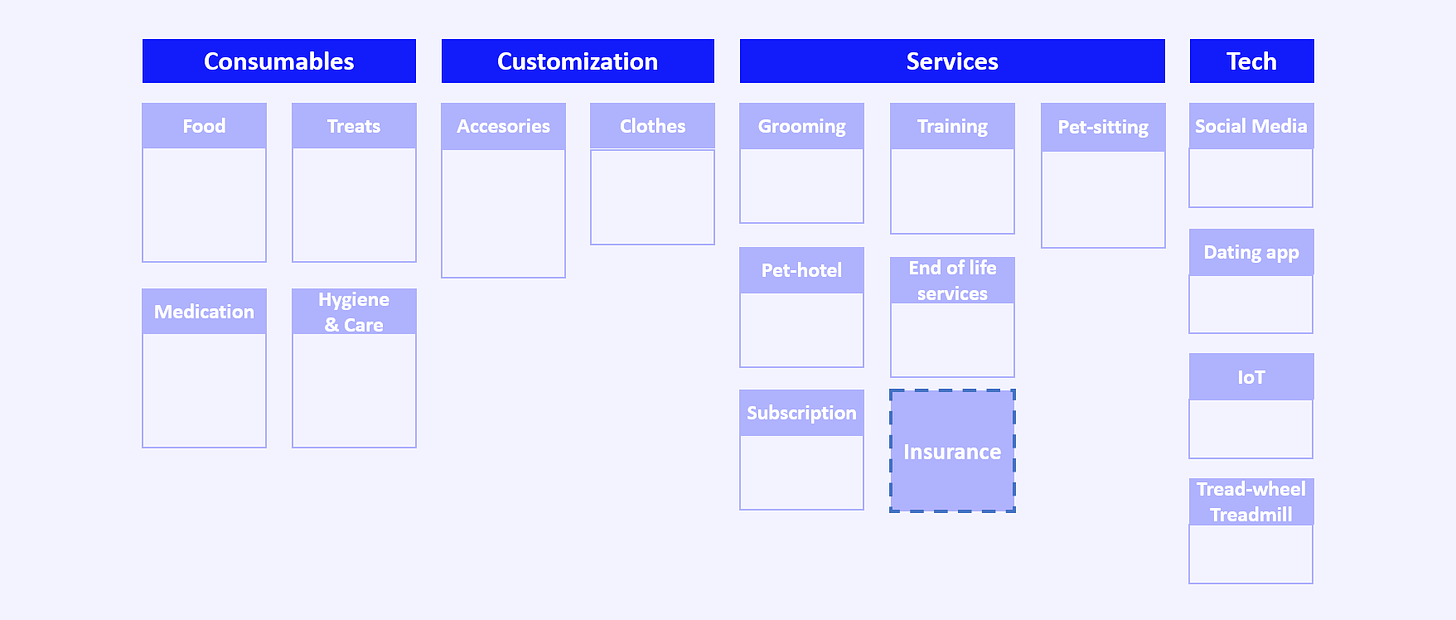

The pet care industry goes from the purchase of your companion, the consumables it needs (food, medication, .. ), customization (accessories, clothes, .. ), services of all kinds (training, subscription, .. ) to technologies (dating app, IoT, .. ).

It’s a massive industry! By crossing different sources, the market size is estimated to grow from $ 225 bn in 2019, to reach $ 358.62 bn by 2027, growing at a CAGR of 6% during the forecast period 2020-2027.

The growth of the market is expected to accelerate over the coming years. It’s driven notably by:

increasing humanization towards pets

urbanization

the boom of the online pet market

rising foodborne and zoonotic diseases

increase in animal healthcare expenditure

What may restrain the market growth are :

high pet care costs

lack of awareness regarding pet care products

low per capita income of middle and lower-middle-class

Pet Insurance is an untapped market

There’s a lot of interesting topics to dig into this industry as you may guess. But when I read Lemonade CEO Daniel Schreiber saying that 70% of Lemonade customers with a homeowners or renters policy are also pet owners, and yet between 1 and 2% of pet owners in the United States have pet insurance, I decided to focus on this insurance vertical: pet insurance.

