Fin-Fluencers

Thought 2 - The cool marketing strategy

This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

Following my piece on social finance, I spent quite some time on social networks to identify trends and interesting chunk of information to share. And I got algo-oriented toward Fin-fluencers content. Believe it or not, they are viral on these platforms and they deserve better coverage.

Finance is a topic of general interest

Finance is more social than ever. Over the last years, there’s been a clear shift in terms of mindset when it comes to money (see Social Finance issue). We share openly about it, we prepare for possible life incidents, we organize our retirement, .. This is not longer taboo and that’s for the best!

Interestingly, the change is coming from the younger. What matters the most for Gen Z, is financial stability and security. If in France, 77% of the inhabitants consider their financial knowledge to be average or low, let me tell you that Gen Z is probably the generation that is the most exposed to financial content and without a doubt, the most interested it in.

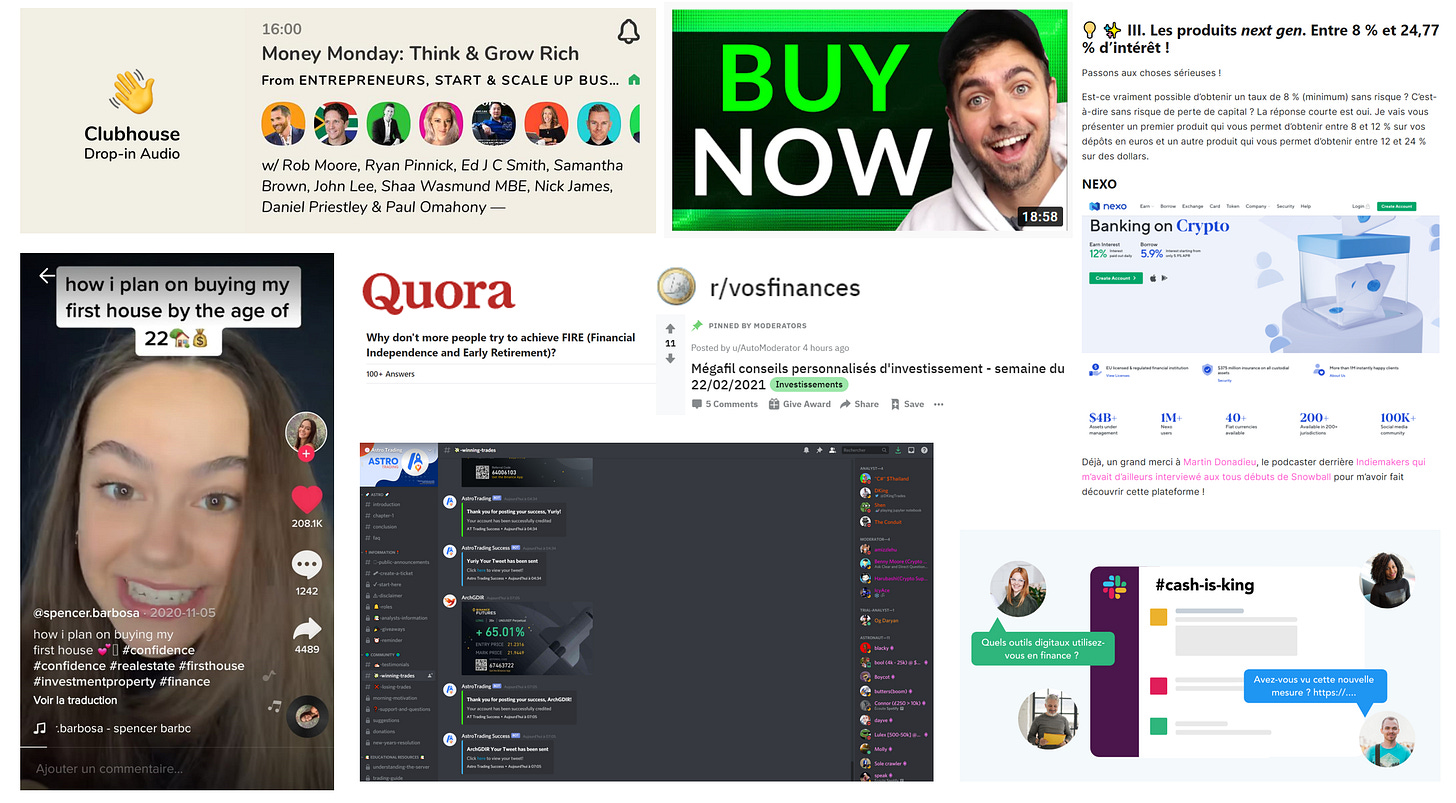

Content, community, creators (side hustlers) are on the rise. And social networks now have a whole new category of financial contents appearing.

Social network hashtags are revealing a large interest. Check Tiktok (#finance 1.5B views / #PersonnalFinance 3.6B views / #financialfreedom 261.7M views)

or Instagram (#Finance 8.7M posts / #financetips 380k posts)Social communities about finance are multiplicating and are getting bigger. Newsletters (Incerto, Snowball, Finary, Cash is King .. ), subreddits ( r/Wallstreetbets, r/vosfinances, r/fire, .. ), Discords, Telegram, Clubhouse, ..

Fin-Fluencers are on the rise

After scrolling a bit on any social networks, you’ll be hooked at some point with more and more verticalized influencers focusing on money management, investment strategy, personal finance management, ..

