Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Did you know that your bank account is your first source of CO2 emissions?

I recently met Maud from Green-got, and she put some words on a green and sustainable finance movement that I was beginning to identify.

Let’s talk about it!

Sustainable finance era

A world increasingly exposed to environment-related risks

The World Economic Forum’s 2019 Global Risks Report mentioned that environmental risks accounted for three of the top five global risks by likelihood and by impact. It found that: “Extreme weather was the risk of greatest concern with the results of climate inaction becoming increasingly clear”.

That being said, we all witness direct or indirect risks listed above. Indirect because of the corporations which produce the goods, manufactured products, services, and raw materials we consume. On top of that, the topic is global as businesses are interconnected and globalized.

Global awareness is rising as we’ve never seen before. It’s time to act!

Commitment to SDGs keep increasing

In 2016, 17 Sustainable Development Goals (SDGs) of the 2030 Agenda for Sustainable Development - adopted by world leaders in September 2015 - officially came into force.

They address the global challenges we face, including those related to poverty, inequality, climate change, environmental degradation, peace, and justice. They are all interconnected and serve as a blueprint to build a better world for people and our planet by 2030.

The SDG vision calls for a deep transformation in which corporations must not only participate but lead.

Historically, most businesses put financial profit above all else. Yet, a new kind of company (often labeled B Corps) considers social and environmental impact as well as financial profit. Thus they rely on a triple bottom line that accounts for the planet, people, and profit (Known as the 3Ps).

The tools exist. Any company (of any size) can find its starting point, understand/share its impact, set goals, and track improvement.

It’s time to act!

Sustainable Finance emerges

Pressed by this surging megatrend, the financial sector left its passivity to embrace the concept of sustainable finance in a more active and comprehensive way.

Sustainable finance aims to finance business that can demonstrate environmental social and governance (ESG) impact. Thus indirectly enable a transition to low carbon and more sustainable economy

Integrating ESG related financial risks in their processes, allow investors to better understand the impact of externalities in their portfolio

Investors don’t/no longer have to sacrifice returns. A London-based investment group for sustainable investing called Generation is one of the top performers among 400-odd long-only global equity funds of this vintage.

“green bonds” used to offer double-digit yields, since they seemed wildly risky, yields are now dropping (Amundi closed a $2bn green-bond fund, the largest to date)

Look around you, things are evolving

The following topics have been highlighted in the media (Source)

Sustainability risks are already having concrete financial Impact

Brazilian mining company to pay out £86m for disaster that killed almost 300 people (July 2019)

After PG&E’s Climate-Driven Bankruptcy, Who’s Next? (Jan 2019)

How Coca-Cola and Climate Change Created a Public Health Crisis in a Mexican Town. (July 2018)

Asset managers increase and broaden their ESG product offer

UBS expands ESG offering with new equity and fixed income ETFs (Aug 2019)

BlackRock takes sustainable investing mainstream with range of low-cost sustainable core ETFs (Oct 2018)

BNP Paribas Asset Management transforms active flagship range to become 100% sustainable (June 2019)

Banks are shifting their portfolios

Stock exchanges are creating green segments

London stock exchange launches green economy mark and sustainable bond market (Oct 2019)

The Luxembourg stock exchange (LuxSE) has launched a green bond channel in partnership with Shangh (June 2018)

ESG rating agencies being acquired by credit rating ones

Morningstar buys 40% of ESG data firm Sustainalytics (July 2018)

Moody’s acquires majority stake in Vigeo Eiris, a global leader in ESG assessments (April 2019)

Institutional Shareholder Services acquires oekom research for ESG ratings, data (March 2018)