On a top-down approach, it’s clearly not a niche market as it’s growing from $ 5.4 bn in 2018 to reach $ 15.07 bn in 2028, growing at a CAGR of 16.3% over the period. But for now, it’s still a global untapped and poorly penetrated market.

The key drivers of this current growth are:

the customer landscape has changed, with millennials now the largest segment of pet parents. They own more pets (about 35% of total pet ownership) and spend more on their pets than any other generation. About 61% of millennials are willing to make financial trade-offs to afford pet care. They also lead the charge in tech adoption.

new and private players offering understandable (see Policy 2.0 from Lemonade), and affordable coverage.

market challengers push for simple and seamless digital experiences from onboarding to claims (no complicated paperwork, no lengthy claim approval processes).

current players are making efforts to educate consumers about increasing veterinary costs (+70% in 10 years in France) and various advantages of pet medical insurance plans

various government organizations are putting in efforts to streamline and standardize the pet health codes (= regulation drives the market) to ensure a smooth and efficient reimbursement process.

pet tech (activity monitors, GPS trackers, RFID sensors, accelerometer sensors, ..) and increasing pet related data will help support a data-driven approach to underwriting and claims processes.

The market is moving fast. On top of a growing number of new market entrants (established insurers, brokers, or simply startups hidden in the hood), there have been several significant acquisitions of pet insurance companies. Recently MetLife acquired PetFirst Healthcare. In April 2019, Program specialist NSM Insurance Group acquired Embrace Pet Insurance.

Nb: Penetration rates are distinct from a country to another. A world-class veterinary example is Sweeden where 90% of dogs have coverage. As a result, this high penetration rate has deepened the funding pool available for care across the country's entire veterinary sector. It brings a lot of possibilities for using more sophisticated treatments and diagnostics. Let replicate the model elsewhere!

What do you cover?

