This is a great weekly newsletter about Fintech & Insurtech. To receive this newsletter in your inbox each week, you can subscribe here:

Hi, this is Clément from HUB612👋

Welcome to all the new followers and hello to everyone!

This week’s issue is co-written with Adrien Peligry on the topic of Vertical Neobanks. Adrien Péligry is a 23-year-old guy passioned about entrepreneurship, growth strategies and fintech. Previously, he co-founded Sweevana, an employee benefits platform acquired by Swile in June 2020. In addition to his current job at Swile, he has now a strong focus on fintech as Swile aims to become the global neobank for employees!

The time of vertical neobanks

Perhaps you remember the first time you heard about neobanks? I remember receiving my first Revolut card back in 2017, only two years after their launch and already being a game-changer.

Opposed to traditional players, whose digital offers were stagnating, these young challengers (Revolut 2015, N26 2013, or even Monzo 2015) pushed the whole industry toward improved user experience and zero-fee services.

The rise of challenger banks is notable as more than 250+ neo-banks already launched worldwide over the last decade. And this is only the beginning.

Indeed, these last years, we've seen an increasing number of white-labeled fintech infrastructures creating the off-the-shelf bricks much needed when you launch a startup. Be it about payments platforms (Stripe, Ayden), KYC (Jumio, Socure), Anti Money Laundering (SynapseFi, Cambr), Banking-as-a-service (SolarisBank, fidorBank), Data aggregation (Plaid, Tink). You can much rapidly go to your market, as you don't have to start from scratch and rebuild what already has been (see my previous issue). These bricks are accelerators and catalysts of fintech innovation.

Therefore, it was only a matter of time before the new wave of neobanks launched. This is a signal we've started to spot as we saw a change in targeted markets and value propositions from certain neobanks. Younger players are less mass-market but rather offer services tailored to specific segments of society based on lifestyle, or niche needs.

Until now, the banking industry was highly fragmented. Only a handful of actors were addressing partially the needs of a wide range of customers. Even the arrival of mass-market neobanks was not enough. We slowly started to see generic product experiences and rising acquisition costs for neobanks. Yet, still (large?) untapped and unique audience segments need specific product features.

This is where vertical neobanks kick in. This new wave targets one specific niche, often yet underserved or overpriced, with a purpose-built product that its horizontal competitors are unlikely to match. Only that way can they expect to build a large and sustaining business in this market.

Vertical Neobanks Landscape

Verticality brings opportunities

As the main infrastructure is the same for all neobanks, the tech advantage is often very low. Most of them rely on Banking-as-a-Service solutions such as Treezor, Swan, Hubuc, etc. They build on top of these infrastructures to offer a unique product. It explains why horizontal players such as Revolut or N26 do not necessarily have fewer features than most vertical neobanks. So what's the competitive advantage of being vertical?

Unique Value Proposition

Thanks to a strong focus on the niche, they can offer a better proposition than incumbents. Vertical neobanks can add features to differentiate from traditional banks and horizontal players. Let's look at some examples 👇

The LGBT+ community is underserved by traditional banks, leaving vertical players like Pride or Day Light to have a shot because this niche has some specific needs. Some people from this community may want a different name on their card than the one on their ID. And it can cause some KYC troubles with their bank: you won't be authorized to log in as Ben if your ID name is John. A player like Daylight enables you to choose the name you want on your card whatever your ID name is, and it can be a huge factor to switch bank.

Many individuals want to invest their money instead of leaving it in their checking account. It explains why there are more and more emerging banks like Letter or Finch to help these people better manage their finances by putting "money to work". Finch enables its users to choose what investment strategy to follow and to invest the entire balance automatically to maximize their yield. They also have instant access to their invested balances just like they would with a typical checking account. Traditional players don't particularly guide their customers where to invest, and once the money is invested you have to wait up to ten days to get your money back.

While new generations pay more attention to climate change, BNP Paribas provided $41.1 billion to fossil-fuel companies in 2020, up 41% from the prior year. It leads to a rise of new players such as Treecard or Helios which aim to become leaders of "green banking" by proposing cards made from sustainable wood, planting trees for each transaction, or by financing sustainable companies supporting the ecological transaction such as waste treatment, energy efficiency, or ecosystem conservation. Their value proposition even goes further: Helios users can track how their money is invested. It builds trust and makes it hard for traditional banks to catch up.

Teenagers might be the new eldorado for neobanks: there is plenty of neobanks targeting this audience: Pixpay, Kard, Vybe... They all want to become their first-ever bank to capture the value from day 1. These players have developed features to teach teenagers how to manage their money and help their parents to manage their accounts. Some merchants are excluded from the loop (online betting, sites prohibited for minors, etc.). These actors also added other social features to comment on your friends’ spend etc.

