Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone! Last week I’ve been listed in BlackFin Tech's top10 global fintech newsletters, and I clearly had a curiosity peak about my newsletter :) It’s pleasant as our community is increasing and I keep having interesting conversation with you!

Months ago, I wrote an investment memorandum about Agicap and the cash management market. Since then, I always wanted to dig the spend management industry. Here we are!

Each week I cast light on different topics related to Fintech & Insurtech through either it is through 1) Market Reviews 2) News of the week 3) Investment Memorandum 4) Data Analysis. The format is evolving! I hope you find it usefull!

Please feel free to provide feedback :)

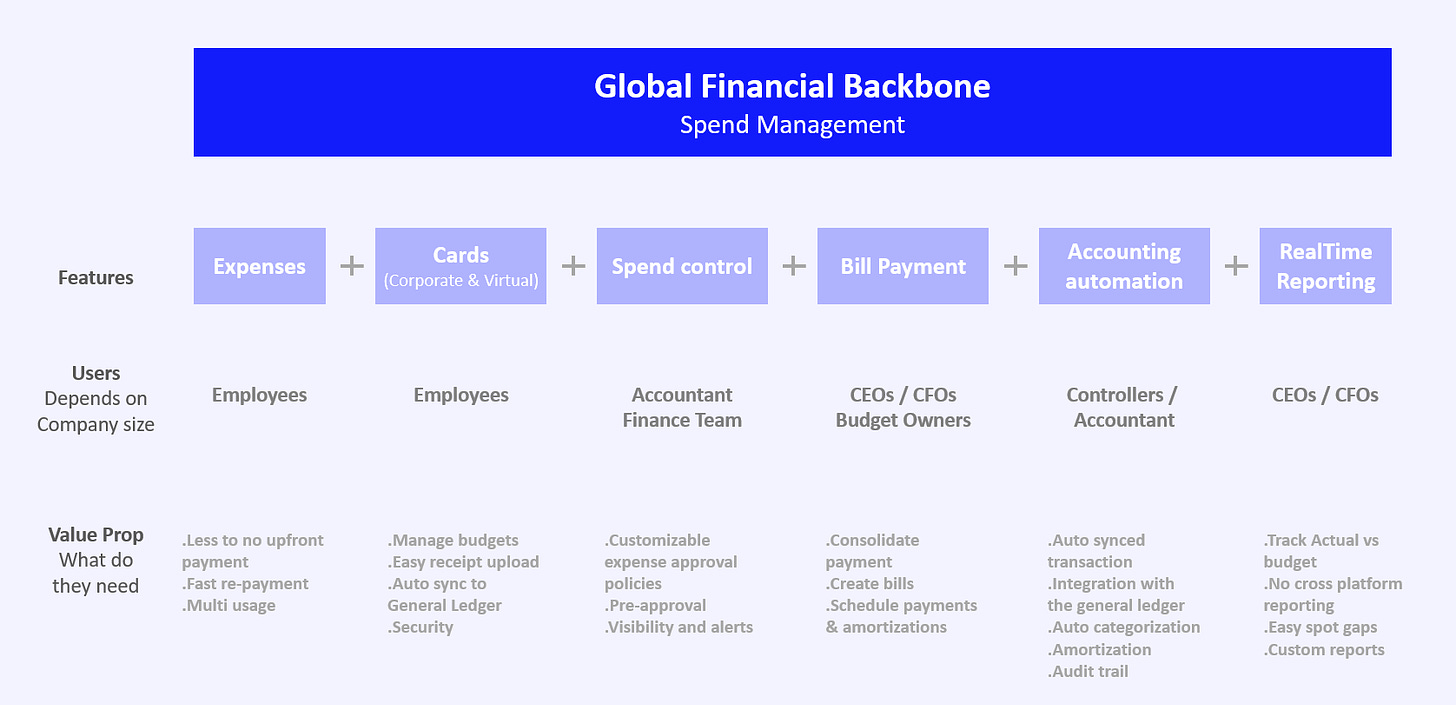

Simply put, spend management is the administration of approvals, payments, accounting, and reporting of all non-payroll expenditures. Thus spend management software are tools dedicated to help your business manage employee expenses quickly and conveniently.

Building a company in this market is complex as you must address different needs, from different people within the same company. Not to mention that according to the size of your company, you may be capable as a CEO to delegate certain tasks (SMEs, Corporates) or manage them all (startups).

The business spend management software market is extremely large ($7.04Bn in 2018) and has a great forecast growth over the coming years ($17.30Bn in 2027 at a 10.5% CAGR).

Let’s look at that.

These are low signals

Many do-it-yourselfers

The market is indeed large, but it appears that a large majority of SMBs are building/relying on clunky in-house solutions. These do-it-yourselfers reveal a huge business opportunity.

See these founding rounds?

In those last years, large rounds of funding were made. Divvy had completed a $200m financing round in April 2019, targeting small companies. For the mid-market firms (100+ employees) Spendesk has added $18 million to its Series B round in October 2020 (in total they raised $56.4 million as part of this round) and Airbase announced a $23.5m extension to its Series A. But there’s many more!