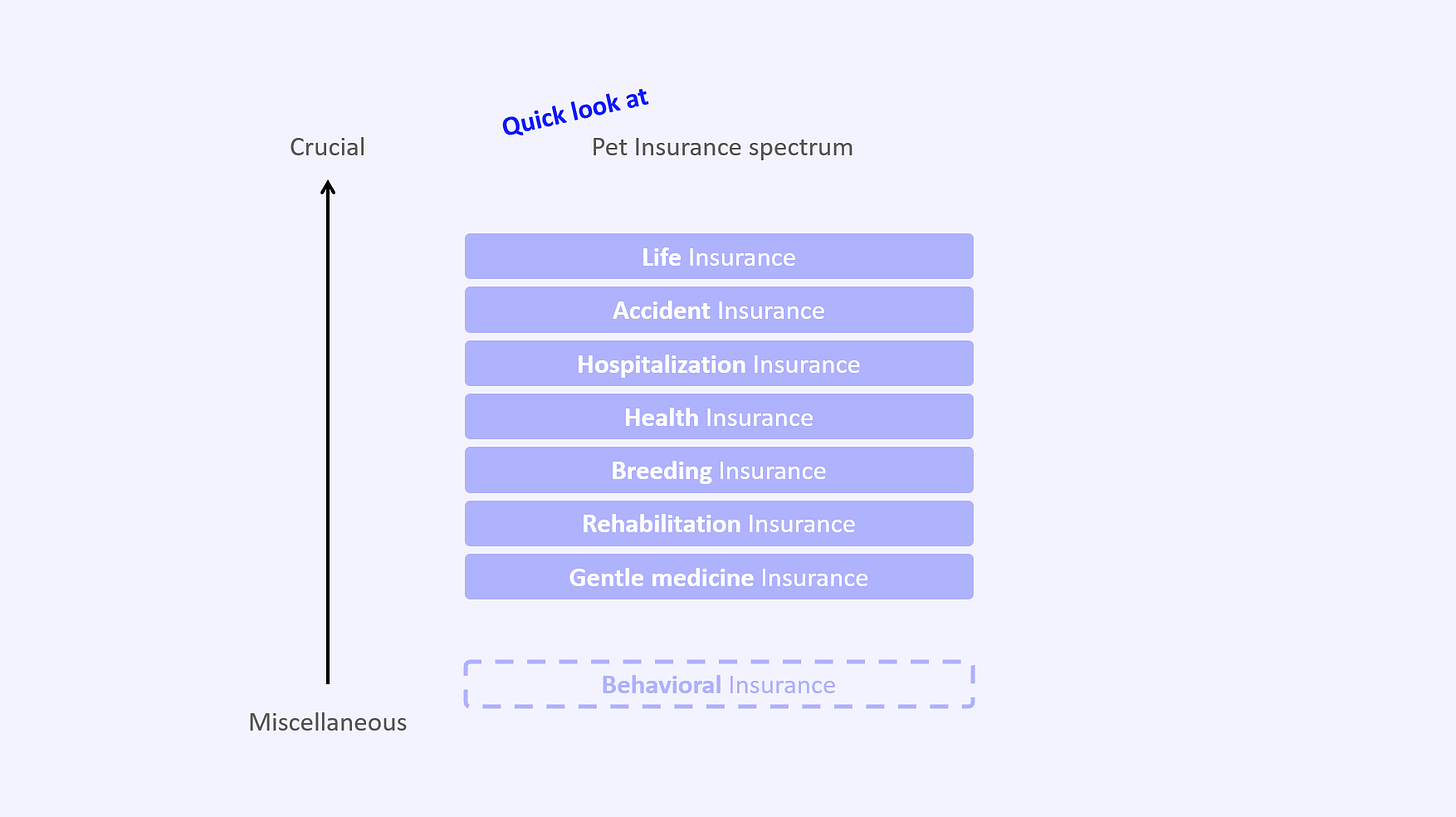

Ranged from crucial to miscellaneous, here is the pet insurance spectrum:

Life insurance provides compensation equivalent to the pet’s value if your pet dies, needs to be put to sleep, runs away, or is stolen.

Accident insurance (procedures, surgery)

Hospitalization insurance (cancer or disease)

Health insurance (medication, diagnostics, vaccine, therapeutic feeding, treatment, dental problems .. )

Breeding insurance will reimburse you for lost income if your pet is unable to breed.

Rehabilitation insurance reimburses you for costs in relation to stretching and massage when the pet gets a muscle injury.

Gentle medicine insurance (phytotherapy, and other plant-based medicine)

Aside from the pet insurance, it’s essential that you get insurance for yourself whether your pet is likely to cause harm to someone

Behavioral insurance provides compensation when your companion, unfortunately, causes some harm to someone

Additional but more marginal insurances are sold to owners in specific conditions. If you (i) have several companions (ii) have a farming (iii) are training dogs (iv) ..

Next-gen pet insurers are here

Hereunder are the key disruptions on which new players and incumbents will fight to increase their take rate:

Rise of millennials customers

Improve customer reach, through strategic partnerships with vets, pet services, employers, breeders, kennel clubs, ..

Improve quote conversion through marketing, personalization & newer product models

Improve pet-parent experience & retention

Rise of Pet Tech & explosion of Data

Data-driven underwriting & reduced premium leakage (important need of historical data to accurately price the premium)

Data-driven claims adjudication & reduced claims leakage

Reduce claims frequency & severity through continuous & contextual loss prevention

Make sure your companion is covered

“Not cool men, you forgot us😤”

Alright, my bad! This is a very early version of the mapping. Please comment on this post/email so that I fix this oversight :)