All the above-mentioned features seem to be very appreciated by these niches but they are not all necessarily a barrier-to-entry for horizontal players such as Revolut. The UK neobank already proposes additional features like "Revolut Junior" to help parents configure and monitor their children's accounts and it's also possible to invest by buying shares of American companies (Tesla, Google, Apple...) or simply buy Bitcoin.

Offer targeted cashback & rewards

Almost any neobank can decide to propose cashback to its user base just like Revolut does. The number of rewards can range from 1% up to a few more, depending on the neobank margin made on interchange fees and on the deals signed directly with merchants.

Being vertical enables players to reinforce their value proposition by offering targeted cashback on relevant shops and e-merchants depending on their target.

Neobanks have a play on driving where the money will be spent. The more concentrated your market is, the easier it will be to drive money flow. For instance, a neobank for the construction industry would just have to sign a few merchants like ManoMano, Leroy Merlin, Bricorama to monetize a major part of the volume, while Revolut will have to sign thousands of merchants to cover their market.

Some already existing examples 👇

Majority, a neobank for migrants, offering local community discounts to reward users by consuming locally.

Juni, a neobank for anyone buying media online, enables its users to get 1% back on every dollar spent on Facebook Ads and Google Ads.

Mythia, a neobank for gamers, bets on gamification to offer rewards like Playstation gift cards and other free video games.

Community flywheel effect

One common promise of most vertical neobanks is community be it B2C or B2B.

Let's say you're launching a startup and you're looking for a bank. If there is a generic bank and another one whose motto is "The bank for entrepreneurs", there is no doubt that you will choose the second one, even if product differentiation isn't necessarily obvious. As a customer, you want to be understood and feel reassured by your bank.

One leverage to reinforce market positioning is card branding. It can embody company values, create a wow-effect and potentially word-of-mouth. Nevertheless, it's for sure not a barrier to entry as Revolut and others also propose specific designs to target communities.

(i) A Letter card with a stainless steel body for "net-worth individuals"

(ii) A pride card to show proudly you're part of the LGBT community

(iii) A Treecard made from sustainably cherry wood to reduce plastic waste

I won't surprise anyone if I say that traditional banks are not famous for their world-class customer service. This is where neobanks, notably vertical ones, have an edge. They better understand their customers' concerns as they are (much more) focused on their problems.

Vertical market positioning creates undeniable proximity between the neobank and its customers.

There is no doubt that a migrant will feel way more comfortable with the Majority customer service than one from a traditional bank. The feeling of being understood and respected by your banker has a strong value for customers, especially for underserved communities.

This is the case for many communities whether B2C or B2B: LGBT, migrants, teenagers, elders, eco-friendly people, freelancers, startups, e-commerce owners, construction companies, farmers, etc.

Some neobanks could even go further just like Daylight by adding social features to create more value for other members: people can get authentic advice from others who’ve been there, access content about the most important money matters affecting their community, etc.

Go-to-market: be a neobank from day one or become one on day two?

New challengers can opt for two distinct strategies to capture the market.

Be a neobank from day one

Starting a neobank from scratch at the very beginning is the path taken by most B2C neobanks like Yotta, Linus, Zeta,.. and a few others B2B focused.

In fact, there are two keys to successfully build a vertical neobank from day one:

The company must have a strong enough value proposition to outperform horizontal players like Revolut (B2C) or Qonto (B2B)

The narrowly targeted audience must self-identify as such to reinforce community flywheel effects.

A vertical go-to-market can be more effective than a horizontal one. If a neobank has a strong focus on a specific industry, it will have chances to outperform horizontal companies that target everyone by leveraging an adequate acquisition channel.

For example, Hispanic Americans might be acquired through a channel like Telemundo as explained in this article from Andreesen Horowitz. Neobanks targeting teenagers could leverage Instagram acquisition channel and Mythia - a neobank for gamers - could reach popular streamers on Twitch to convert their audience.

Become one on day two

As product differentiation isn't obvious for all vertical neobanks, companies can opt for another go-to-market strategy: focusing on a specific product (software or marketplace) and then add banking features to strengthen their initial proposition value.

As a16z VC fund explains, as "every company will be a fintech company", most SaaS leaders will add financial services to increase the lifetime value of their customers and reduce their acquisition cost.

This strategy is somewhat similar to a popular strategy for bootstrapping networks: "come for the tool, stay for the network." Startups can imagine a new vertical SaaS to quickly capture market shares to then add a banking product. There is a huge opportunity of cross-selling these add-ons to their existing user base to extend their global LTV per user.

