This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

I recently supprised myself crawling the whole internet to look after a coupon or a discount before buying a product. And this seems crazy for older generations, but I’m not an isolated case.

Intrigued, I decided to dig into this whole market which is not the so called niche people use to overlook!

Discount, Voucher, Coupon, Deals, Cash-Back, ..

Record online sales in 2020 are changing the perspective on payment (and retail)

We’ve all experienced a global change in our shopping habits. Mckinsey explains that more than 60% of online shoppers changed theirs and intend to stick to them.

Last year, customers were less inclined to spend money as they were isolated. But this didn’t prevent huge blockbuster days from happening. Alibaba set a new record by racking up $115bn of sales in a single day!

And interestingly, the principal motivation (48%) for buying a product from a retailer was “Better prices/promotions”.

Millennials are deals diggers (yeah that’s me)

No need to wait for bi-yearly discounts. Millennials buying power increase as time goes on and paradoxically they are the pickiest customers when it comes to purchasing. When shopping online, 69% of them search for coupon codes for at least 3 minutes (crazy commitment compare to the increasing bounce rate effect of a 5sec long loading bar on a website). On top of that, 56% of Millennials follow brands online to gain early access to deals.

This has a significant impact on retailers as they must change their marketing strategy accordingly and they can’t just wait for the customer to show them a discount/offer, the brand must proactively reach them through a different distribution channel.

Cashback is hot in Europe

When it comes to the coupons and deals market, Europe is a late adopter. Yet, there’s been an increasing amount of investment and interest over the last year about this market with Joko raising €10m, Paylead €6m series A, ..

And more recently, iGraal (FR) has been acquired by Global Savings Group for $123.5m. It reveals a great dynamic over a once called “niche market”.

