Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Too long, didn’t read/listen?

#1 - Is now a good time to launch a challenger bank?

As Vivid Money launches in Germany, Alexander Emeshev (Co-Founder) gives his perspective on the launch of a neo-bank in an already crowded market.

The COVID-19 made it is extremely important for customers to manage their money and make it grow. Now banked and unbanked people look after smarter solutions to manage their money.

Alexander sees that people don’t know what to do with their money, especially the money that piled up during the lockdown. Suddenly, they are more willing to test products/services. Which makes it an interesting opportunity for existing players and new entrants.

Vivid Money launches in Germany, a market already trusted by famous neobanks (notably N26). They understand that neobanks used to poach clients from incumbents. Now they are targeting other neobanks customers, not an easy task.

To make a difference today, Vivid Money bet on immediacy. Alexander believes it is a strong value proposition, especially in the current situation where people are much more cash sensitive. That’s why they work on cashback (immediate incoming cash flow following a purchase) and on avoiding fees (upfront reduced prices) for customers.

My take on this:

Cashback is clearly not largely adopted in Europe. Mainly because the market isn’t mature. For instance in France, only a few players are offering this service. The recent announcement of Revolut launching cashback in France, will surely educate the market. Yet, the unique value proposition of Vivid Money is thin.

#2 - How to survive when your product becomes a feature?

As mentioned in my previous issue, fintech is everywhere. In a not so distant future, financial services will be natively embedded in other non-financial products and simply become an extra feature to the product.

So what should a startup do when their product becomes a feature?

Historically, we’ve seen startup unbundling the financial industry by offering new vertical products and frictionless experiences to a wide range of unhappy customers. Then these successful companies reached a concentration point and started to rebundle several products/services and became platforms. Adding other financial products on top of the original core value proposition is mainly attracted by easier upselling and revenues expansion.

For instance:

Revolut used to be a digital wallet. Now they offer crypto, bank accounts, stock trading, etc..

Robinhood first offered trading, now crypto, margin investing, bank accounts, ..

In this new world, the writer believes there are 2 possible moves for most of the existing fintech consumer companies:

Move down the stack – become an infrastructure provider

The assumption here is that essentially any company that has direct contact with the user will monetise also through a financial product (and it won’t change its core business to refocus on finance). They will use a payment-as-a-service or banking-as-a-service provider to power these financial features. Typically: Stripe as a PaaS

Move up the stack – become an aggregator

If companies get their own fintech layer of features, then customers will take loans or create accounts through different platforms. At this point, the author considers that an emerging need will arise for the re-aggregation of these constellations of accounts and products under one single umbrella. Meaning, somebody will be seen as the single financial touchpoint of the user: the aggregator of a fragmented experience.

#3 - Invest Like the Best EP. 13

Bill Gurley, a general partner at Benchmark Capital talked about various topics in this podcast, interesting ride!

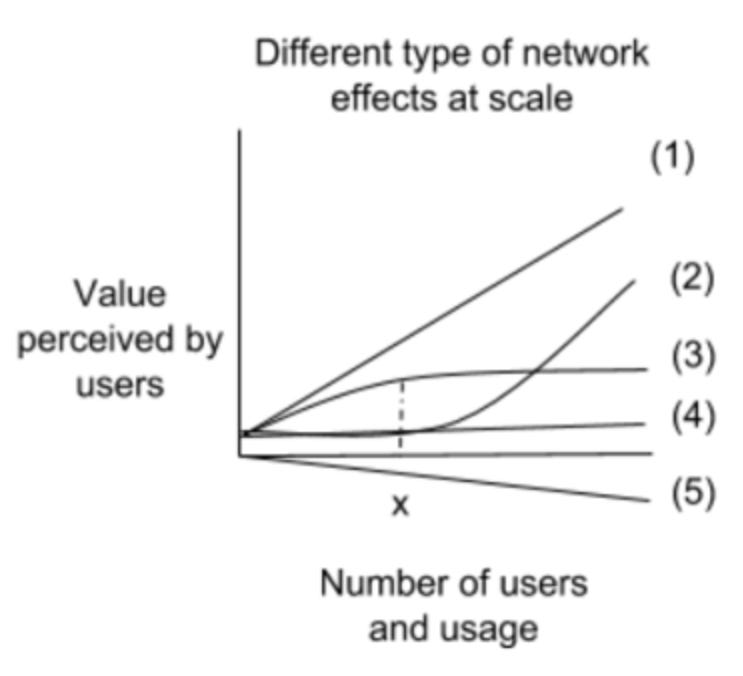

How to get a healthy network effect (NFX) 101:

Go where people are

The team leader should know the playbooks and the system in place

At first, you got to see the market! Glassdoor founders went to interview people to get reviews. It is a necessary effort to ignite the machine

High fragmentation of supply => If there is a dominance supply, it’s going to be complicated to grow your take rate

Being cash efficient is key in the long game

Having a high liquidity quality (incredible unit economics & growth metrics) means you have a playbook working

Technology changed the world of value investing. The Internet has created more connectivity than ever. Especially for NFX which is about connecting demand and supply.