Divvy co-founder Alex Bean described the company’s product-market-fit as “crazy”. No wonder why there’s so much venture capital investing lately.

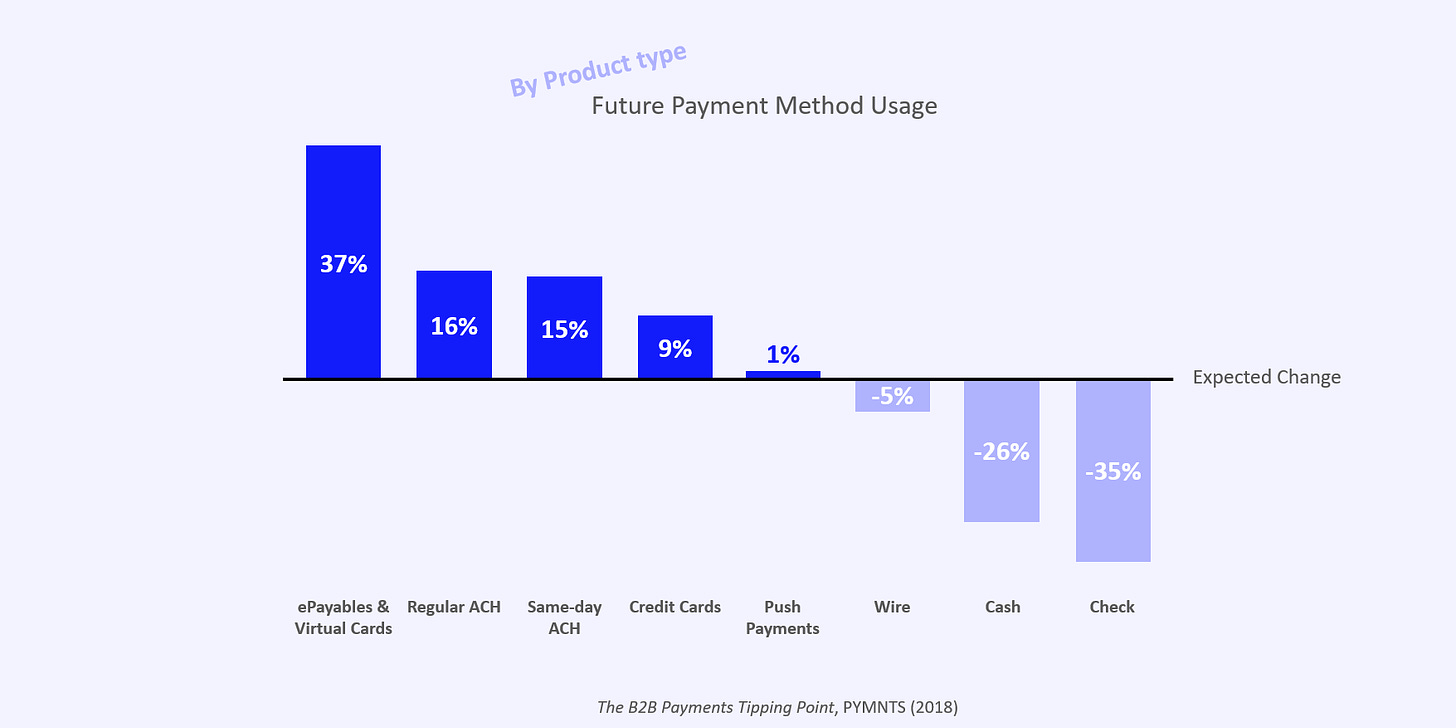

Future B2B payments usage

Employees are expecting flexibility and friction-less payment method. And this is revealed by the upper adoption graph.

The ongoing digital payment movement is creating a set of challenges that add up to significant pain for finance leaders. Subscription model pricing, and digital payment platforms, are expected to accelerate over the next several years, leading to increased stress put on finance teams (eg. struggle to reconcile transactions across an array of software).

