Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

This first semester has proved that technology has made investing much easier for everyone. Certain apps (Robinhood, Revolut, .. ) now allow you to buy assets of different kinds in a few seconds and in the palm of your hand.

Gold, stocks, crypto-currencies, .. You can get everything you want! Yet, I’d like to introduce you some cool trends I see as an alternative asset investment

Disclaimer: Be careful while investing, there is always a risk of losing your initial investment

The rise of stonks

You may have seen in online during the lockdown, the most iconic meme of this lockdown maybe is this one.

Following the announcement of lockdown across the globe, markets crashed extremely fast. Yet in weeks, markets (incoherently) got back on track. Many people saw an opportunity to make some cash. Many wannabees traders got onboard, using fresh new savings. They were mocked with this meme as a joke about making poor financial decisions, but were they making bad investments?

The surge of un-professional investors is also driven by technology improvements facilitating the access and management of assets, and regulatory barriers evolving (JOBS Act) to open some markets to un-professional investors.

Interestingly, Millenials (a new generation of wannabees investors) are hesitant to invest in the stock market and are lurking/investing in alternative assets.

The investor playground is growing

Traditional vs alternative assets

Collectibles include fine art, wine, stamps, classic cars, coins, antiques, jewelry, or other tangible assets with strong fan-bases willing to pay a premium.

I recently spotted the growing collectibles trend as I came across different startups offering platforms for buying & selling equity shares in collectible assets (see hereunder). No commissions, no management fees, no prohibitive investment minimums, a platform creating liquidity, and truly available to absolutely everyone that can invest a few bucks.

A true investment opportunity

But why would someone invest in such assets?

It outperforms the stock market!

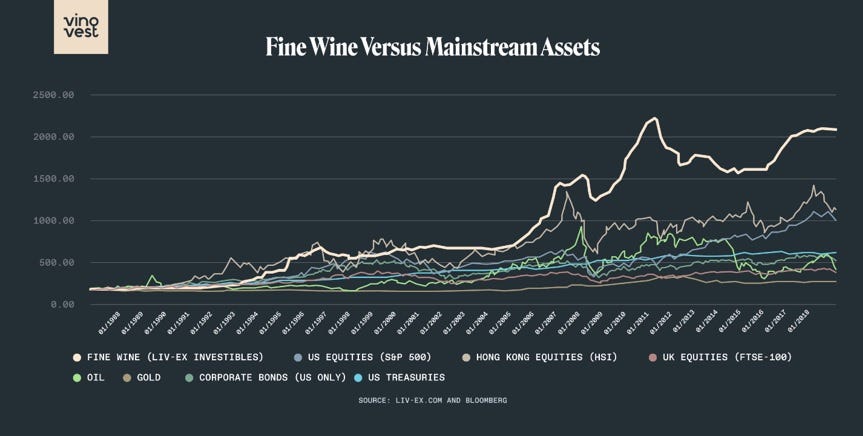

Exactly like a stock market, those collectibles have their own exchange where sellers and buyers trade. Certain of these alternative investments (here wine) have consistently beaten out equities over the last 10 years!

For instance, a baseball card saw its value raise +48% between 2013 and 2018.