Certain businesses are prone to monogamy (babysitter, doctors, hairdresser, ..). Clearly, those businesses are tough for marketplaces to be launched. Others are prone to promiscuity. For instance, you have your favorite restaurant but you still want to experience something new. Here something can happen.

User-Generated Content (UGC) Businesses create/maintain strong NFX. If people contribute, it adds value to the platform, creates a NFX, and improves the quality!

More assets will be connected in a not distant future. It started with cars (uber) and homes (Airbnb) in a search cost movement. People want to get the thing they need faster, it’s going to happen through people

How to spot fools’ gold in marketplace businesses (Things that are not marketplace)

If no organic growth => no NFX (

Lead gen businesses => no NFX (instead be a transactional business)

A snack between two meetings

50 Futures Unicorns?

CBInsights recently shared its annual prediction of future unicorns (companies that CBInsights think will eventually be valued $1B or more). On this list, 20% of these startups operate in the fintech/insurtech space! But what are they doing exactly?

Alan: online health insurance for businesses and self-employed people.

Capsule: delivers prescription drugs to local patients in two hours via an online app.

CRED: a members-only app that offers you exclusive rewards for paying your credit card bill.

Currencycloud: software platform enabling companies to carry out international transfers and currency exchange.

Divvy: built an expense management platform that allows companies to more easily issue and manage corporate credit cards. Expense reports go away because all purchases are done with the card and tracked through the platform.

Flutterwave: it provides technology, infrastructure, and services to enable global merchants, payment service providers, and helps banks and businesses build secure and seamless payment solutions for their customers by smoothening the exchange of funds.

Mercury: provides bank accounts built specifically for startups by combining Federal Deposit Insurance Corp (FDIC)-insured checking and savings accounts with tech tools like cashflow analytics, intuitive dashboards, and efficient payments, enabling tech startups to have a practical financial stack, real-time insight into company finances, and tools to maximize operational efficiency.

Rippling: manage employees’ payroll, benefits, devices, apps, and more—all in one platform that automates your manual work, like onboarding new hires

Thought Machine: cloud-based technology that powers this new generation of services on behalf of both old and new banks

Tink: offers a platform that allows banks, fintech, and start-ups to quickly develop and deploy their own applications and services. Via Tink's API, it is possible to access aggregated financial data, initiate payments, enrich transactions, and create personal financial management tools.

Uala: personal financial management mobile app targeting the unbanked

ATM face id

CaixaBank is implementing biometric technology as an alternative to the PIN throughout Spain. The product is already in use in various places in Spain and will be roll-out across the country.

During the registration process, 16 000 points on the image of the customer’s face are mapped (order of magnitude: 30 000 points for Apple face id). From that point, the PIN will no longer be necessary to withdraw money from biometric-adapted ATMs.

The expansion is strongly motivated by customer expecting less physical contact with ATM. It makes you wonder how good is the algorithm behind the camera because Face Id has already been tricked..

Nevertheless, I think the rise of the 30€ threshold of contactless paiement with credit cards is more relevant (now 50€ In France). Aside from the cybersecurity, physical cash tends to disappear as we buy more online than ever, we now can pay with our phone, we can transfer money in a few clicks, ..

On top of this, it looks like an important investment for CaixaBank to change all the ATM for biometric-adapted ATMs. Is this a PR move to look like a tech company?

Incumbents are sexy

For years, fintech players dragged away customers from incumbents because of poor customer experience, outdated offers, and many other points of friction.

Bloomberg recently spotted that the pandemic had an effect on the market shares of new players. Indeed, few startups had their system not working or glitching resulting in increasing defiance over their product (For instance Robinhood had several issues)

It’s not something new. Incumbents perfectly know they are historically more stable as they’ve been operating for decades if not more. Even today, would you trust your neobank enough to put 10 000 € on your account? Not everyone would say yes.

The fight is currently over the quality and trust of the service.

“Clients are gravitating toward the biggest, stable institutions”

- James Gorman | Morgan Stanley CEO

When people are in desperate need and you answer positively, you won’t be forgotten.

More Reads

Lemonade, the direct-to-consumer insurance-focused fintech, filed to go public

Uber Africa launches Uber Cash in partnership with Flutterwave

Forbes released its annual ranking of the world’s best banks

After months of talks and trials, WhatsApp has finally pulled the trigger on payments in its app

Did I miss something huge?

There is a lot happening out there in Banking, Fintech, Financings, Exits, M&A, ..

If there is something worth reading, Do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :)

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it✌🏻