It especially makes sense when the SaaS brings their customers to send or receive money (such as a marketplace like Airbnb or Shopify). Let's consider an invoicing tool to collect customer payments effortlessly by automating follow-ups to get paid faster. This SaaS could create a banking account for their customers to hold the cash flow instead of sending the money away.

This was exactly Lydia's go-to-market strategy if we pay attention to their product expansion. Their initial value proposition was "pay someone or get a refund just with a phone number". After getting enough traction to grow their user base, they quickly added a banking feature to better monetize the cash flow transiting within the application.

Which strategy would you choose?

Go-to-market is the first challenge entrepreneurs must face: should they build a neobank from day one or should they focus on a core product and then add banking features?

If we dive into the e-commerce space, we could compare Shopify & Juni.

Juni is building a neobank for e-merchants by proposing a "tailor-made banking experience for the marketing and e-commerce ecosystem". Juni's customers can benefit from instant cashback on Facebook Ads spends and get a centralized overview of their cash flow through integrations with e-merchants tool stack (Shopify, Mailchimp, Google Ads...).

On the other hand, Shopify whose initial proposition value was to enable anyone to create an online business by creating a website and accepting payments is now expanding its product. Shopify plans to enable their huge customer base (820k merchants) to open a banking account powered by Shopify. It will function similarly to a typical bank account, except it will run through Shopify instead of a traditional bank with no monthly fee and no minimum balance account. Merchants will be able to make deposits, withdraw funds, pay bills, and track transactions through the account with physical and virtual cards. We could also do the comparison with Karat - a vertical neobank for influencers - that might face Instragam if they decide to offer banking services to their users.

Will it work?

The Business Models of vertical neobanks

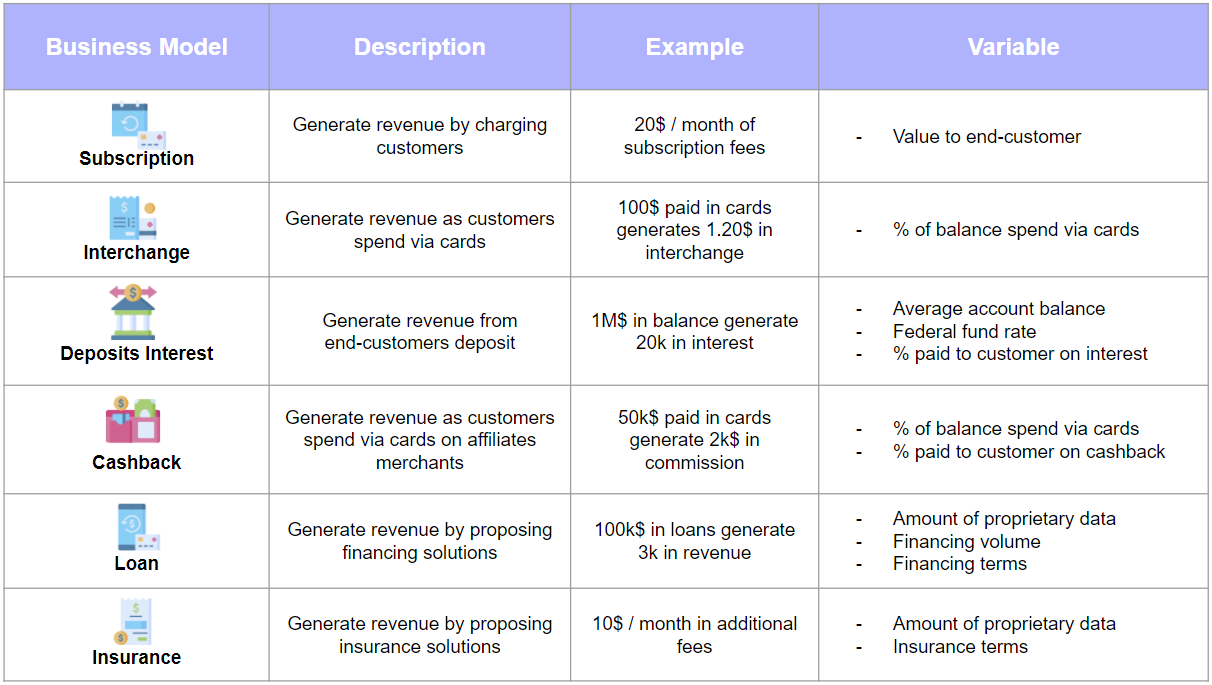

There is a multitude of products and services with which users are monetized.