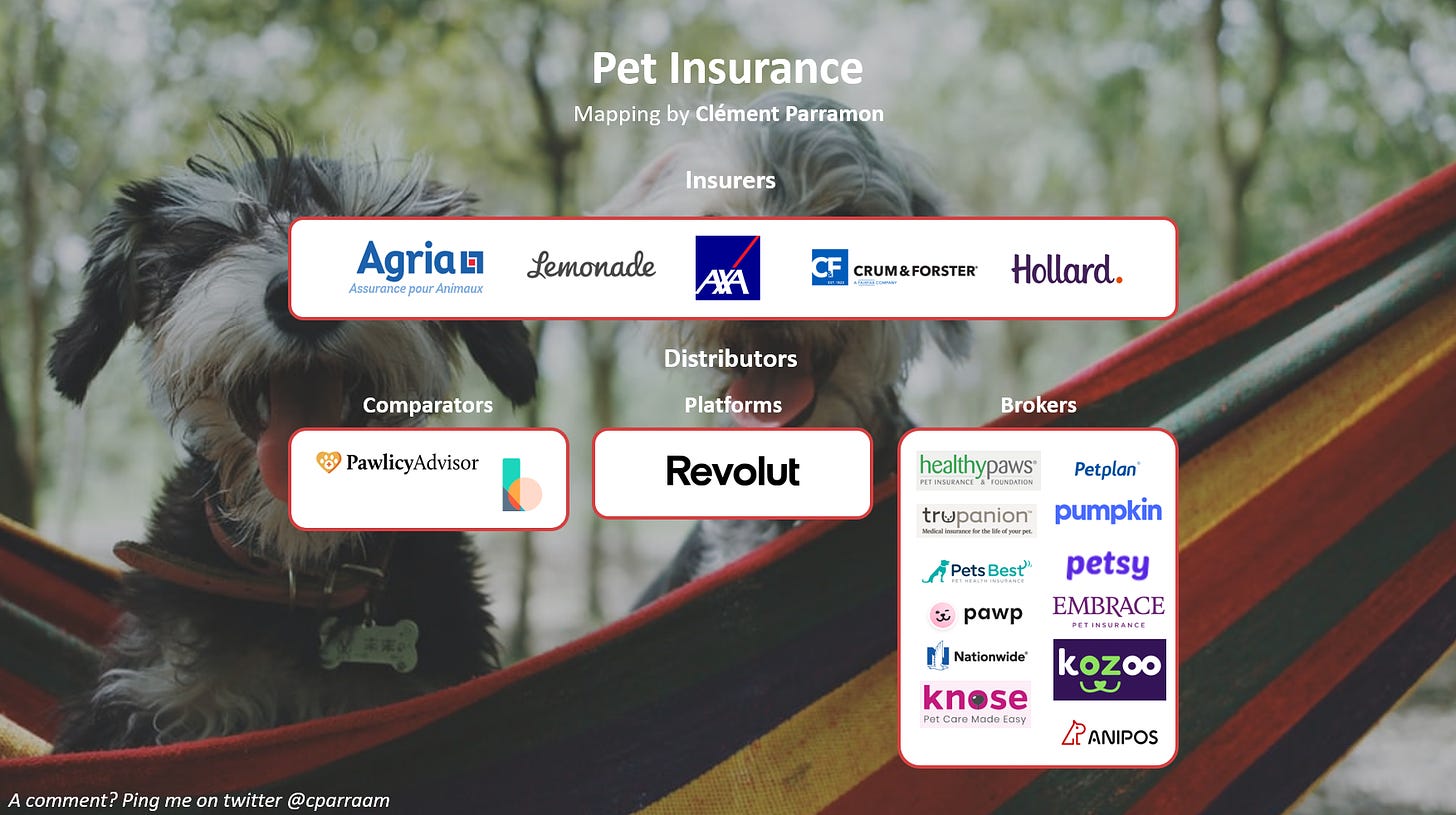

This untapped market is closely monitored by a wide range of players. In my opinion here are the three best go to market strategies:

Extend your value as a platform, and offer a nice to have insurance product for your existing client base. Typically Revolut diversification strategy is coming to this market as some people received surveys about the pet insurance market

Cross-sell pet insurance for all your clients, notably, if you are a home insurance provider (Lemonade strategy, possibly Luko in a near future?)

Get a distribution advantage by getting closer to veterinary

Recommended Reads

Did I miss something huge?

If there is something worth reading, do let me know by replying to this email :)

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️