Hi, this is Clément from HUB612👋

As I’ve previously talked about fintech for kids, I recently decided to go in the opposite direction: Deepdiving in the market for the olders. Most of us are working toward retirement. But are we ready for that? (I’m not!) This newsletter issue is about macro trends that are shaping the aging population’s financial situation.

Each week I cast light on different topics related to Fintech & Insurtech through either it is through 1) Market Reviews 2) News of the week 3) Investment Memorandum 4) Data Analysis. The format is evolving! I hope you find it usefull!

Please feel free to provide feedback :)

The global population is aging. The United Nations revealed that in 2019, 702.9 million persons aged 65+. Meanwhile, the number in 2050 is expected to grow to 1548.9 million.

Clearly, this indicates demographic shifts in our societies. We live longer than the previous generations, thus we are facing different financial realities.

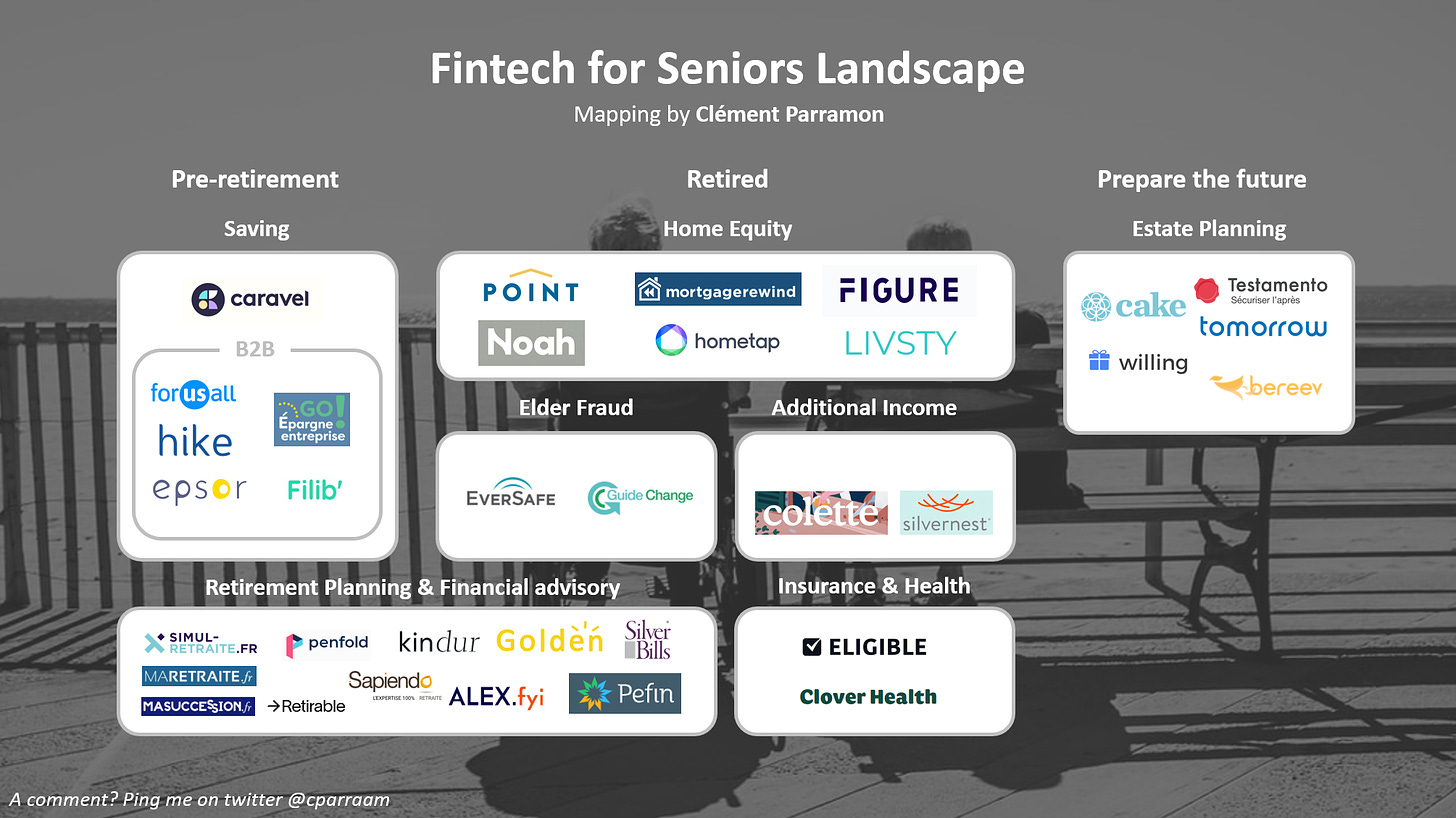

A growing number of startups are building services for pre-retirees, retirees, and seniors. This is a nascent market, largely untapped, that is going to be fascinating to look at!

These are low signals

Market insights can differ a lot from a country to another as our social systems, healthcare systems, and financial education may be completely different.