Cashback players have their own playbook

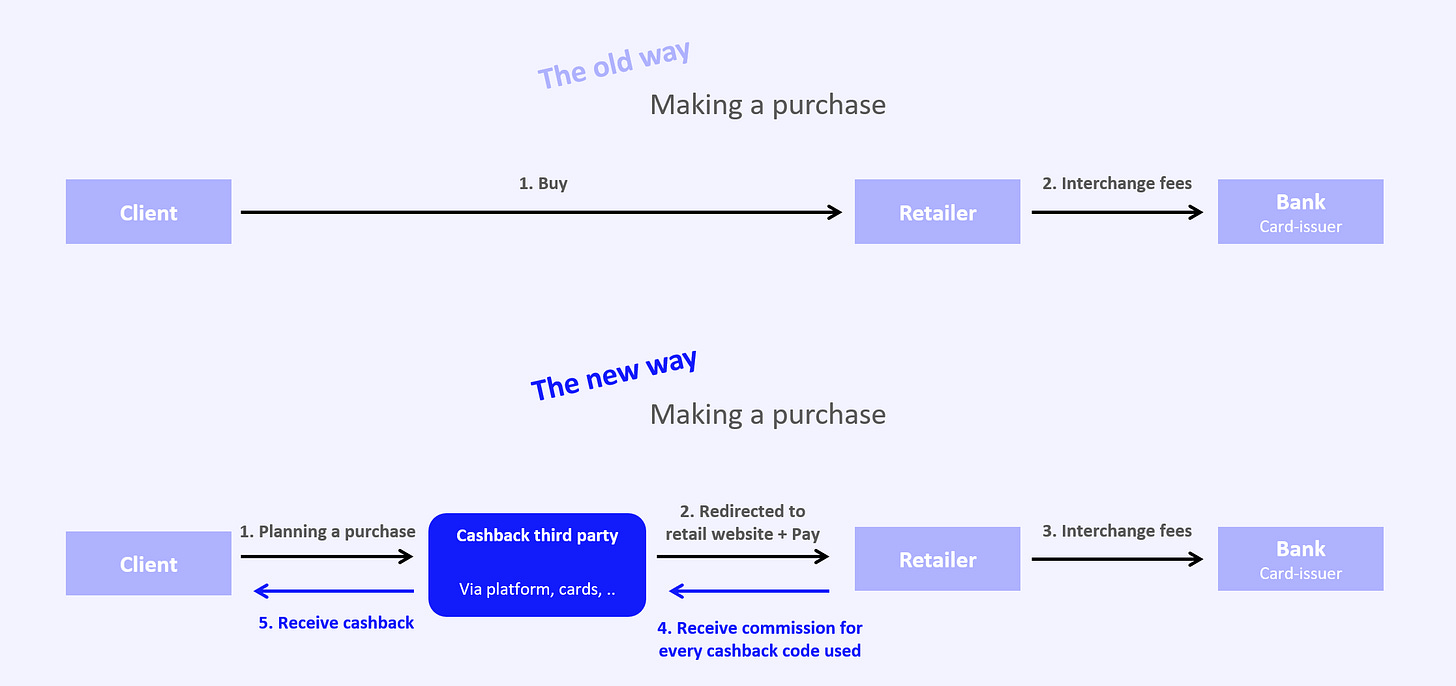

There are multiple cashback players appearing in Europe, each of them has a specific spot in the customer journey and a distinct value proposition. Most of them are free of charge and their business model relies on getting a commission from the client brought to the retailer. Their value? The reduce massively the cost of acquisition

Chrome extension

An identified pain is the time you spend online looking for deals, discounts, coupons, .. The fastest way is to have a navigator extension ready to fire up anytime you are on a retailer website.

To obtain these codes, some of them have a community (Wanteeed has 120k+ users), others have automatic crawlers. The client on his side gets a direct cashback or has to wait up to a certain amount of points before getting a real cashback or coupon.

Cards & Corporates cards

Most of us pay every month for our payment cards and, some of them offer direct cashback on each transaction you make. But, the model has certain limits.

The business models here are mostly dependant on the interchange fees between a merchant and the bank issuing the card that pays the transaction. In the US, cashback is a widely adopted product. Whereas in Europe, the interchange fees are capped at 0.3% for credit cards and 0.2% for debit cards since the end of 2015.

According to the card issuer (not only banks as it can be a neo-challenger) strategy, they can bet on acquisition or loyalty.

A not so performing playbook about acquisition is announcing a 3% cashback BUT you rapidly understand the yearly amount at this rate is capped (up to 120€ a year for instance). Thus, there isn’t much opportunity here. But banks have a powerful distribution so it’s still developing.

For corporates cards, as your company pays a higher amount to get these cards, there is a sufficient margin to provide cashback on certain services/products. Though, it’s more a nice to have feature.

Open-banking powered

Here startups are getting a little more intelligent as they analyze customer’s banking data. Thanks to DSP2 in Europe, startups allow brands to supply personalized offers to them while guaranteeing their anonymity.

That a real deal. Even Google Pay is betting on this as they recently announced similar features for their incoming V2.

For retailers (see Joko) it’s particularly interested in the way they attract customers to their shop. Customers are profiled and offers are then personalized. In the end, the cost of acquisition is reduced as the model is performance-based (if a client pay, a retailer pays Joko).

For banks (see Paylead) which are laggards on leveraging on their own data, they want off-the-shelf loyalty program management platforms to (i) increase NPS (ii) attract new customers (iii) create recurring revenue (iv) maximize credit/debit card usage.

Crypto-currency investing

I came across this interesting use case with Cash.app. By using Cash’s free debit card, you will get a $1 discount on any coffee shop purchase. And in the meantime, they have a bitcoin buying feature at a 1% cost. Here you can typically invest your cashback directly in crypto-currencies.

I wouldn’t be surprised to see this model being replicated. There’s a FOMO from customers. They’ll rush to use such a feature and given the current price increase dynamic, this cashback could be a great investment.

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️

Help you save money

https://www.timelycoupons.com/

E-Learning platforms & online masterclasses have become increasingly popular on a global scale. The Masterclass Collective is an educational production platform that emphasises learning through engaging content. Our production team delivers stunning online courses meant to intimately connect audiences to their instructors

<a href="https://masterclasscollective.com/">Master Class Collective</a>