This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

These past three months, fintech seemed too much focused on crypto (notably DeFi and NFT). To the point that it may have eclipsed the recent hype around Buy now Pay later market. And yet, this (nascent?) market is taking off :

Multiple fundraising have revealed an important traction on different geographies : Alma (FR, €49m raised), Klarna (SE, $1bn raised), Pledge (FR, €80m raised), Payright (AU, $27m raised), Wisestack (US, $19m raised), ..

Executives are suddenly talking about “buy now pay later” and the “BNPL” word surge in transcript (earning calls, conferences, shareholder meetings, .. )

What’s happening here ?

The rise of BNPL

BNLP what??

As the name suggests, "Buy now pay later" solutions give the opportunity to buy something without having to pay it until a later date (after a set interest-free period, or in installments).

The notion of BNPL includes a wide range of services (that may differ from a country to another), listed hereunder. Buy now ..

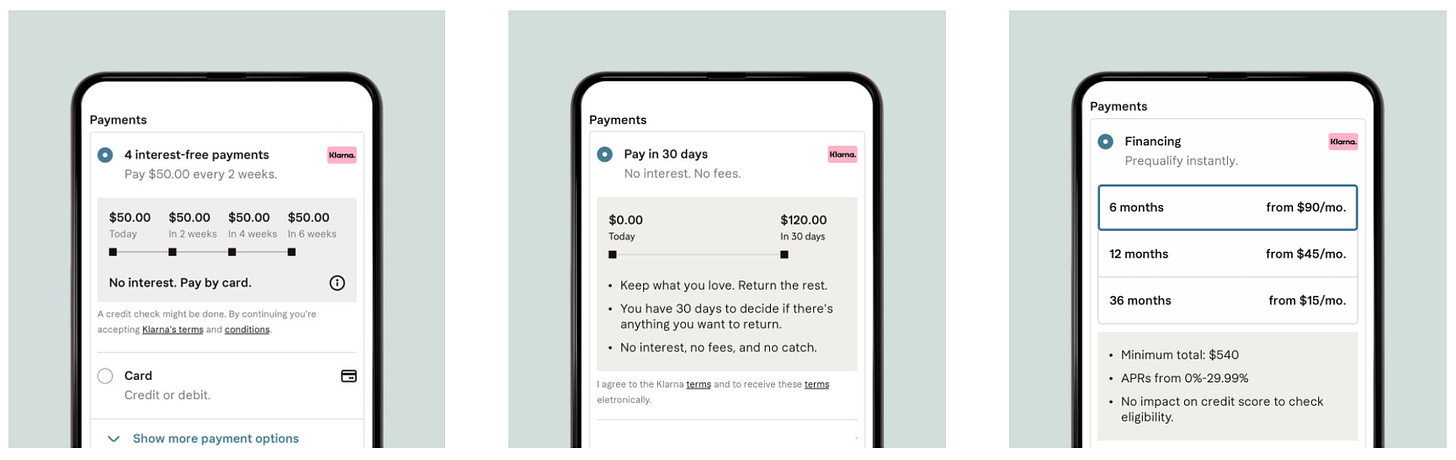

.. Pay on Finance(Point of Sale Finance)

Traditional credit to finance large purchases over 3-36 months, where you agree on formal payment upfront. You'll be most probably charged interest over the period.

.. Pay in installments (Pay in Four)

The total amount of the purchase is split into a few installments (3 to 4). Usually, you make one payment directly and give permission to the BNPL provider to take the following incoming payments. In case of late payment, you may have to pay late payment fees. If not, there's no interest.

.. Pay later(Pay in 30 days)

Here you simply delay the total payment for a number of days. Typically from 14 to 30 days. You'll get a friendly reminder when the payment is due. The model is particularly interesting for customers who want to have time to try the product before buying it. There is no interest.

At first sight, you may say it's not something new, it actually has existed for years. This is a credit, with a specific reimbursement form. Merchants have long offered customers credit (notably through store credit cards), both to enable/increase purchases and to encourage customer loyalty.

Furthermore, the finance trick behind BNPL models is old! A business that sells its accounts receivables to a third party at a discount is known as factoring.

Yet, BNPL is taking off.

BNLP zero interest hook

You may say it's still a drop in the ocean of credit, and I will say yes.

The last figures I found revealed that the main BNPL providers have financed around $40 bn of sales, globally. And it looks marginal compared with the $10 trillion credit spend that passed through the pipes of Visa, Mastercard, American Express, ..

However, this is a low signal of a market shift. The BNPL industry is expected to finance around $680 bn in sales in 2025. That would represent a 103% CAGR over the next four years! That may be a pond?

