This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

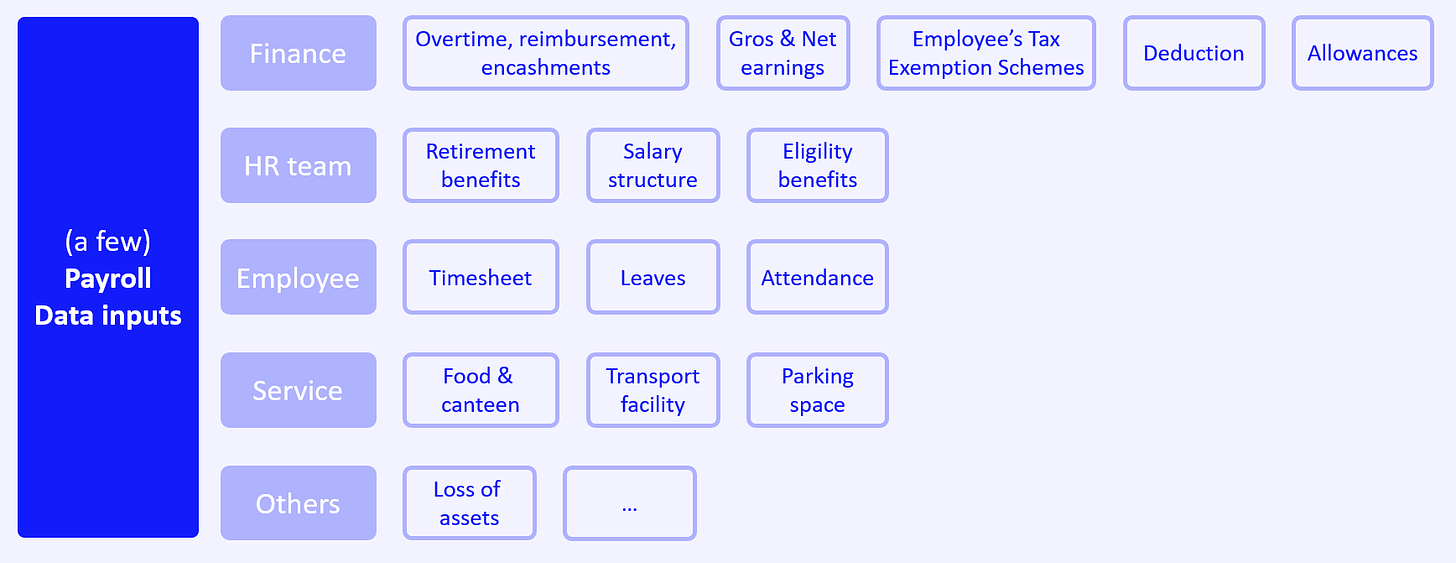

Payroll seems easy peasy. As an employee, you work hard and you are paid (hopefully) at the end of the month. In fact, the calculation and execution of the monthly payroll are quite complex for the company. Entrepreneurs have been trying to help to smooth payroll processes for both the company and employees, and ultimately things have moved quite a bit.

They see me Payrolling, they hatin'

Companies often use payroll providers to assist them with the calculation, the generation of tax documents, ensuring compliance with local payroll law, etc .. Incumbents have been operating for a long time (ADP founded in 1949, Intuit in 1983, .. ) and there haven't been great innovation since direct deposit technology in the mid-'70s.

And let’s be honest, these players are (i) way too complex for small and medium companies (ii), not fitting current market needs (iii), and super expensive.

The monthly repeatability and the inherent complexity of the task are the reasons why so many players have entered the market recently.

I see two big trends shaping the future of the payroll industry:

The shift toward an all-in-one benefits platform for the employee

Payroll data through API could precipitate a new wave of innovation in fintech

Payroll as a platform

Payroll systems are an excellent entrance for innovation as they are centralized access to payroll, benefits enrollment, expense reimbursement requests, paid time-off requests, perf review, .. They’ve recently expanded from past core offerings to a bundle of services for employees. And some partnerships are being built between market challengers (Payfit <> Alan).

Directly or indirectly related to payroll, payroll as a platform enhance employee satisfaction.

Employee perks & engagement

Why using a complex and obscure internal webpage to get employee perks/rewards (ex: gift & travel vouchers)? These perks are now fully integrated into the payroll system and employees have clear interfaces (app, web app) to access them.

Btw, huge growth here for Swile with the recent acquisition of Vee Beneficios (Brasil)!

Salary on-demand

New players now partner with corporates (HR software providers and payroll systems) to enable flexible access to earned wages. Whenever needed, receiving a few days in advance of your salary may get you out of trouble.

Crypto Payroll

Would you be up to be partially paid in crypto-currency? You may receive 1000$ this month, but perhaps in a year, those would be worth 10k$? Some companies are heading toward such a possibility (Twitter is currently looking into bitcoin payment for employees).

Pre-retirement saving

Retirement is an anxious time, especially from a financial point of view. It’s time to dust off your company's employee savings and retirement plans.

Payroll data is extremely valuable

When looking at the recent acceleration of fintech development, clearly one of the catalysts has been open banking regulations (DSP1 & DSP2). It pushed banks to provide direct and open access to their customer account data to third-party payment providers, allowing them to innovate. The focus was on paiement and here the list of data accessible through APIs.

Back to payroll, even though there’s been limited innovation in the market, it’s important to mention that these payroll firms hold precious information about employees and their company: hourly wages, income history, employee headcount, total salary, .. Meaning, much more diversified data inputs.

More importantly, this data ultimately belongs to the consumer and some startups consider they should be able to share it for their benefit. Here are a few pain points possibly solved with payroll data:

Income verification: When applying for a mortgage, you could easily show your gross incomes

Employment verification: For government benefits, when applying for credit products or even for job application, you may be asked to rapidly show where you currently work

Identity verification: For a wide range of financial services (ex: opening a bank account), your identity will be check

Lending: Credit underwriting is increasingly relying on alternative data inputs. Here payroll data could help have a better view of the customer's financial stability.

Direct deposit switching: Let’s say you want to switch to another bank, how convenient would it be that they automatically redirect deposit to your new account.

Furthermore, there are other related topics that could be improved with direct access to payroll data.

Embedded payroll

Let’s separate your existing internal software from the old external payroll management tool you use. With APIs, your internal software would simply embed payroll as a feature. It’s just about pipes, you already have the data. You keep its value and no longer shared with the external payroll management tool that failed to improve the experience.

GigEconomy & multi-job consolidation

Multiple streams of income are the new normal. In order to better understand how users earn through these multiple income streams (and more importantly, how they can optimize those earnings), startups could/can provide a full financial picture using payroll data.

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️