This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

Following on an issue I wrote about 6 month ago about sustainable finance, the topic got some growth to the point that I recently worked on a large and dedicated study (FR) about Green Finance.

This week I’m co-writing with Prem Munday a piece about neo eco-banks. Do you wonder why are we seeing so many fundraising in this space at the moment? What value do they bring? How do they work?

Let’s find out!

Sustainability is finally reaching the financial industry

Over the past decade, many industries have been working to understand and reduce their environmental footprint. Driven by growing consumer demand, the retail, energy, food, and cosmetics industries have largely developed green services/products.

The fact that finance is also seeking to go green is not new. The head of the Bank of England was already talking in 2016 about greening the industry to avoid deflation and boost growth. Also, the idea of more environmentally friendly finance is a subject that is becoming more and more visible to the consumer. It is, for example, widely discussed in the latest season of Bad Banks, a symbol of a subject of concern.

Fundamentally, moving towards green finance is moving towards finance with a positive impact. It is not surprising to see startups working hard so that our money can have a positive impact on other issues than the environment. The expectations for this sustainable Finance are in fact multiple.

On the one hand, there are consumers who want to redeem themselves by offsetting their carbon emissions. The idea here is to cancel their carbon footprint for the current year (ex: by planting trees) with a real effect within a few dozen years.

Other consumers plan on investing in sustainability, because it matters to them. They may be looking at investing in agriculture, gender equality, employment and solidarity, health, access to water, ..

Finally some may still be looking after financial return on investment, but it needs to be with a positive impact. Something we call a SROI: Social Return On Investment.

Incumbents are seeing a shift in demand and are being pushed by their clients to move toward sustainable finance. That’s why some big financial institutions have made statements about no longer financing shale gas, oil, or heavy metals industries. On top of that, they’ve started to offer ISR funds and Green Bonds to those interested in an investment that balances a financial and extra-financial approach.

Although customer outstanding is on the rise (from €100m in 2018 to €400m in 2020), we believe the value proposition is minimal, and this kind of investment is not personally measurable. Incumbents have created a distance between the customer and the outcome of their investment. In today’s world, people tend to have a posture where they want to see/measure their impact. But the current offer is about investing in GreenBonds or ISR funds. The only outcome you’ll see is the increasing amount of money on your bank account and not your impact.

To date, most of the market is passive when it comes to money. They aren’t financially acculturated, they may see it as a complicated subject full of numbers and bad stereotypes.

We can foresee that the first big step will be about “impact awareness”. Given the current enthusiasm about sustainability, it would be coherent to see customers shifting attitudes and seeking impact through their money.

The second step will be harder to climb. It would mean that customers are willing to act on their own to impact positively the earth, through their money. But this may require a solid financial background to access correctly and decide wisely what to do with their money.