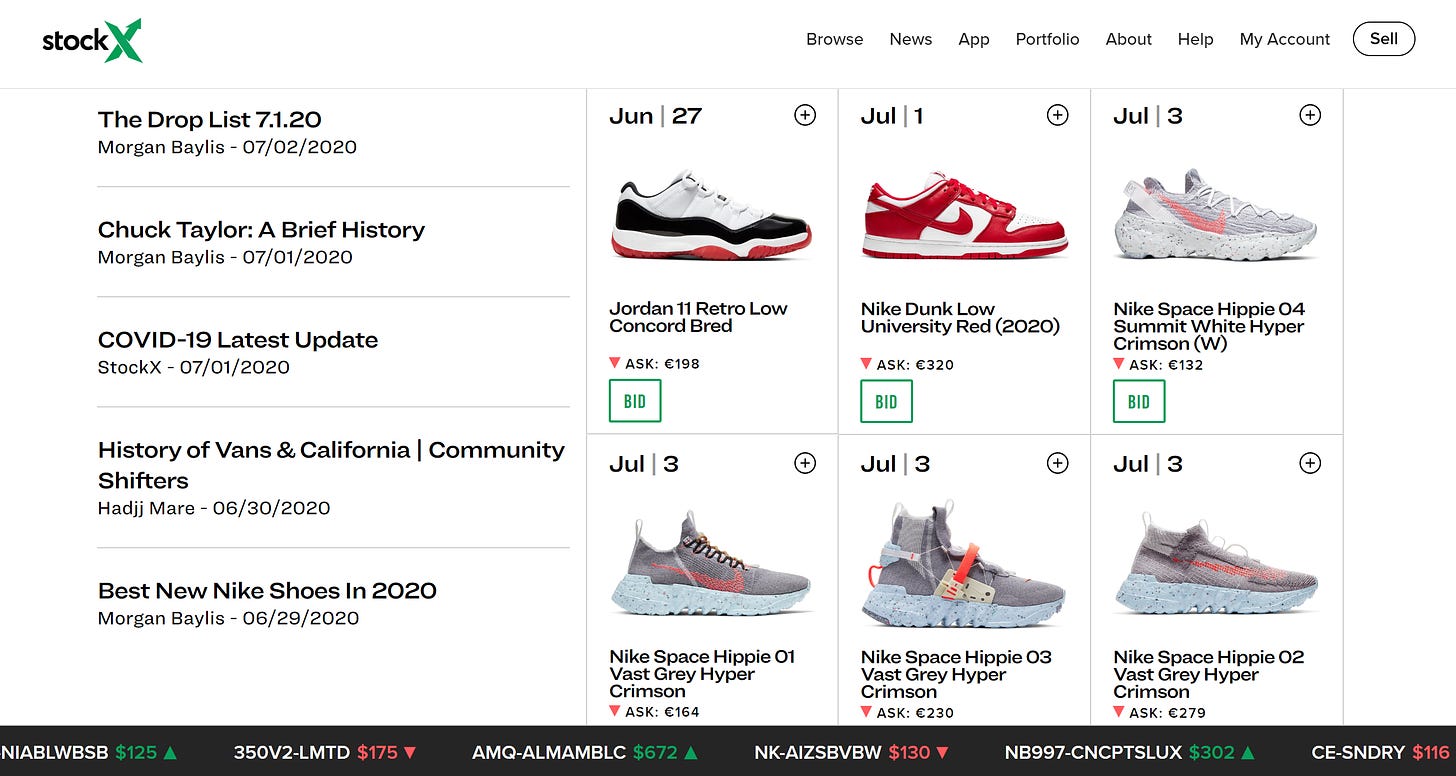

If you are interested in seeing the potential return of collectibles investing, you can also check StockX User’s Performance portfolio, it’s baffling. In this collectibles trading platform, the best investor earned $5,750,823 (7468601% perf) over its trader history.

It’s a no brainer. People already used to trade collectibles, but the distribution didn’t exist and was, in most of the cases, exclusive to a certain number of people. But as distribution and accessibility developed, now there is an opportunity to sell/buy everything you want, wherever you are, and make money out of it.

We are all collectors

As Guardian outlines, a third of people in the UK collect something, we all do! It can be stamps, clothes, comics, ephemera, domestic appliances, technologies, .. literally everything. The reasons for such behavior vary hugely from a person to another. Yet, this panini effect is real. We accumulate belonging:

to prove loyalty. For instance, regular purchases of your favorite soccer team merch.

to obtain a status. Collectibles such as fine art and rare cars provide diversification, but they are also linked to high society and can act as a status symbol.

because we are sentimental and have a special relation toward a product.

as we are passionate about the things we value, and whose value we understand

..

We could call those collectibles, passion assets.

We invest in what we like, and eventually, we can make money out of it.

Startups thriving on these markets

Alcohol | Wine

Buying rare wines is like investing in startups: You need 10 years of runway to see significant returns. The bottle you bought/received a few years ago may be worth a lot more than you think!

A UK-based wine portfolio manager, Cult Wines, has returned an average of 13 percent annually. In 2016, its index performance was actually 26 percent. And this performance is solely based on wine investment. Also, it’s worth mentioning that the wine stock market is quite stable. During the March stock downturn, the S&P 500 dropped 25%, while the Liv-ex index barely changed (see hereunder).

