We're all biased

Market Review #9 | Behavioral Finance

Hi, this is Clément from HUB612👋

Last thursday, I was networking at Fintech R:Evolution and I came accross a startup working on Behavioral Finance (BeFi) and got interested in it! Wondering how can behavioral sciences work with Finance and investment ? Here’s a few hint at what it can brings to the market.

Each week I cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum. The format might evolve soon! I hope you find it usefull! Please feel free to provide feedback :)

Behavioral Finance 101

First, let’s look at behavioral sciences. The aim of these sciences (neuroscience, sociology, economics, anthropology, ...) is to be able to understand the human being.

Behavioral sciences is a relatively “new field” in science. Still little taught, it’s something that emerges, notably in Finance. Back in the 1970s, Daniel Kahneman and his fellows (Amos Tversky, and others) worked on behavioral economics for which Daniel was awarded the 2002 Nobel Memorial Prize in Economic Sciences.

For a long time, we took as granted that financial agents were rational (and making rational decisions). But they’re not! People, under the eye of behavioral finance, are not always rational. They have cognitive biases (or mental errors) that get into the way of good decision making (see the rollercoaster hereunder), leading them to non-optimal decisions.

Let provide some examples of behavioral biases that influence investor decision:

Anchoring Bias: Anchoring refers to getting fixated on a number or value, based on past information.

Let’s say you buy a stock for 100€ and right after that the price starts falling; chances are that you’ll be anchored to the price of 100€ and won’t sell the stock even if it continues the fall, until it is too late.

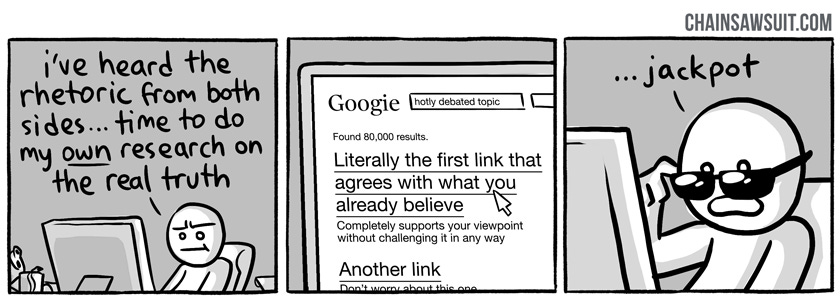

Confirmation Bias: Confirmation bias is when you have an opinion on something, you search for shreds of evidence that would confirm your opinion and completely ignore information that doesn’t support that opinion.

If you decide to invest in shares of a specific stock, then you’ll probably turn your eyes away from any information that might not confirm your choice of investment.Overconfidence Bias: Some investors might underestimate risk or overestimate expected return. This can cause excessive trading or lack of diversification since we’re convinced that a choice few stocks picks will do well.

Loss Aversion Bias: Loss aversion implies that one who loses $100 will lose more satisfaction than another person will gain satisfaction from a $100 sudden gain.

Thus, you might find yourself shying away from risk in order to avoid loss, which in some cases, can be detrimental to your long-term investment success.There a loooong list of behavioral biases in Finance here (60+)

Is this really a thing in Finance?

Following the 2008 financial crisis, in 2011 the European Commission has proposed changes to the regulatory framework for financial markets (known as "MiFID 1") to correct the weaknesses that emerged. A second correction of this European directive, known as "MiFID 2", was passed in 2014. Its objective is to strengthen the protection of retail investors, while improving the transparency, security and functioning of financial markets. Similarly in Switzerland, LSFin regulate that.

Thus, the regulators now oblige investment advisors to assess their customer investment profile (appetite and knowledge) annually. If advisors don’t comply, they risk a fine of € 20 per customer. For Caisse d’Epargne (one of the biggest French Bank) such a fine for 20,6m clients is a 200m annual blow (outch).

Basically, the regulators have created a market for startups here. There are 410m European residents that are now part of the banking system, thus just at a fine level, the EU market is worth € 8.2Bn.

Investment advisors are numerous and in different kind of structures:

Major networks of banks, mutual insurance companies and Bank/Insurance

Pure players in private banking

Independent Wealth Advisors (IFAs) or Financial Investment Advisors (FIAs)

Platforms

Online banking

Online brokers

Robo-advisors

All of them have build their own know-your-customer-investor-profile (KYCIP) questionary, to comply to the regulation. The observation is that (i) they poorly identify their customer’s risk profile (ii) the UX is bad (iii) the process is often not digital (iv) it’s time consuming as you have to answer to a ton of question (v) ..

Why financial advisors use BeFi?

Regulators (at an European level and at a national level), are now mentioning and occasionally pushing financial advisors to look at BeFi. But the regulation isn’t the only value proposition of BeFi.

According to Charles Schwab 2020 Behavioral Barometer, following the backdrop of increased market volatility in early 2020, advisors reported the greatest benefits of using behavioral finance included:

Kept clients invested during market volatility (55%)

Strengthened trust and relationship with clients / increasing client retention (48%)

Better managed client expectations through effective communication (40%)

Reduced short-term or emotional decision making (37%)

Developed better understanding of clients comfort levels with risk (33%)

Behavioral Finance blossoms in advisor practices. Advisors are increasingly incorporating behavioral finance within the context of (i) client communications, (ii) reduce chrun and (iii) ease portfolio construction.

(i) About the notable uptick in client communication, Cerulli’s research has consistently found that the level of an advisor’s proactive communication efforts during volatility is the most reliable indicator of the degree to which the advisor will add new clients during the period. And proactive personal communication was valued by investors and was especially effective for advisors who have made behavioral finance a part of their client engagement strategy.

(ii) Client education is extremely important as it helps clients create a durable mental framework to deal with the adversity presented by the uncertainty in the markets. If they understand, they won’t blame you for the market volatility an their associated losses. Bingo, the churn is reducing.

(iii) Having a regular discussion with your clients increase your chances of being able to advise him better and, why not make up-sell / cross-sell.

Notably, those who use behavioral finance were almost twice as likely to gain clients after the first quarter of 2020 as advisors who did not use behavioral finance (66% vs 36%). Interesting.

(not so) Startups under the light

The challenges for startups in this market are the following

Difficulty of translating behavioral finance theory into practice, and make it tangible for advisors to understand

Complexitiy of integration to the existing advisor’s tech stack or cohabitation with other software / platforms

Long sales cycle + test + implementation, especially traditional banks (sorry folks)

Content to snack

Yet, if interested here are a short selection of content you may like on the topic

Vous allez commettre une terrible erreur ! Combattre les biais cognitifs pour prendre de meilleures décisions - Olivier Sibony (Source)

Finance comportementale et gamification, les nouveaux outils des Banquiers - Finscale #5 (Source)

Système 1 / Système 2 : Les deux vitesses de la pensée - Kahneman (Source)

Did I miss something huge?

There is a lot happening out there!

If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues (wait, there’s more!)

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️