Hi, this is Clément from HUB612👋

This past week got super interesting in the Fintech ecosystem. Moves from global players (GooglePay Relaunch, Lemonade coming after France, .. ), lots of fundraising, and trendy french startup batch revealed to the public (Station F Future 40 - 2nd Batch)!!

Yet, I decided that I wanted to talk this week about french fintech entrepreneurs.

Each week I cast light on different topics related to Fintech & Insurtech through either it is through 1) Market Reviews 2) News of the week 3) Investment Memorandum 4) Data Analysis. The format is evolving! I hope you find it usefull! Please feel free to provide feedback :)

French Fintech Builders

As highlighted by my peers, France is still a ghost town if you only look at lagging metrics like ‘number of unicorns' or ‘large exits’. It’s in fact similar to a seed-stage startup, you can spot early signs and place your bet on what could become a world-class entrepreneurial ecosystem.

Here are what interests me today: these low signals revealing a growing maturity in the startup ecosystem, and more specifically the fintech one.

Hereunder, I started public monitoring of the French Fintech Builders. It’s a work-in-progress and it serves different purposes:

Mine

Increase my personal knowledge about the markets, regulation, tech, business models, ..

Develop my personal network

Discover investment opportunities

Code another project :)

Yours

Create one (and probably not the first) efficient quantitative monitoring of the French Fintech Market

Connect entrepreneurs with (i) accelerators (ii) investors (iii) talents (iv) etc ..

Perhaps, meet me? :)

..

Live Monitoring - Free Access

The current model is using the following data: (almost) all french fintech startups that raised money since January 2020. It's a small portion (52 companies & 108 founders) of the whole herd but a good first step for me! (You can add more data down there. ⬇️)

Here are (imo) cool insights about these companies/founders I couldn’t find elsewhere:

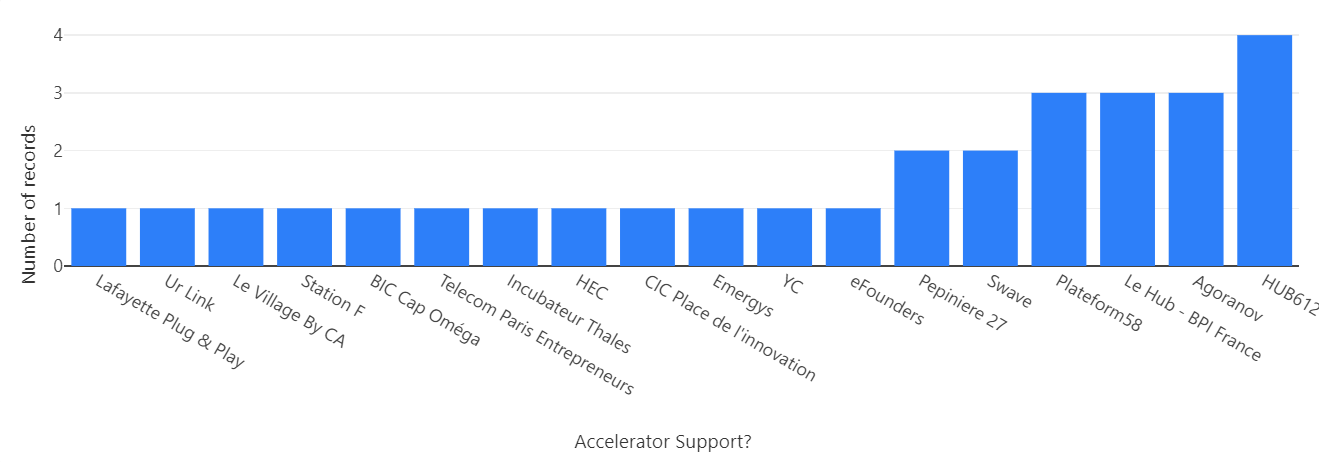

Supporting structures are great partners

A startup ecosystem is not only made of startups. There’s a bunch of players that support these entrepreneurs (incubator, accelerator, startup studio, .. ) to help them build and accelerate. Note: These startups are possibly supported by distinct players, sometimes at different stages of development.

Kudos to HUB612, Agoranov, Le Hub BPI France, Platform58, Le Swave, and all the others for your support!

First time building stuff?

Among 108 founders, 58 are repeat entrepreneurs (53.7%). I’m so impressed by this figure. These people have experienced failures and success and are more prone to frictionless startup development!

There is no age to build a Fintech

I estimated the age of the founders using their educational background. The average is 37 and the median 36y old. Most of the repeat entrepreneurs are more than 30y old.

Proud Alumni

Success in supporting and investing in pre-seed and seed venture is highly correlated with the level of human interaction you develop with the founders.

One of the questions I always ask myself when I met new entrepreneurs is “why are they here, why are they building this?”. Thus I always wanted to have a view of where they were coming from, professionally speaking.

Here, I pulled a view of Finance and Insurance companies that had future fintech builders in their rank at some point. (More Insights here)

You can contribute too!

The list will be updated regularly, so as the deliverables (graphs, tables, .. ). And will stay accessible for those interested. But I may need some help in consolidating this list! Feel free to contribute :)

Recommended analysis

If I picked your interest in data for the Fintech market, please check the following resources:

Did I miss something huge?

What kind of data would you like to see? Do let me know by replying to this email :)

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️