Let’s look at the various income streams of neobanks in more detail.

Subscription Revenue

Neobanks can monetize through paid subscriptions just like a traditional SaaS could do. Revolut for example offers three different plans for consumers - standard, premium, and metal. This model enables fintechs to generate predictable stream revenues.

Interchange

Interchange revenue is money that a card issuer receives when swiping its card. It is paid by the merchant through payment processing fees. (The merchant is the party accepting a card payment in return for services).

The specific amount paid to the card issuer depends on a number of factors and it varies for every transaction. The average interchange rate at 1.25% in Europe. But Banking-as-a-Service solutions often take a cut on those percentages.

Deposit Interest

Interest revenue is earned by a depository institution, investing customer funds in low-risk securities. The depository institution typically pays the customer for keeping their deposits at the institution. The key equation for the profitability of this revenue stream is:

(% interest earned - % interest paid to depositor) * deposited amount

The interest earned for neobanks is typically equal to the effective federal funds rate. Because the federal funds rate is constantly shifting, the profitability of this revenue stream for neobanks is constantly evolving. It seems that a neobank must already make a very high volume before monetizing deposits interest and the yield might be close to zero depending on the rates of the market.

Cashback

Neobanks already got a commission for every transaction through interchange fees but there is a way to increase the commission rate. They can contract directly with merchants to get a higher commission than interchange fees with a position of business facilitator. If they negotiate a 20% commission with a merchant, neobanks still have the choice to offer a part to their users by giving them cashback.

Loan

Neobanks also have a play with loans by receiving parts of the loan value. There are two main benefits for a vertical neobank to embedded loans: it can leverage user data to better underwrite and better rates than traditional banks while simplifying the customer experience instead of sending their customer to a bank. Shopify announced that it will provide $200 loans as starter capital to help new merchants kick start their business. If the merchant does not pay back, the money is lost. Another example is Toast Capital which is proposing loans for their restaurant customers.

Insurance

Embedded insurance has a major role to play in expanding revenue engines and customer acquisition strategies. It can leverage data to better underwrite insurance while neobanks can monetize by receiving a part of premiums sold. More and more tech solutions such as Tint or Qover enable businesses to embed insurance within already existing products. Revolut relies on Qover to propose their insurance features!

Market size

We keep mentioning niche markets as being new opportunities in Fintech. However, we didn't comment on how big these niches are?

Up to recently, most investors were probably too scared to go up against N26, Revolut, Monzo, etc. How can you compete with such fast-growing and cash-intensive neobanks that are already well established around the world?

Interestingly, we have now reached a point where investors that have missed the first wave of neobanks are ready to surf the new one. For this to happen, they are closely monitoring market dynamics. There are for sure, numerous niches worth investing in around us.

Here are a few takes about the time to market, size, market dynamic.

Green & sustainable

It was a matter of time before seeing green and sustainability reach the financial industry (see my previous issue). The time to market is excellent. For multiple reasons mentioned earlier, people tend to green their personal finances. The pandemic made us save a ton of money, and more and more people are questioning the role of their savings. Maybe it's time to shift to a sustainable bank?The total addressable market is huge, however, only a small portion is climate/impact sensitive. The trend in adoption is pushed by the youngest, I hope this will accelerate!

Crypto

The current bull market is on fire. And that's partly because we've seen the arrival of a ton of new investors (the number of addresses mentioned in blockchain transactions increased from 100k in January 2020 to 1,8M in April 2021). The market dynamic is outstandingly good, the market capitalizations of most cryptos are breaking records every week or so. The question of "how to use crypto" in real life, is by the way now largely addressed through recent announcements, some of which include Visa accepting stable coin payments, Binance offering its Binance card, PayPal allowing payments in crypto, Goldman Sachs allowing investment in bitcoin and BlackRock having bitcoin futures...Kids & Teenagers

Gen Z represents 30% of the world’s population and will constitute a third of global consumers by the end of the next decade. Their global spending power is estimated at $3.4 trillion simply because of (i) their direct spending power (some just turned 18+) and (ii) their influence over their parents' purchases. This market is tough to crack (see my previous issue). It's constantly renewed and there is often a double acquisition strategy (kid - parent). However the digital banking adoption has considerably increased over the last decade, and both targets are more inclined to subscribe to this kind of banking service.

To improve my work, please tell me how you felt about this issue!

Previous issues (wait, there’s more!)

🕑 Give it some credit | Market Review #18 Buy Now, Pay Later

💵 Cash Management for SMEs | Investment Memorandum #2 Agicap

✈️ Sorry, that’s excluded | Market Review #8 Travel Insurance

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️