The sustainable finance foundations built by challengers

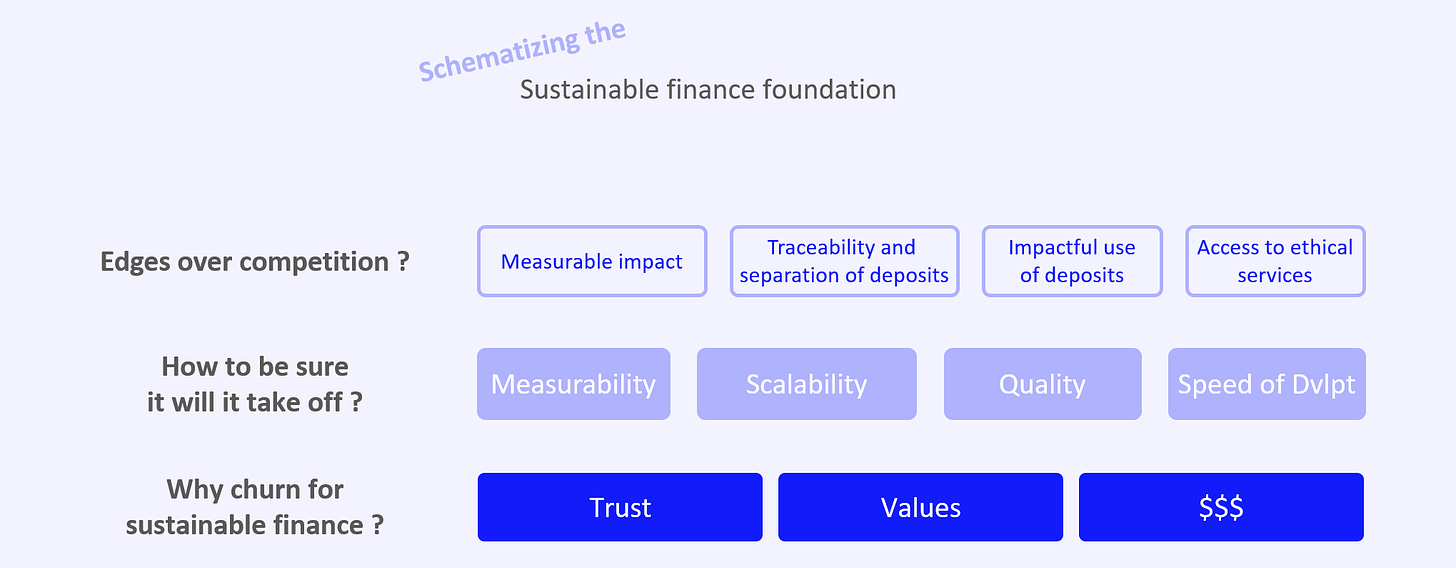

Something you need to be good at when you work with your customer money is trust. Especially in the banking industry! When looking at the top five factors for choosing a bank, Trust ranks second. This is important as consumer trust in banking drives behaviors; banks build loyalty and generate opportunities for revenue growth if fostered correctly or create risk if customers choose to disengage.

Surprisingly, most people (ex: 59% in France) have no idea how your bank deposit is used. It’s to date, largely invested by banks in carbonated industries. Believe it or not, up to 41% of your personal carbon footprint comes from your savings.

These past 5 years, neo-banks have been great challengers to incumbents. Pushing forward the user experiences, breaking the fees, or reconciling users to financial services. They are the living proof that the financial industry can shift rapidly and that historical players can be pushed to change when they have no choice.

The second wave of vertical neo-banks is now appearing. Focused on communities or specific thematics, this new wave is tackling precise topics that even the first generation of neo-banks couldn’t address. One of them being sustainability. Driven by multiple investments, mostly in Europe, the market is booming. Most European players launched after 2019, according to Dealroom and several more are set to launch this year

The first question for these early-stage players is whether consumers can trust their ‘green’ credentials. Indeed, up to 42% of environmental claims on websites are not supported by evidence (= exaggerated, false or misleading). This practice is sadly growing with the increasing consumer interest in environmentally friendly products. Calls of greenwashing have already begun in this nascent sector.

Then, how can we spot an eco-bank with real impact from just a tree-planting bank?

A way of seeing it was verbalized by Joff Hamilton-Dick (founder of SparkChange). For him there are 4 points to assess the validity of an eco-bank (sustainable fintech):

Measurability: “Can you measure the environmental solution of their product?”

Scalability: “Do you have the tech or space?”

Quality: “Do you have the expertise?”

Speed of deployment: “When will [we] see the impact?”

Fundamentally, these new players are built on trust and values (transparency, positive impact, .. ). And you can’t fake it nor allow exceptions. You can build green, but you can’t become green. You’ll be grey.

Whether one or another challenger still stands over the medium/long term is then about perfect execution in startup creation and compliance to their core base value.

The value-added of these challengers is then a set of features that not a single current actor can genuinely provide.

How neo-Eco Banks work?

