Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Two weeks ago, I wrote about embedded fintech features for corporations and I thought it would be interesting to showcase a startup leveraging on financial services to better serve and retain their customers.

At the exact same time, I was looking for a condominium (condo for short) service solution, and I came across Matera. I didn’t know much of this market and the problem it solves as I was new in property management.

Here comes the memorandum ride, get in there!

Disclaimer: I’m completely unaware of what’s happening from the inside, but this doesn’t stop me from having a point of view on their business ✌️

The Memorandum

Matera is a Saas solution providing to condominium (also called condo) co-owners a global solution to manage their building. For most condo (80% of them), the building management is usually delegated to a third party (called condo syndicate) because it's convenient. But, the regular failures of these incumbents have a bitter taste for condo co-owners, pushing them to embrace the building management themselves.

Matera's platform thus brings all the necessary tools for the proper management of a building from accounting, legal, and administrative running. On top of the core features, the startup offers expert support so that any co-owners can now manage their building directly.

___________________(👎: Problem | 👍: Awesome | 🤔: Question) __________________

Need

The need can be quite different in Europe, even though there’s very close residential market structures, challenges, and legal obligations. For now, Matera is mostly (if not only) focused on France, as will be my analysis. Though, the startup foresees a rapid expansion in Europe.

An important part of building in France (28% of the building stock, or 9.7M flats) are in co-ownership. Thus buying an apartment in France means becoming a co-owner. In a residential building, the co-ownership operates according to strict rules set defined by law.

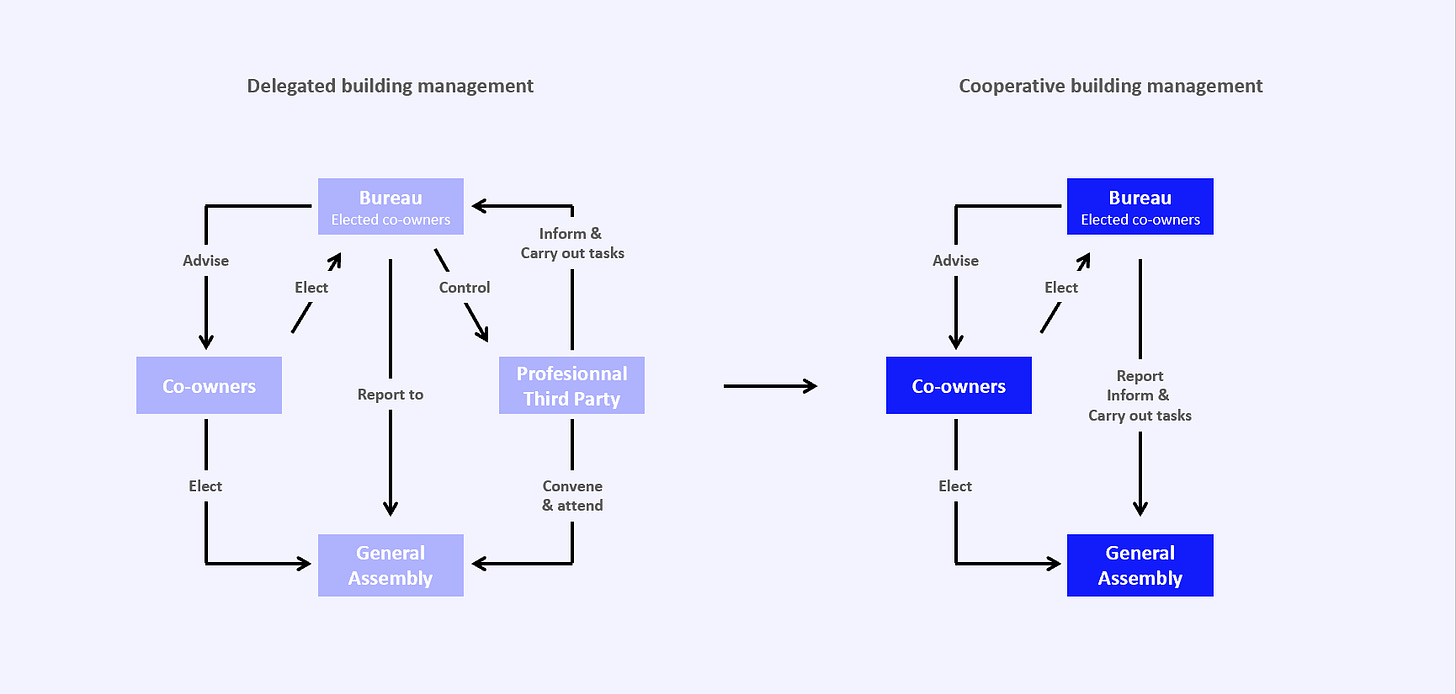

Gathered in a General assembly (ordinary or extraordinary), the co-owners decide by vote and by the majority, on future actions to be taken. Subjects are varied: repair of the stairwell, installation of intercom systems, bringing the lift up to standard, change of management representative or doormats, installation of a relay antenna, etc.