There a few reasons that drive this (sudden?) shift :

Given the current pandemic, e-commerce has seen unbelievable growth. Credit usually given to customers while purchasing on brick-and-mortar stores were no longer possible. BNPL provider initially caught this opportunity by partnering with a loooooot of online merchants, to embed a BNPL feature directly into their website.

Credit card lending hasn’t grown an awful lot over the past 15 years (CAGR < 1%), particularly among the Millenials & Gen Z. They’re now relying on debit transactions and using BNPL services as supplementary finance options.

BNPL is a more transparent solution. Indeed, the total cost is known upfront, it gives the borrower more of a feeling of control compared to alternatives (ex: credit card).

BNPL is not necessarily seen as debt. As long as the amount is paid on time, they are 0% Annual Percentage Rate (= no fee). That's a strong value proposition given the current growing fear about debt from customers. Furthermore, most BNPL providers are capping their late payment fees.

BNPL providers have maximized the convenience of purchasing. Frictionless experience on a side, an increasing number (and size) of transactions on the other. It's super easy to sign-up for BNPL scheme. In a few minutes and with basic information, you set up an online account. For a regular credit, you would have waited days!

BNPL schemes allow more flexibility in issuing credit. Of course, BNPL providers perform credit checks. And even though they often target low-income and younger crowd (who lack good or long credit history), they still manage to keep the default rate very low

A business model built on consumer welfare

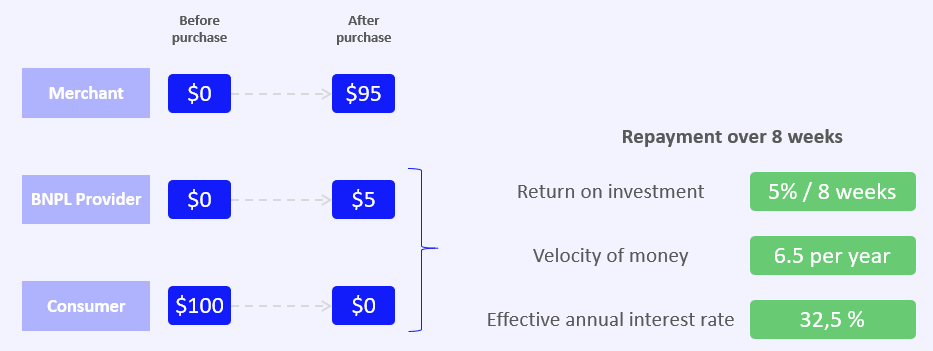

It's a strong value proposition to offer a 0% interest on credit. But you may wonder what is the BNPL provider business model? Compared to traditional credit cards or personal loans that are generating their revenue on overdraft fees or late payment fees (they need the customer to loose so that they gain), BNPL schemes are mostly relying on their revenues from merchants (ex: 86% for Afterpay).