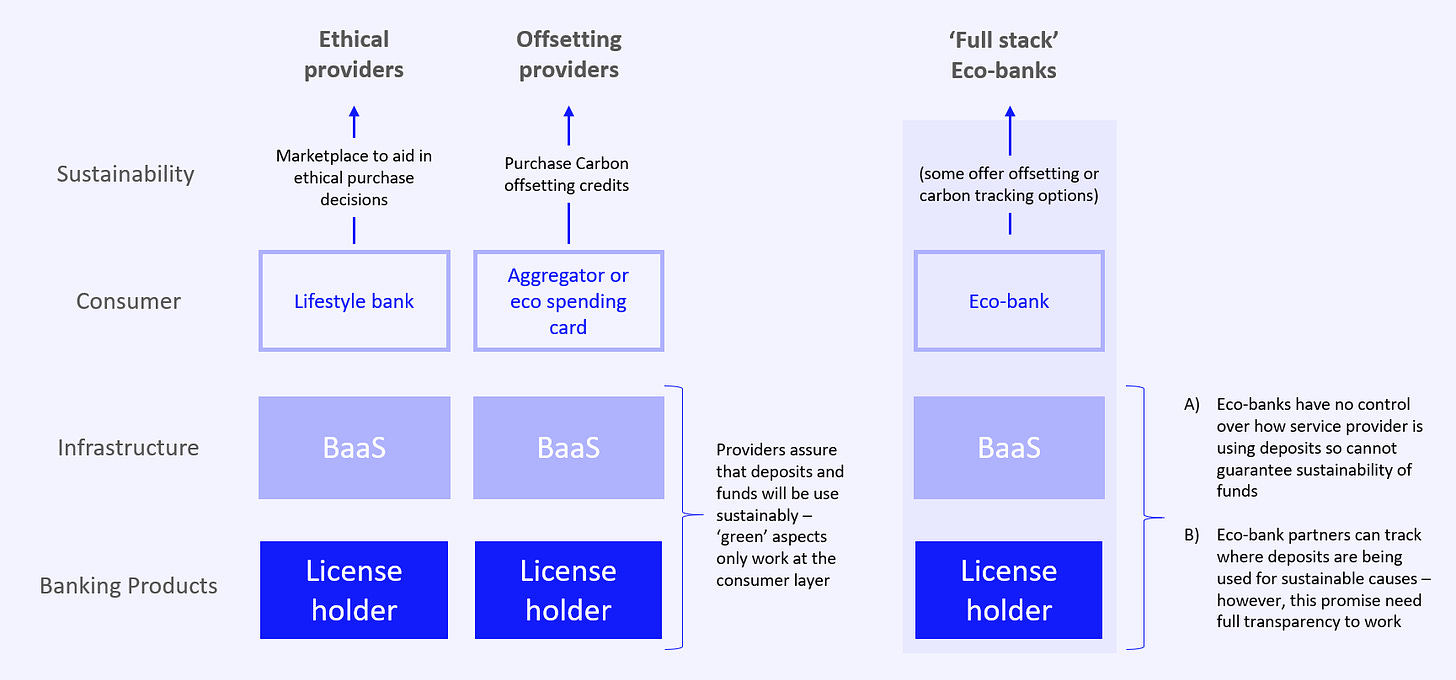

There are various models ‘neo-eco banks’ can take in order to provide sustainable offerings to customers. We have broken these down into 3 models.

The ‘full stack’ approach

Here neo-banks provide your spending from one account. They aim to be your primary bank account and you use it for all your sustainability needs. This example can be seen with Tomorrow, Triodos, Helios, Green-Got, and Only One. These banks aim to be your main point of call in finance and offer green finance accounts promising to be sustainable.However, a first bump in the road is how sustainable are these products in reality? A majority of these companies use third-party provider firms to provide their services. If the infrastructure layer is not sustainable how can the firms offer true ‘green finance’ to their users?

The offsetting approach

These are common with offsetting products, they aim to pool all your banking transactions into one place allowing you to offset your spending accurately in one space. Some simply allow you to offset your spending in your current banks (e.g. Yayzy, Minimum ), whilst some provide aggregator cards offset as you spend by using interchange fees to pay for this (e.g Treecard and Tred)The ethical/lifestyle providers

They aim to provide incentives to be green by trying to alter your spending habits and reward you for being sustainable. For instance, Mitto created a payments app that incentivizes you to spend at sustainable stores. Or Elyps converts spending into cashback for NGOs and creates a personal life store to help you aid purchase sustainable products.