As it can be time-consuming and it requires certain skills (on accounting, awareness on ever-evolving legislation, and administrative running), in 80% of the cases co-owners opt for a simple delegation to a professional third party. It’s also possible for a co-owner to voluntarily manage its own building because he owns those skills.

Finally, the growing trend is cooperative building management that empowers all co-owners.

👍: Traditional and so-called professional third party management is awful. Low service quality coupled with high prices and misalignment of interests, there is nothing worst (look at NPS in this sector!).

👍: In France, between 2007 and 2017 the cost related to a co-ownership building surged by 37,4%. Notably, the management fees charged by professional third parties (+52.5%). Tracking the budget and getting rid of inefficient services is a legitimate demand from co-owners.

🤔: Let’s be honest, this cooperative approach implies for each co-owner to engage themselves in the building management. It’s not something magic, I doubt that the software alone can change the mind of reluctant neighbors.

Market

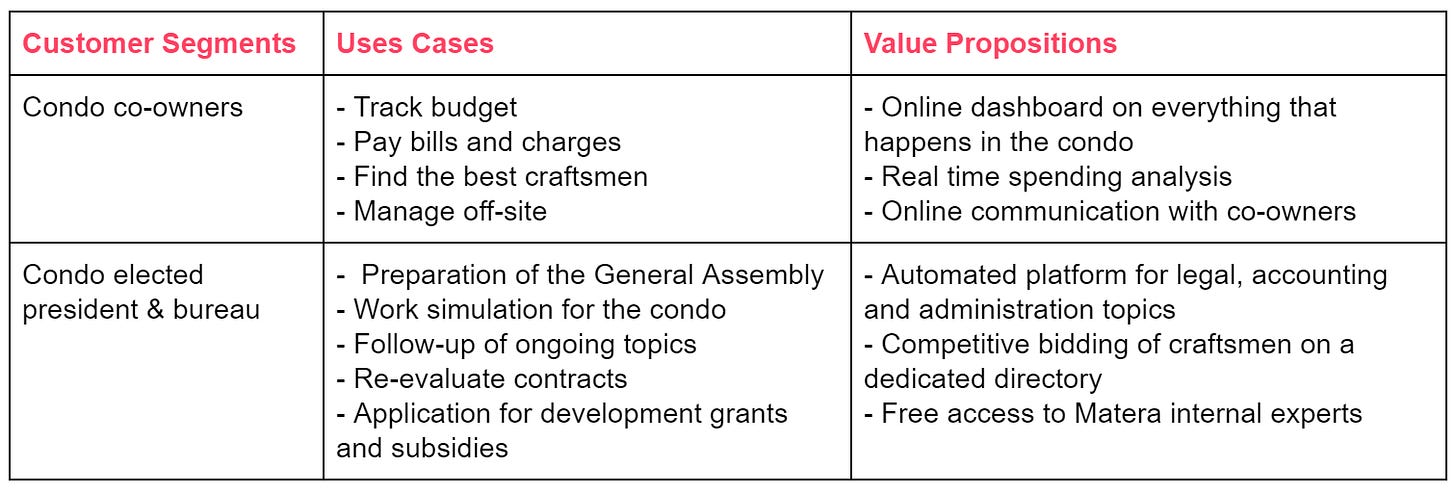

Matera initially (and still) focused on condominium now embed offers home multi-risks (HMR) insurance and display a craftsman directory for buildings. Thus there is one main market and two submarkets (HMR & craftsman talents).

Condominium in France accounts for 28% of the building stock or 9.7M flats. The growth is slow as it depends on two things:

Legislation: As of December 31, 2018, registration is mandatory for all co-owners with at least one residential lot

Building construction: In France, the annual building stock growth is 1.1%

With an € 8 subscription / month / flats, the annual TAM is € 931,2M

🤔: Matera’s model is transparency. There are no hidden added costs. But, at some point, if they keep adding value to their customer they will increase their prices. Prices have changed in the past. I wonder how much they value their market

🤔: The very close residential market structures, challenges, and legal obligations are about a certain number of countries in Europe only. The diversification of Matera’s offer is key to get in other countries, potentially with another core value proposition.

Product

![[animate output image] [animate output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F7afedfe4-b25f-47ff-8336-2a0109973ac3_1200x657.gif)

The platform is accessible anytime, anywhere, and soon via an app.

