Hi, this is Clément from HUB612👋

The world of Finance is driven by information, data and signals. In recent years, the explosion of Big Data (Volume, Variety and Velocity of Data created) has brought new opportunities to the market. Here I’d like to spend some time on how space has pushed Finance into a new era: Spatial Finance.

Each week I cast light on different topics related to Fintech & Insurtech through either it is through 1) Market Reviews 2) News of the week 3) Investment Memorandum. The format might evolve soon! I hope you find it usefull! Please feel free to provide feedback :)

Let's take some height

It’s been almost 75 years since the first photo of Earth was taken from space. This picture at that time was kinda blurry, but now the satellite technologies capture high definition shots. The satellite with the highest resolution imaging system is able to collect images with a ground resolution of around 15 cm, it’s sick!

We’ve all witnessed (almost all my subscribers I guess) one of the biggest moments in geospatial history with the launch of Google Maps in 2005. It made mapping technology available to a mass audience. And gave a sense of what geospatial data was.

Earth observation has served throughout the years many industries, and notably Finance. By integrating geospatial data (local temperature, rainfall, wind speeds, humidity from meteorological agencies + analysis of images from satellites) into financial practices, the financial system has led to increased transparency between players from the market (from data providers to practitioners).

That said, using spatial data isn’t new. For instance, insurers have used satellite data since the 1990s to model flood and hurricane risks. Though, it was rare to see the use of such data.

Recent technological developments have propelled the use of such data. And what I can tell from my deep-dive is that there’s an ongoing space race, and it’s oriented toward earth observation.

The launcher is ready

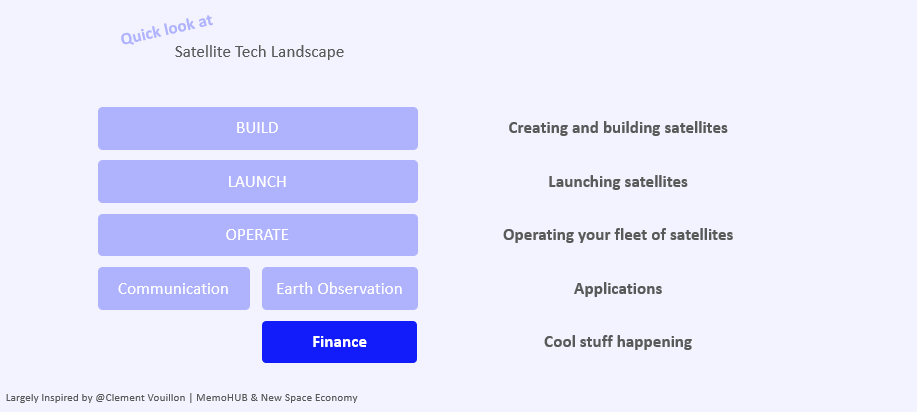

Over the last decades in space tech, here are the big changes that created new opportunities in space tech:

Overall market improvement

The cost of launching a payload into space has fallen significantly (it was x20 expensive back in the 2000s)

Acceleration of investments and innovation in the space sector (just look at what Space X recently).

Data Capture

The number of satellites orbiting has increased tremendously, pinging back an ever-larger volume of images

Cheaper sensors and platforms

The improvement of satellite precision and the flexibility of the overflights has improved data quality (and indirectly the insight retrieved from it)

Data processing & predictive modeling

Computing breakthroughs (more specifically developments in artificial intelligence and cloud-computing) have made the tools to interpret and analyze the data much more powerful and fast

Of the shelf processed data are available at all times. For instance, Spire employs data to track maritime vessels and airplanes and understand localized weather patterns. GHGSat uses its platforms to measure asset-level greenhouse gas emissions. Meanwhile, satellite data collected by ICEYE is used to monitor economic activity day and night.

Some challenges remain to see emerge a wide range of applications:

Purchasing data from satellite providers remains a high-cost

While satellite imagery of any point on the planet is available, there isn’t yet any corresponding or interlinked database showing who owns each piece of property for instance.

Spatial Data for Finance, really?

Alright, looking at earth it’s pretty cool. But what are the benefits for the Finance market from observing earth?

First of all, it’s a neutral and unbiased source of information. It’s global, frequent, and timely available. It offers socio-economic and environmental insights.

The typologies of client I have identified are the following:

Capital Market

“Climate change has become a defining factor in companies’ long-term prospects. “

BlackRock | Chief Executive Officer - Larry Fink

For most fund managers this manifests as a focus on incorporating environmental, social, and governance factors in their investment decisions—buying and selling stocks based on how well they score on factors such as carbon emissions.

Earth observation (ie Spatial data) now allow:

Effective implementation of ESG practices (at least detection of biodiversity covenants breaches and enforce compliance)

Comparison between assets and businesses (compare statement and reality)

Fundamental triple bottom-up analysis (Profil, People, Planet)

Insurers

They now can predict the potential damage to assets and infrastructure from a changing climate and extreme events (physical risks). This direct lower the cost of claims as (i) clients can now anticipate events (ii) insurers can estimate more rapidly the costs of a claim.

Insurers can go towards the personalization of insurance policies by adapting them almost perfectly to the risk to which the insured is exposed (parametric insurance).

All sectors are concerned: retail, agriculture, automotive, ..

Regulators & Policymakers

Regulators will assess more accurately environmental and social systemic risks within the financial system. Whereas, Policymakers will be able to track progress against the Paris agreement (for instance)

Corporates

They have the keys to verify internal data collection, compare performance with peers, and understand biodiversity risks and impacts within their supply chains

Prepare for take-off

If you are a space explorer, you may want to check the following resources:

Did I miss something huge?

If there is something worth reading, do let me know by replying to this email :)

To improve my work, please tell me how you felt about this issue:

😍 🤯 😴 😡 👍 👎

Previous issues (wait, there’s more!)

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️