Anyone talking about finance is basically what we call a fin-fluencers. Whether you are an expert or victim of the Dunning Kruger effect after downloading your neo-bank app, as long as you talk to an audience you are acting on the opinion ( = you are influencing).

Content on social networks can be radically different. From educational purposes to well-marketed scams. By the way, it can be tricky to distinguish them as they may have the same messages, resulting in different outcomes.

“You want to be a millionaire ?”

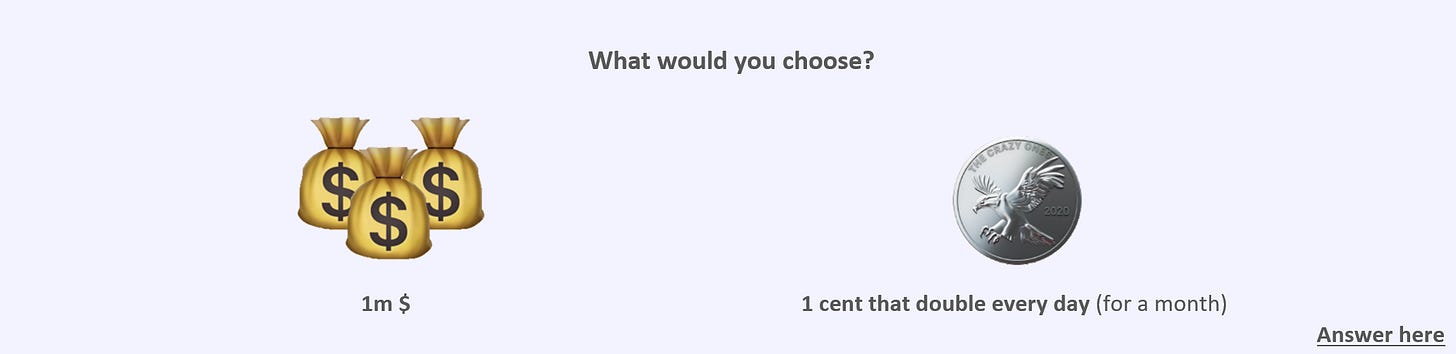

Some will teach you how to spare money, diversify your investment, and use the compound effect to reach a long-term financial goal. Whereas malicious people will push you to invest in an unknown obscure scheme for an incredible return on investment in just a few days. Be careful 🙃

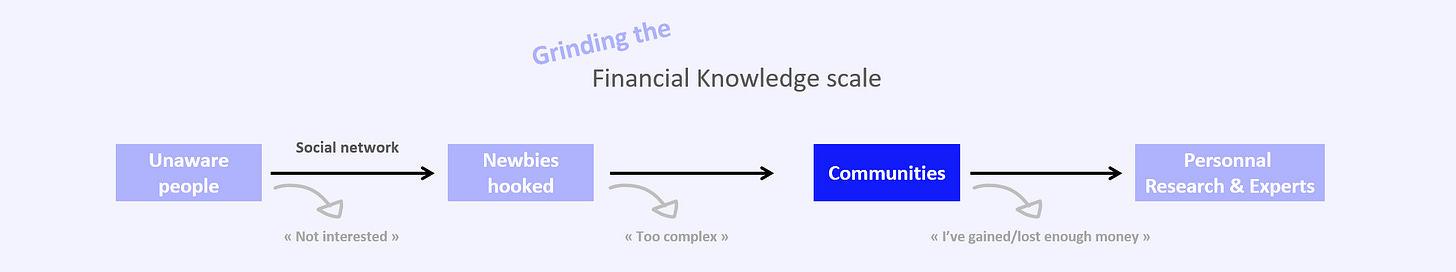

In my opinion, there are contents for different states of awareness regarding finance and people are here to digest adequate content. Most of the free content accessible on social networks, as of today, is educational. It pushes Gen Z to think about the long term.

Newbies are hooked because of surprisingly crystal clear videos/blogs posts about complex concepts like compound interest, credit score, inflation, .. Fin-Fluencers using content to educate GenZ (and younger generations) are in fact extremely popular: @humphreyyang (1.6 million followers) @marktilbury (6.0m followers) ..

Communities then kick in. It provides reassurance and advice to anyone that wants to retake control over their financial life. Looking for mentors, tools, tricks, side hustle to earn money, ..

Fintech brands partner with fin-fluencers or try to become one

Brands are trying to grasp the value of fin-fluencers, but it's not an easy task. Usually, on social media, multiple strategies exist for a brand to grow:

Create an account + produce regularly pieces of content

Pay for ads

Encourage User-Generated Content around your brand

Leverage on other people influence sphere (partnerships with influencers)

The platform is also crucial. Each social network has its audience, and some of them are already saturated with content/ads/ .. and it can be difficult for a brand to build from scratch an aura big enough to generate business.

For instance, Tally (Fintech startup) has reported that Tiktok ads are over 300% more effective than other platforms like Instagram. New platforms are opportunities for brands!

The end goal is to embody the Gen Z aspiration, and you need to understand their codes, be where they interact, and create genuine content for them to whom they can identify.

Interestingly, startups are open their capital to influencers as it is a great way to reach millions of potential customers. Gerard Piqué invested in Sorare (Fantasy football NFT), Charli d’Amelio invested in Step (Neobank), ..

I wouldn’t be surprised to see more influencers becoming business angels in the fintech/insurtech industry. It’s an interesting hack for B2C businesses that almost zero investment fund can provide!

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️