Lots of efforts have been made in the 20 last years to shed some light on what had been a very opaque market. It’s now possible to track the prices of luxury wine thanks to online exchanges like The London International Vintners Exchange (Liv-ex), which came online in 1999.

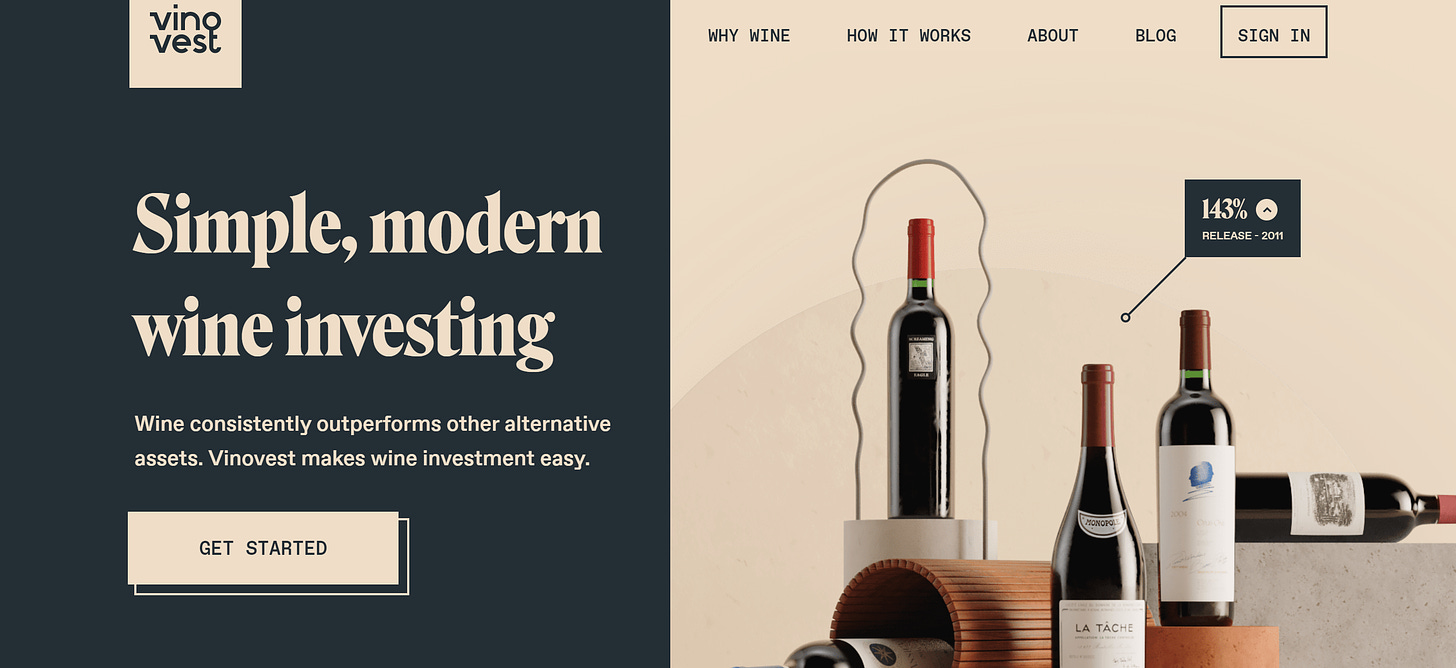

Vinovest is a cellar’s market, looking to woo new drinkers by guiding users digitally through investing in managed portfolios of investment-grade fine wines. In a nutshell, they are modernizing the wine brokering market for a wider consumer base.

The startups take care of the storage (wine can age prematurely if badly stored) and insurances of the bottles (remember the cellars at WineCare Storage damaged during Hurricane Sandy?) for you.

Stop drinking and start selling 🍷?

Cars

Besides being a beautiful product to drive, rare automobiles have seen their value multiply over the years. Maybe one of your dreams is owning a ‘65 Aston Martin DB5?