After a rapid onboarding, free of charge, and mostly done by Matera’s team, all co-owners have a direct global view of their building. They can manage all daily tasks directly on Matera, with a network of experts to handle more complex services. Each of them can track expenses in real-time, pay bills and charges online, engage conversations with other co-owners, report any operational issues, ..

From what I saw from their customer review :

👍: The onboarding is fast ⚡

👍: Most of the customers use the tool on a daily / weekly basis

🤔: I wonder how often the experts are solicited by the owners and how much of the building management process can be automated. Even though it’s in the technical roadmap, I don’t have a clue of what can

👍: The money saved, either from expensive contracts (insurance, security, maintenance, .. ) or from the professional third player, can reach 50% of the former budget!

To go further, here are my takes:

👍: Retention must be high as Matera is such a pain reliever and a reactive player. Already 25000 clients (as of 31th of January 2020)!

👍: The adjacent market of craftsman talent is interesting. Indeed, it’s hard to find a reliable craftsman service on the internet. You have to go through a huge market, with many different and non-transparent rates and many bait offers. Even the European Commission is supporting platforms for craftsman services. There is something happening here as well!

👍: This is a great example of embedded fintech features! Matera handles everything that involves money in building management. The platform allows money collection from co-owners every month and checks how the money is spent. Also, it does automatically a huge chunk of accounting for you (and even their experts can be solicited).

Furthermore, Matera has now an insurance layer. It gives you a quote for multi-risks insurance for the building. It feels like a pain-reliever to concentrate all needs a building may have, under an all-in-one platform.

Team

This a top-notch proptech from Paris, and I’ve not met their founders yet!

📩 We should meet sometime?

After watching all possible interviews & article + checking the LinkedIn profiles of the founders, I could find out that:

👎: Raphaël and Victor, the two initial co-founders, did not have a specific founder-market-fit. The company was created while being in ESCP Business School, so they had little to zero experience in startup creation

👍: Jeremy (CTO) got onboard post-market-fit, a long search to find the killer CTO

👍: Highly selective in their recruitment. They look for experts and empathic people => Robin (Head of Sales), Simon (Head of Growth), ..

👍: The quality of the board is 🔥 Martin Mignot (Index Ventures) & Aurore Falque-Pierrotin and José del Barrio (Samaipata)

Marketing, Distribution & Sales

Most of the acquisition is on co-owners which were already paying for a professional third party (80% of the market) rather than single co-owner management or cooperative management. The value proposition here is much more about saving money and getting transparency.

Such acquisition means co-owners have to wait for the annual general assembly (or prompt one) to set Matera as their new operating tool to manage the building. Thus Matera has worked enormously on:

Having internal experts for Q&A with leads (to reassure them)

Taking in charge the update of the coming general assembly agenda

Onboarding the freshly new clients (set-up the platform, put right the budget, .. )

Customer testimonials are consistent. Once acquired, allowing up to 50% reduction in the burden on building management and easier resolution of day-to-day problems is a game-changer. This results in extremely high customer satisfaction.

👍 : The wow customer experience translates into an organic growth driven by word of mouth (and more recently sponsorship program). Indeed, 20% of new customers are actually brought by existing customers. There are no switching costs, and Matera has made a lot of effort in making the transition and the onboarding as smooth as possible for condo co-owners. As a consequence, Matera's CEO states that they are submerged by incoming leads to the point that they can treat them all.

![[animate output image] [animate output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F0b56ed16-c88c-4202-b47e-058d50779e46_1200x900.gif)

👎 : Matera's advertising campaign (up here) is not going out to incumbents. They're suing the start-up. I do like the advertising campaign as it confronts those well-established actors with the reality on the ground. But this could hinder their development fighting with players rather than going forward in their development. Keep up the pace folks!

👍 : As the market expands, Matera as drawn partnerships with large condominium builders and social house providers. They are betting on Matera, foreseeing the startup to be the model of the future building self-management. It's such a great distribution channel to pre-empt newbuilds!

Regarding their growth trajectory: (8€ subscription / month / co-owner)

Sept 2017: 1 building

March 2018: 100 buildings

Dec 2019: 1000 buildings

Feb 2020: ?? buildings = 25 000 co-owners = 200k MRR

Interestingly, they acquire buildings of different sizes (up to 900 co-owners), meaning their product is meant for a wide range of customers and can scale (on a customer level).

🤔: Though, I’m curious to see how much can be automated in big buildings. Dealing with 900 co-owners must be such a challenge that features (for instance co-owners list) must adapt to the buildings.