Entrepreneurs are building a better world

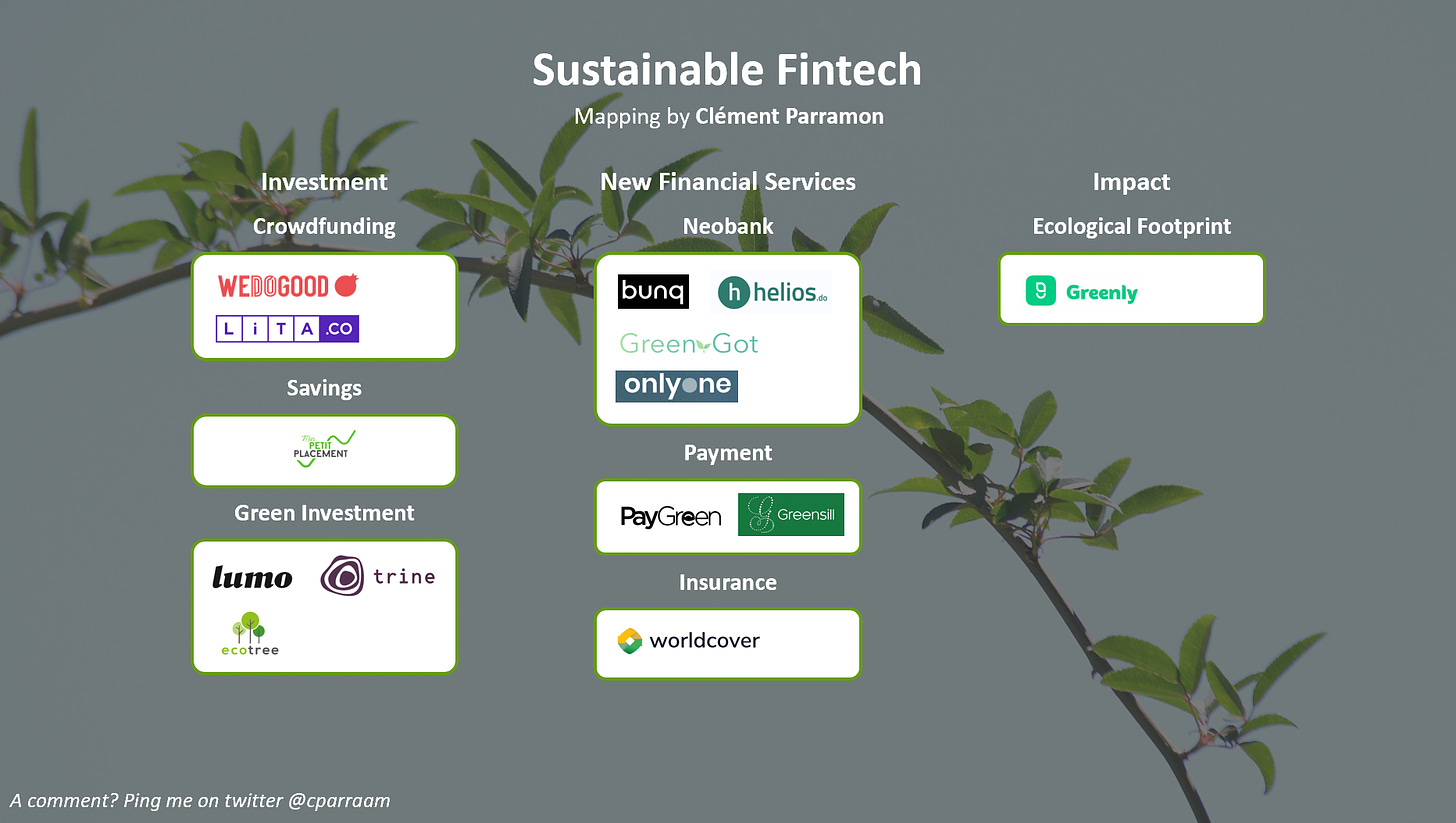

During my research, I have identified a few startups actively working for sustainable finance. I thought it was an interesting exercise to make my own from scratch. Here is my first draft! Feel free to help me on that one :)

“Not cool men, you forgot us😤”

Alright, my bad! This is a very early version of the mapping. Please comment on this post/email so that I fix this oversight :)

Did I miss something huge?

There is a lot happening out there!

If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :))

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

🏘️ I’m in love with the condo | Investment Memorandum #5 Matera

+ News of the week

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️