This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

For the second time in my life as a VC investor, I met with entrepreneurs building a copycat. You know, it’s a startup that has copied an estalished startup in one country to develop it on new geographical markets where competition is low or doesn’t exist.

I think it’s a great playbook for kickstarting a company, but it doesn’t mean you’ll be successful.

Fintech copycats around the corner

Copycats are opportunistic projects. It’s simple as that. You see something working pretty well elsewhere and you wonder why this idea wouldn’t be working in another geography.

It’s the fundamental idea of innovation. You never create something from scratch. You always re-use parts, ideas, tricks, .. to get a little further.

Please remember, and I can guarantee this to you, if you are the first to build a product upon an authentic idea, people are going to take notice. A great idea entering a market draw attention and becomes a source of inspiration. As a consequence, you start being copied in one way or another

And it’s OK that you’re not alone, that people are building after your idea:

An idea is barely the start, execution is everything (see this)

You think you are original but people may have made the same discovery

Did you notice how often in history, innovations are made independently and more or less simultaneously by multiple persons? This concept is called “multiple discovery”.

Confirmation bias (again)

Once you have it in mind, you see it everywhere. Unless you make a genuine disruptive breakthrough, you are probably building upon existing things/ideas. No surprise if your idea looks similar to others.

Ctrl C + Ctrl V a Fintech startup: Try again

You only see the top of the iceberg

“It looks the same”. Exactly. It looks the same but it’s not. You may be identifying similarities when comparing two distinct products, but keep in mind that they have different parameters: Company’s vision, local regulation, the team (and skills), capital, ..

Furthermore, a startup is building upon the problems it has solved. And we can’t see them from outside. It’s hard to compare the current life of two startups. You can instead compare their trajectories over time. In the end, all we can say is that innovation happens on the inside.

Market readiness

A market isn’t necessarily ready for your startup to launch. For instance, the adoption of QRcode payments in France is very low. This is why I hardly believe the feature will suddenly be a new habit.

Either (i) the market may not need your product or (ii) isn’t aware yet that it needs you.

In any case, before experiencing the same success as your model, you should expect to fumble around to find the right positioning (adapt the value proposition, the message, .. )

Regulatory barriers

Before entering a market, depending on the activities you plan to run, you may need to comply with local regulations. It’s both a great barrier to cross and a barrier to build.

These barriers take months if not years to build. Careful if you plan on launching a startup to have a clear view of the requirement to fully and legally operate.

Fintech Copycats, here to innovate

Venture builders are enablers

Copycating is such an opportunity that there are factories (or venture builders) that have industrialized the process. The whole point of their activity is to copy promising business models and adapts them somewhat to other local markets.

Forget about who had the original idea, it’s about who was able to exploit it most effectively.

It’s great to be copycated

While developing your venture, you may reach a concentration point in your existing markets and think about expanding in new regions. Possibly a great strategy. Probably expensive, time-consuming, and surely full of obstacles as each country has its share of surprises.

Here a great playbook is simply an acquisition strategy. When Stripe recently thought about going full speed in the African market, they opted for the acquisition of their competitor PayStack.

Paystack was such a highly technical and fanatically customer oriented startup that it looked like the perfect opportunity for Stripe to soft-launch in a new continent, without having to re-build a new product from scratch (with new parameters).

Copycats are the new normal?

It’s always hard to tell who was here first, but does it matter? In the end, the company successfully builds a great product, serves a market, and delivers great innovation.

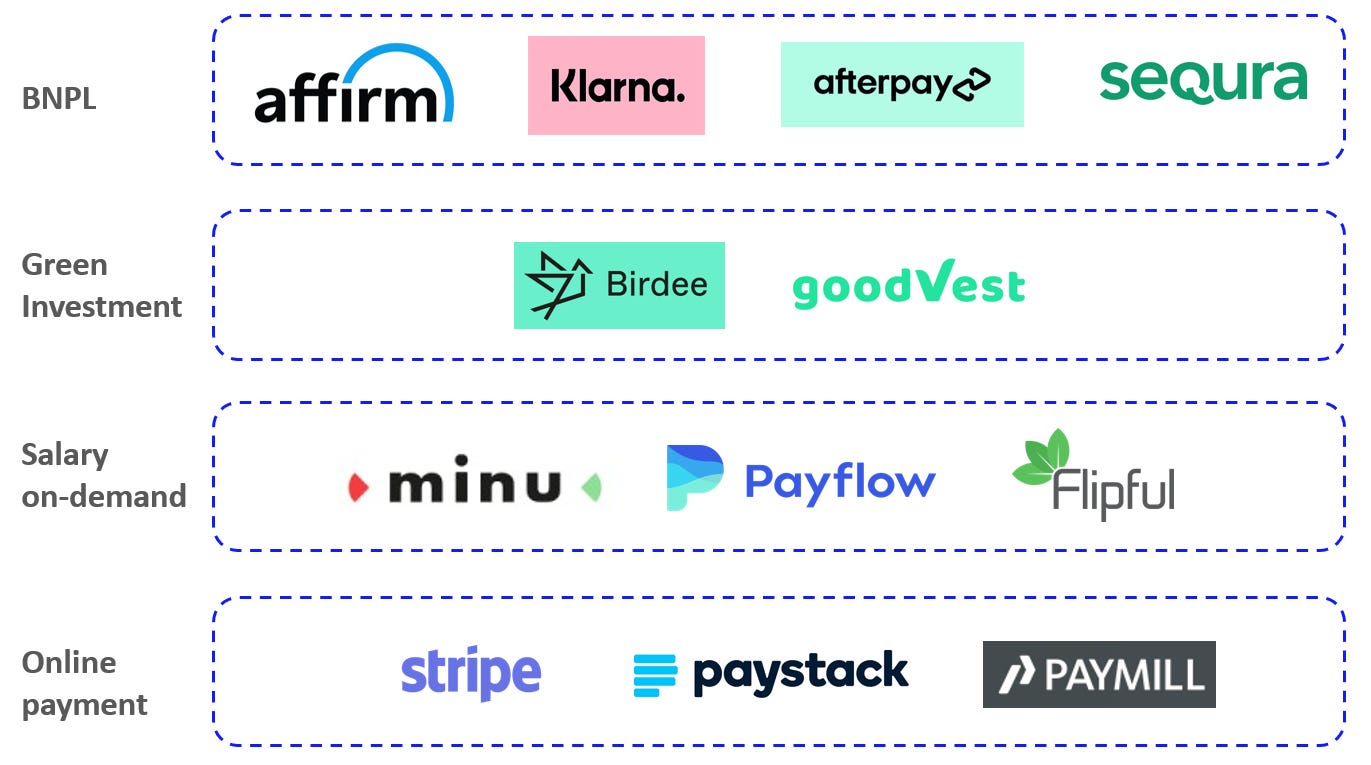

This isn’t extensive research, nevertheless here are a few competitors that aren’t in the same initial market but whose value proposition is extremely similar.

Call it copycats, inspirations, or competitors, all of them are changing the industry.

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️