It can be argued the sustainability model is broken to some degree, whilst consumers in these models can offset directly or make informed purchasing decisions to reduce carbon impact, they have little impact on how their banking service is being conducted as they are provided by Banking-as-a-service providers or 3rd parties. Even those who are full stack and claim to use your funds in a sustainable manner are reliant on 3rd parties to provide these products. Therefore, they may only be as good as the labels the services they use provide. Here we are left with a situation where the neo eco-banks are allowing consumers to act green without solving the problem directly in the finance industry.

However, banks like Helios are changing this by partnering with BaaS providers to track clients’ funds could signal a shift in how underlying finance is changing.

Furthermore, there are questions about the revenue model of these providers. It may be unprofitable to create a neo-bank that serves a niche that doesn't have a clear way to monetize its user base. Many of these green fintech companies claim to use key revenue drivers, such as interchange fees, to aid sustainability. Since the majority of these players are not licensed banking institutions they cannot monetize from a lending perspective and could be left with premium offerings whose effectiveness to take neo-banks to profitability is unproven.

Finally, where the distribution hack for these sustainable spending products, it is still unproven how many customers will use a focused sustainability banking. This is why we see many firms taking the aggregator approach and partnering/leveraging existing firms or creating alternative revenue streams through lifestyle offerings. However, the success of Treecard and the pre-launch demand with over 100k sign-ups may disprove this notion.

Neo-Eco Bank Landscape

This ongoing mapping is a good characterization of where these products sit within the wider landscape.

Will they win?

The next test for green fintech will be breaking into a mainstream audience. With the current challenger banking fatigue we are seeing, it could be argued that creating niche value propositions is needed to attract customers. This means that niche proposition is where consumers seek to conduct their banking.

Additionally, they could face the challenge of ‘copycats’. For instance, Italian incumbent Banca Mediolanum recently launched a digital bank — Flowe — complete with a wooden bank card and tree-planting pledge.

However, there may also be a disadvantage for incumbents entering the space. Despite ESG product making being trendy, they are hard to execute. It has been argued there is a resource gap between incumbents wanting to offer ESG services and their ability to provide this. This is where incumbents could eventually partner with fintechs to fulfill their ESG promises due to the skill required to provide these services. Fintech expertise in ESG services can provide unique differentiation compared to incumbents.

Financial transparency will also help set green fintechs apart. For instance, compared to traditional banks and neo-banks like Revolut, Helios’ app users are able to track where their account deposits have been invested in and see the impact of the projects they’ve funded, this could be a key winner in the sustainability and differentiate from other players in the green eco-bank space who don't take the ‘full stack’ approach as they can’t demonstrate to their users they are eco-friendly.

This plays into trust, one of the key components as outlined previously for the success of an eco offering. By building a purpose-built brand and product you can build trust with consumers to use your offering in a way that neobanks and incumbent banks can't.

Whilst there are many threats to the success of the niche eco-bank offerings - by doubling down on the trust of their eco-credentials, their expertise in eco-friendly offerings, and their niche target segment they could provide real value to users and create compelling propositions not offered by other finance providers.

Our take

The viability of neo eco bank isn’t proved

The sustainability model may not hold up. When creating a sustainable banking proposition it is often ignored that the underlying fintech stack you use to build this product maybe not green - However, as seen with Helios, banking stacks are evolving to solve this issue. There may be a cyclical component to this where transparency and trust builds a momentum of consumer uptake of neo-eco bank offerings