Where the market is moving

Build up your own ecosystem

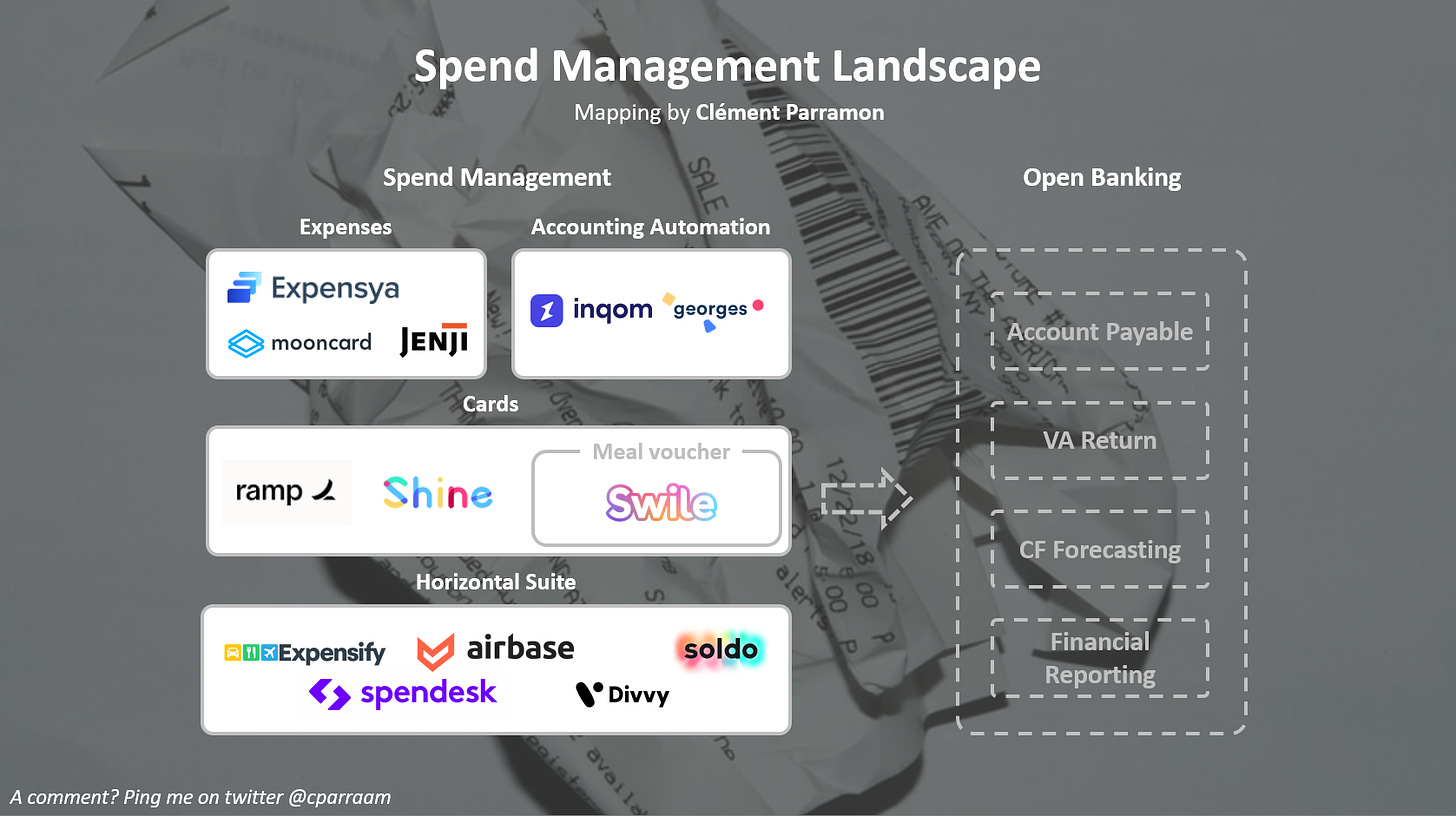

Historically, most tools were siloed from one to another (eg. Accounting tools not communicating with Spend tools) thus it was conter productive. But an expense has a context. Therefore, I need my spend tool to be a conductor of all my tools.

An ongoing trend is the development of each actor’s ecosystem. They are building partnerships with Uber Business for your rides, ERP (natively or via connectors), VAT return players, travel agencies, time tracking for budget, ..

Bringing context to an expense add value, reduce friction in the process, and create stickiness toward the product/service.

Enlarge your market and become a global financial backbone

Most players started on a sub-market of spend management. They identified a clear problem and addressed it. Currently, what I see is a race (in Freelance and SMBs market) to become the major global financial backbone of the spend management market. At small and medium scale, a tool can provide a coherent financial backbone, but for big corporation you reach a limit were you’ll need experts.

Expensya recently broadened their long time known offer introducing corporate cards.

Open Banking brings new opportunities

A lot is happening here. Typically open banking's payments initiation function is another significant opportunity to expand functionality.

A recent survey revealed that 60% of surveyed businesses lacked automated approval workflows. As a consequence, if an employee sent his expenses to validation, the average time spent processing a single invoice was 25 days!! (I cross checked with a Deloitte report announcing 30days).

It’s costly and a major productivity problem. Not to mention the poor experience for the employee that have to wait for weeks before getting refunded.

With payment initiation integrated to the backbone of a product, that process can be reduced to 24 hours (or less).

Two major players in France are bringing this function, Oxlin and Bridge. They offer to their partners (payment integrators, online merchants, banks, service providers, etc.) the opportunity to offer their own customers the possibility to initiate payments by transfer from any online space (website, mobile application) or channel (SMS, WhatsApp, QR Code, web link, etc.). This will considerably improve security, customer satisfaction and increase the value proposition.

But more is happening when it comes to VAT return, Cash Flow forecasting, Financial reporting and more .. Stay tuned!

Did I miss something huge?

I may have missed something on this topic? Do let me know by replying to this email :)

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️