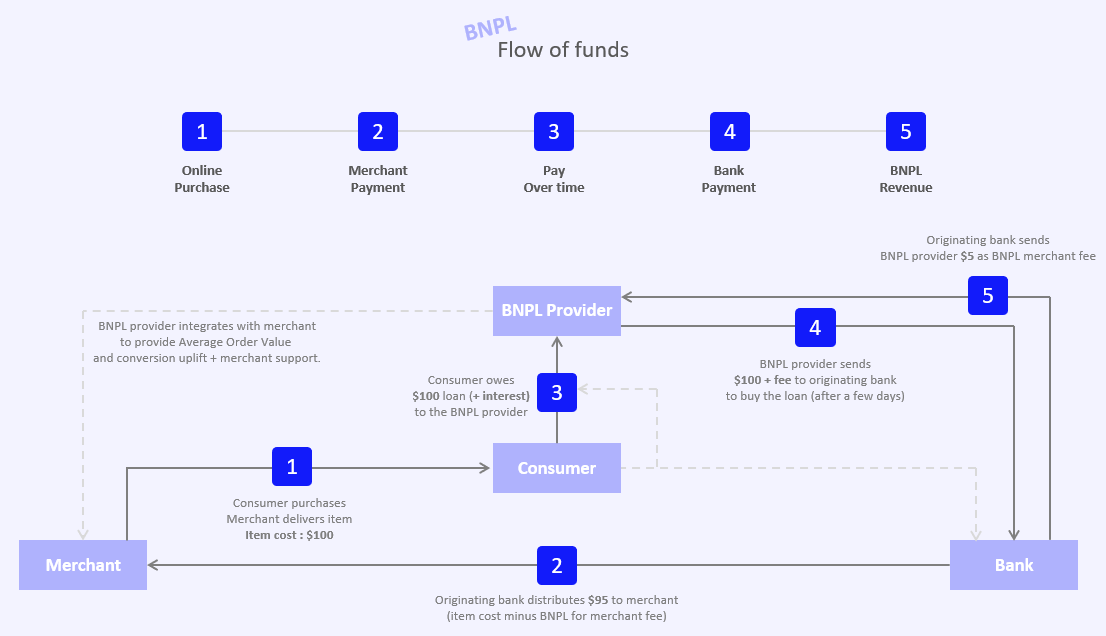

On the upper graph, you typically see the flow of money. You probably notice that most of the money is coming from the merchants. Indeed, BNPL startups usually charge from 2 to 8% of the purchase amount (some charge a flat fee per transaction). It's seen by the merchant as a more expensive payment method alternative (others being: Credit & Debit Cards/Wallets/COD). However, BNPL schemes are known to be a major boost in conversion rates at checkout and customer loyalty, which is a game-changer.

On the customer side, some BNPL startups gain from late paiement fees. But they all encourage consumers to repay in time by setting up incentives such as freezing customer accounts on payment defaults.

In a nutshell, BNPL schemes align interests: with the revenues relying on sales commissions (BNPL provider interest), the business model ensuring that all efforts are aligned to reduce repayment defaults (consumer interest) and increasing sales frequency and transaction sizes (merchant interest).

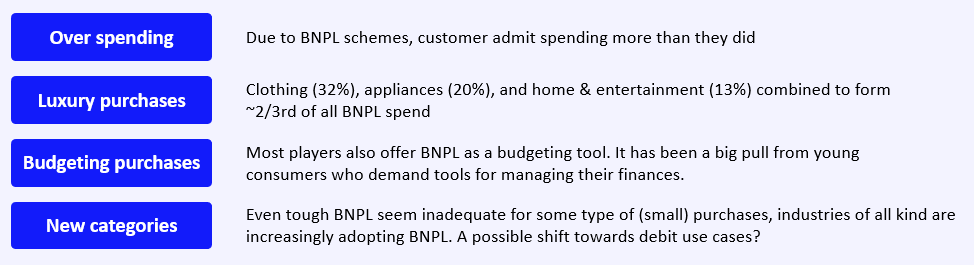

Some geographies are well ahead in terms of BNPL adoption. For instance, in late 2020 more than 30% of Australian adults were using a BNPL account. Based on such consumer volume, there are a few notable behaviors that have been validated in other geographies :

BNPL is still in its infancy

Distribution strategy evolution

BNPL startups go to market strategy was initially a B2B2C approach. They successfully signed-up an incredible amount of merchants with the upper-value proposition. Their acquisition then drove the usage of end customers.

More recently, most of these players have added a B2C layer to their activity (personalized marketplace, fast checkout, loyalty & cashback .. ). In my opinion, the greatest value is their push from these players toward consumer finance management (ex: budgeting)

That will be interesting to monitor!

A legal loophole? Increasing regulatory scrutiny

I spotted that in Australia, BNPL providers are not regulated by the National Credit Act in the same way as other credit or finance providers. The reason? Either they did not technically charge consumers a fee on their debt, or because they charged upfront or periodic fees that were fixed, did not vary according to the amount of credit provided, and were less than minimum specified amounts under the law.

These grey areas will be addressed at some point. Actually, BNPL providers are facing increasing regulatory scrutiny, that's a great signal, to be honest.

But in this case, it's a legal loophole and a key differentiator as Australian BNPL providers are not obliged to perform a credit check, verify the customer’s income, and ability to pay a debt back.

Lateral neo-bank, future financial super app?

Klarna, a BNPL startup, has just turned its mobile app into a banking app in Germany. Adding a bank account provides more (full?) visibility over the customer finance. This clearly opens to new opportunities for credit lines and related features.

I should dig into lateral neobanks .. :)

It’s flourishing globally

On top of that, some incumbents (financial institution or not) are trying to catch up.

Banks could be reluctant to push the product too much for fear of cannibalization. Indeed, as of today, their profitability in their revolving card business is higher than in the BNPL schemes.

Goldman Sachs: already offers POS lending through its Marcus brand

Visa: working on a number of projects to allow card-issuing banks to offer installment-style options directly at the point of sale

Paypal: has long offered a line of credit product. It has expanded into the ‘pay in 4’ category. With an existing, large merchant network, this may be the most serious competitor

Apple: already offers 0% financing via Apple Card “monthly installments” when used to buy Apple products.

..

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️

Thank you 🙏 for this great content! I’ll go deeper into your previous post.

Note: Typo here: « BNLP zero interest hook » BNPL 🤓