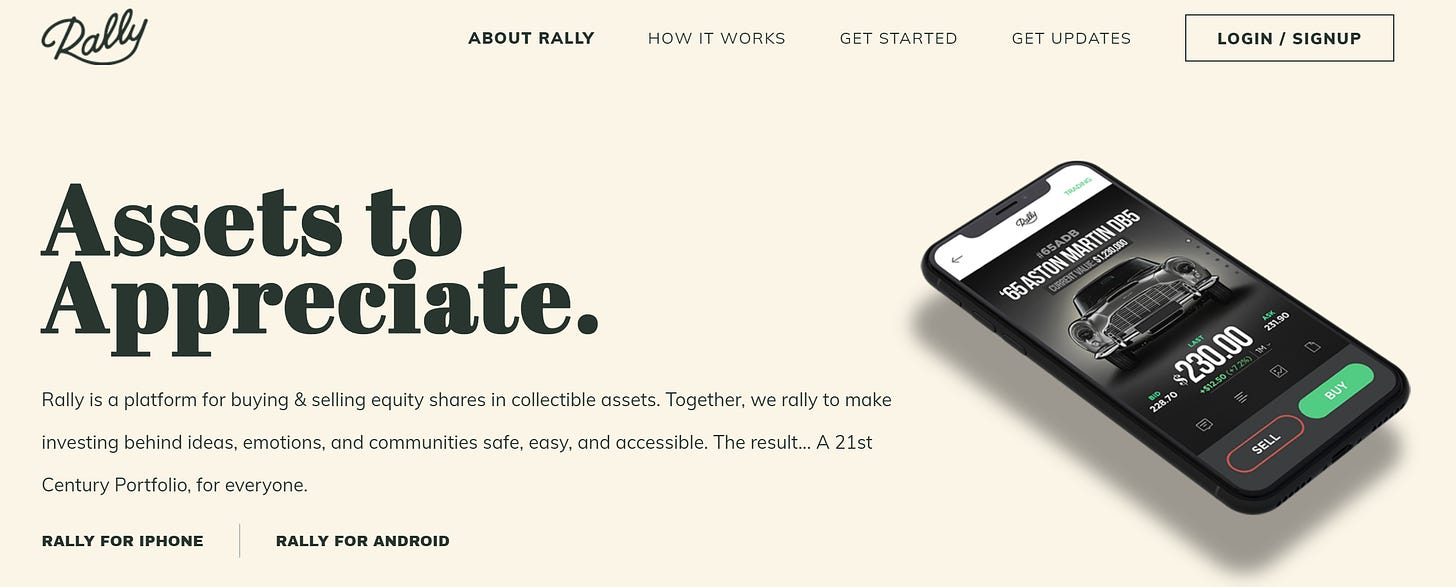

Well Rally, an app-based platform, allows you to buy equity shares in collectibles cars (even if it’s 1/10000th of the total price).

How does it work?

Rally sources, verifies and buys the most noteworthy items from collections and individuals

The item is turned into a company, then split into equity shares

An “Initial Offering” is launched on Rally where investors of all sizes can purchase shares & build their portfolio

After 90 days, investors have the chance to sell shares in-app or add to their position on the periodic trading day

The trading on such collectibles is important as about 5 to 20% of the float is changing hands.