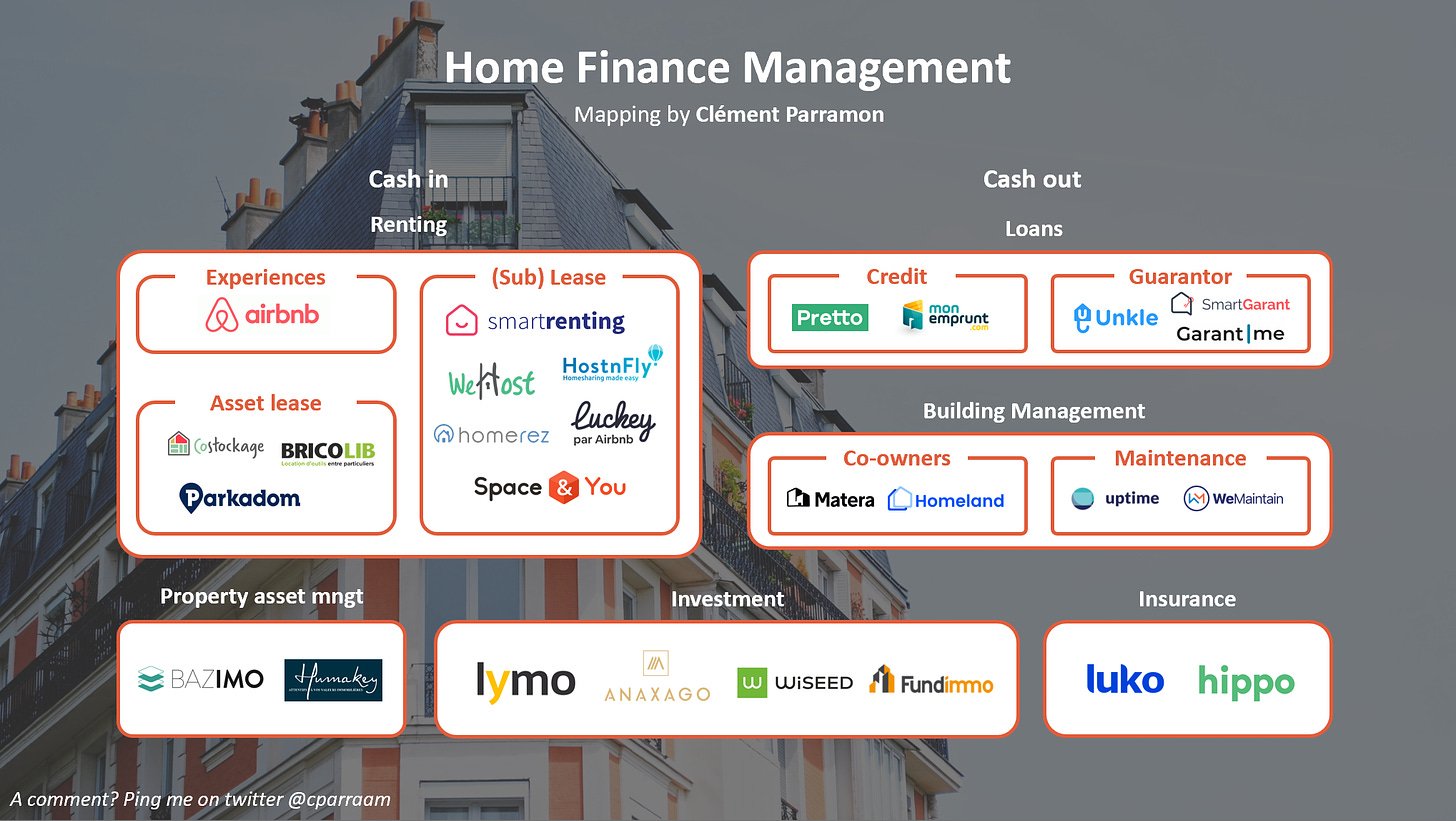

Mapping

During my research, I have identified a few proptech mappings. I thought it was an interesting exercise to make my own from scratch focused on home finance management. Here is my first draft! Feel free to help me on that one :)

“Not cool men, you forgot us😤”

Alright, my bad! Please comment on this post/email so that I fix this oversight :)

Would you invest in the company?

I’m interested in having your opinion about the company :) What do you see as an opportunity and what are the challenges?

What is new about them?

# News 1 - They’ve recently raised € 10M!

This €10M round was led by Index Ventures with prior investors Samaipata and angels participating. This series A is the opportunity for them to rebrand (formerly illicopro) and announce their European ambition.

# News 2 - They are recruiting A LOT!

Check their job offer page, they are recruiting a lot of various profile (👎 mostly in Paris though). They plan on recruiting 100 top talent. Beautiful years ahead, get on board!

Did I miss something huge?

Hard to be right when you aren’t close to the team. I try to eat as much content as I could in a short amount of time. If there is something worth reading, do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :))

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️