Even though, here are a few trends I spotted:

The longevity economy

The longevity economy (well detailed by Joseph F. Coughlin here) is a “ slowly emerging market”, populated with eager consumers. Just look: in the U.S. alone the spending of Americans ages 50 and up in 2015 accounted for nearly $8 trillion worth of economic activity. It’s actually one of the fast-growing emerging markets in term of volume. Multiples sectors are mutating: housing, technologies for seniors, holidays, .. And of course, finance management.

The first generation to experience a retirement crisis

Born between 1945 and 1965, baby boomers now represent an important part of retirees and the current generation retiring. Are they prepared? Apparently, it depends on the country. In the US, nearly 1/3 of baby boomers had no money saved in retirement plans in 2014. Multiple reasons for that (i) impact of the 2008 financial crisis + chronic low-interest-rate since (ii) the cost of living is different (iii) .. more here Planning to retire, manage your finance while being retired and estate planning are badly addressed today.

Living longer brings a financial complexity

While the average longevity in France was 70 years in 1960, it is now 82 years. People are living longer, thus they will spend more. But have they saved enough money?

Furthermore, the cost of living is increasing. Healthcare costs continue to rise, Housing prices have skyrocketed (Back in 1980, in Paris the price per m² was 2500€, it’s now 11500€ on average), .. Are the seniors

Boomers-technology fit

Come on, you all know a Grandma Finds the Internet meme and probably have seen it in real life with members of your family. Easy to say as I grew up with computers, but there’s a clear technology adoption gap in upper generations.

Though, recent studies (or simple observations) revealed that screen time among baby boomers has increased for those in their 60s, 70s, 80s, and beyond.

Forbes states that in 2000, 14% of the 65+ years old were internet users; they’re now 73%. And surprisingly smartphone ownership is up to 53% in this age range. Owning them is not using them (that’s another topic).

What do I see? Different usages, the younger tech-savvy generation becoming 65+years old, and the topic of financial management still poorly addressed!

These new players may help us age well

Even though I still in my twenties, I’m deeply interested in the FIRE movement. (Over)Thinking about your retirement should be more common. Here are startups working around your retirement that you may consider interesting opportunities.

Pre-retirement

Retirement is an anxious time, especially from a financial point of view. It is accepted that we will lose between 25% and 50% of our income the day we stop working.

Thus, we need to save money individually. However, the solutions are opaque, non-digital, and above all not oriented towards sustainability.

Caravel is launching in January 2021 a B2C offer to secure your quality of life the day you stop working while aligning your interests with those of our planet.

Epsor offers a B2B alternative to the traditional players and dust off your company's employee savings and retirement plans.

Taping into the senior home equity

One of the most significant assets you’ve built (are about to build) in your life is home equity (the difference between a property’s value and the amount owed on it ). Not only a roof under which you live, but it’s also a great option to leverage for retirees if money is needed in the last decades of your life. In the U.S only, the senior home equity reached $7.23 trillion from Q3 2019, and experts foresee massive sell-off or family handover.

Sales leasebacks, Home equity lines of credit (HELOC), and reverse mortgages are available options, and startups are trying to make it more accessible.

Noah lets you tap into your home value without the debt and monthly payments of a traditional loan.

Additional income

May be a life of work has not been enough to save enough money to live in today society (longer lifespan + increasing cost of life). Thus many retirees decide to work again (not only for financial reason though), even part-time. Don’t be surprised, Job platforms say so and give you a glimpse of what jobs are the most appropriate for seniors.

Also, a recent growing opportunity is home-sharing. Not only it’s a formidable way to strengthen social interaction but it provides an additional income for the retirees.

Colette want to take the virtuous and little-known practice of intergenerational cohabitation and develop it on a large scale. In practice, this means helping young people under 30 to move in with older people over 60 who have a spare room at home.

Protect the senior against trust abuse

I see some similarities between the fintech serving the young and seniors. Both categories are massively influenced, that’s why a lot of fintech players are doing their best to educate them to protect them from financial exploitation.

Those are not isolated cases, one in five seniors have been victim of trust abuse / scam, resulting in financial exploitation.

EverSafe identify signs of exploitation by monitoring users’ bank transactions. If there’s unusual withdrawals, changes in spending patterns, late bill payments, missing deposits, or irregular investment activity, the startup detect a potential financial exploitation.

Estate planning

A step in your life will probably be a smooth legacy handover to your family. This is not a funny topic, but what I can tell you is that it must be prepared. The market is highly unprepared, probably because the topic taboo and because they don’t know how to tackle estate planning.

In 2017 in the U.S, 60% of boomers didn’t have a will yet. It’s mostly do to the lack of financial know-how to create succession plan on their own, or because they don’t have enough asset to leave to anyone.

Testamento believe that all stages of life should be simple to anticipate, especially the one that scares us the most. This is why they have developed, since 2013, with notaries and specialized lawyers, the first platform for anticipating succession.

Did I miss something huge?

I may have missed something on this topic? Do let me know by replying to this email :)

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️