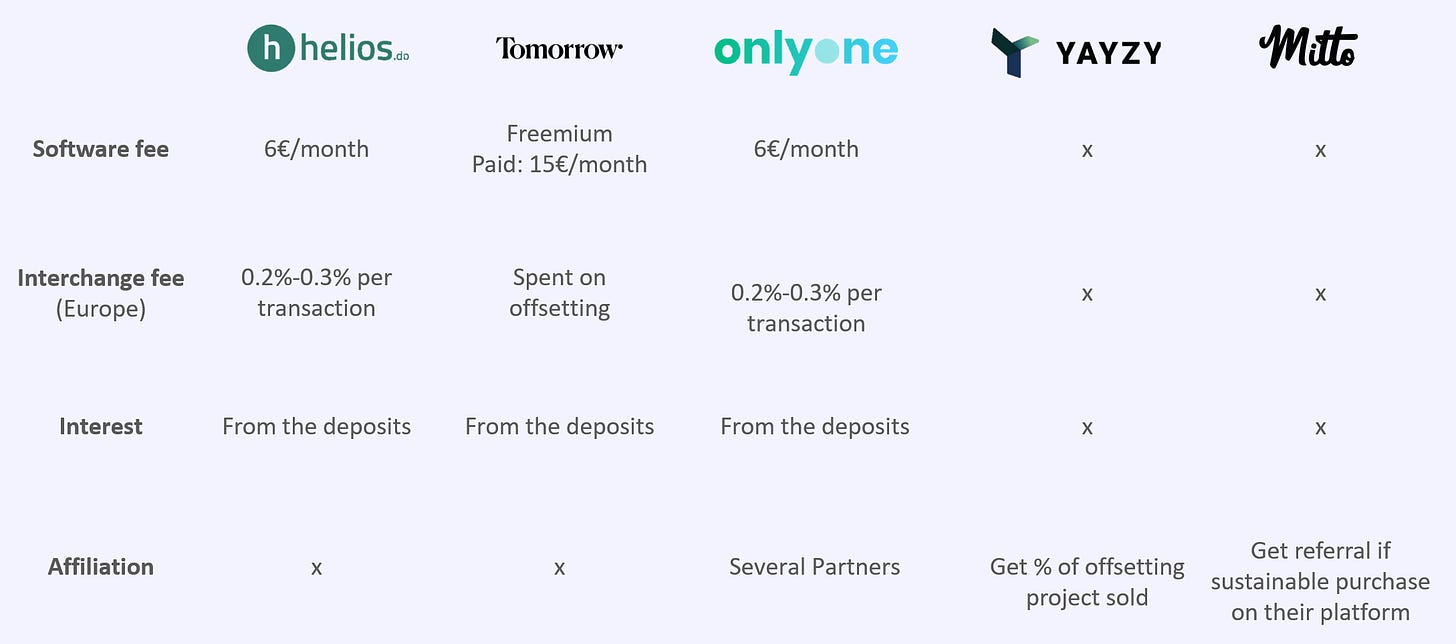

We had a quick look at some of the various providers’ revenue models:

By looking at this small sample of providers, from full-stack banking products to spending cards, to lifestyle providers. They have 3 clear ways to generate revenue:

Using Interchange fees for profitability can become a competitive disadvantage as some players use these fees to allow users to carbon offset as they spend. By using this as a source of revenue for profitability it reduces your value proposition compared to other platforms.

The majority of platforms rely on affiliate fees from upselling carbon offsetting projects or other green services to users. However, these eco-banking platforms may find the revenue is not sufficient to sustain their product. Additionally, they do not sell their own services directly meaning most of the value is captured by 3rd party providers

Subscription fees - whilst subscription fees are highly profitable for these fintechs, it may be difficult to see how many users end up paying for these services - this struggle has been mirrored in traditional neo banks. Read more from Chris Skinner on the struggle for neo-bank profitability

In our view it is likely, just as we have seen with normal neo-banks, these ‘eco neo-bank’ will have to focus on revenue generating products once at scale to reach profitability. It remains to be seen what they can offer to do this, unless they move to offering their own financial product which may prove a stretch too far considering the difficulties existing neo-banks have had doing this. Additional it may be difficult for subscriptions and affiliations to provide the desired revenues for profitability for these ‘neo-eco banks’

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️