Culture

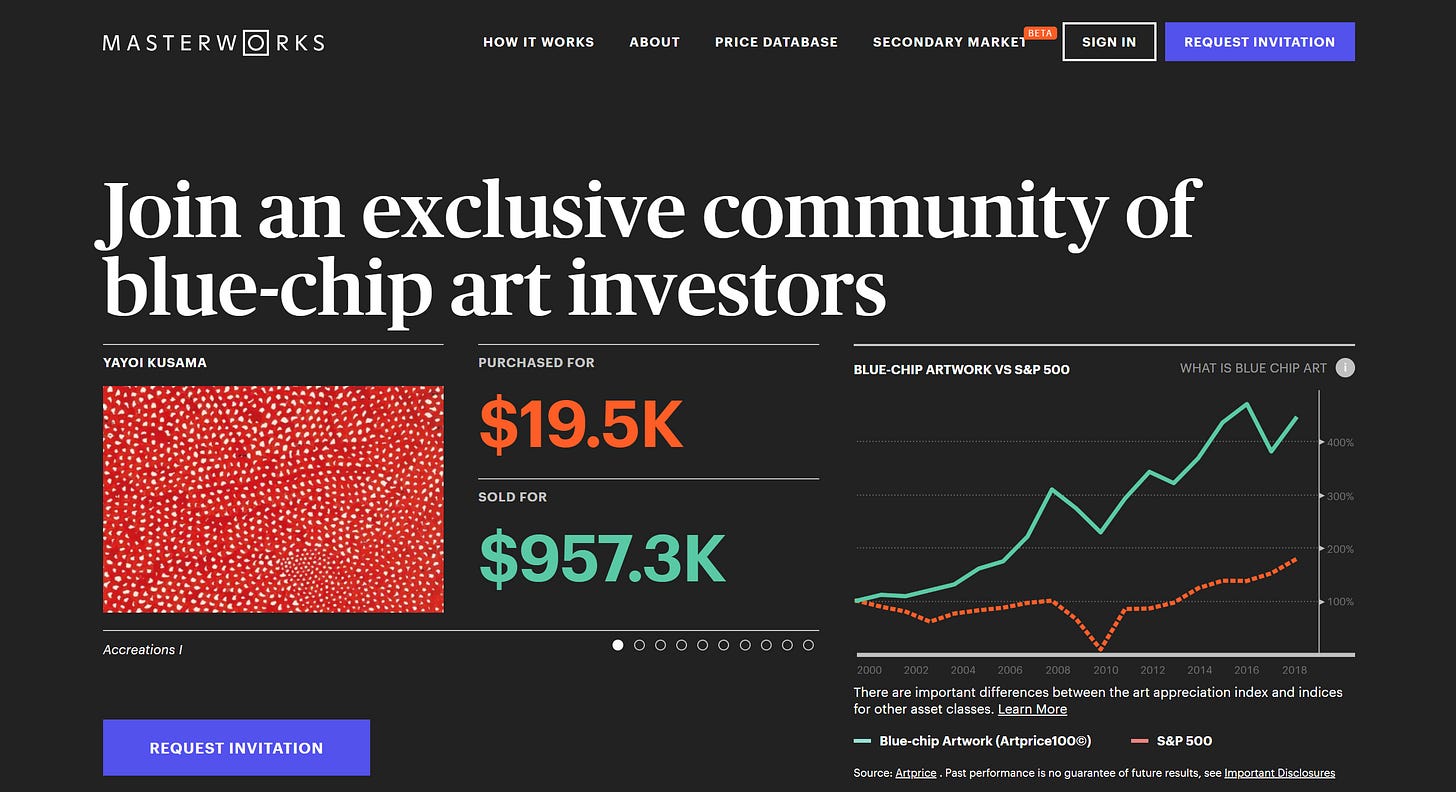

“Culture is a new asset”, that is a clear statement from Otis, a marketplace that lets anyone invest in exclusive alternative assets. There, you can invest in iconic pop culture collectibles, famous paintings, .. culture in a broad sense.

In culture, the sense of belonging is important. The idea that you can “own” the same thing a celebrity wears, use, possess, or created, has propelled surprisingly the value of certain items. Often (reaaaally) expensive, the fractionalization of those items made their price increase even more but accessible to a broader spectrum of investors (I can’t buy this Yakoi Kusama painting, but maybe I can have 1/100000th of it!).

Clothes | Sneakers

According to sneakernomics, Nike SB Dunk Low Reese Forbes Denims originally sold for $65 are now reportedly worth over $4,000 (nice ROI).

In a $21bn athletic shoe market, the rise of platforms like GOAT and StockX has opened up the market for ownership. Some say there’s a guessing game or element of unpredictability making it exciting for some collectors. Limited sneakers with low supply (scarcity + hard to find) and high demand are for sure the most valuable ones. Yet hype remains the most important factor. It’s absolutely everything to how a sneaker goes up in value.

Cool to see people building millions of $ companies out of this market.

Did I miss something huge?

There is a lot happening out there!

If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :))

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️

This space is so interesting. There's a world of options out there, and not enough people are talking about them all. So I've just started a Substack on exactly this. Have a look if you're interested: http://AlternativeAassets.substack.com

Great trend - I really like alternative investment landscape and think this is huge especially the cultural investing (Otis and StockX) (on a side note its interesting how big brands have leveraged this in recent times with the Yeezy collabs and Kaws x Uniqlo). Do you think there is a market for authentication stemming from this either 3rd parties verifying investing platforms or verifying in marketplaces?