Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Following my market review on sustainable finance two weeks ago, I’d like to spend some time on a fintech which is launching in this market.

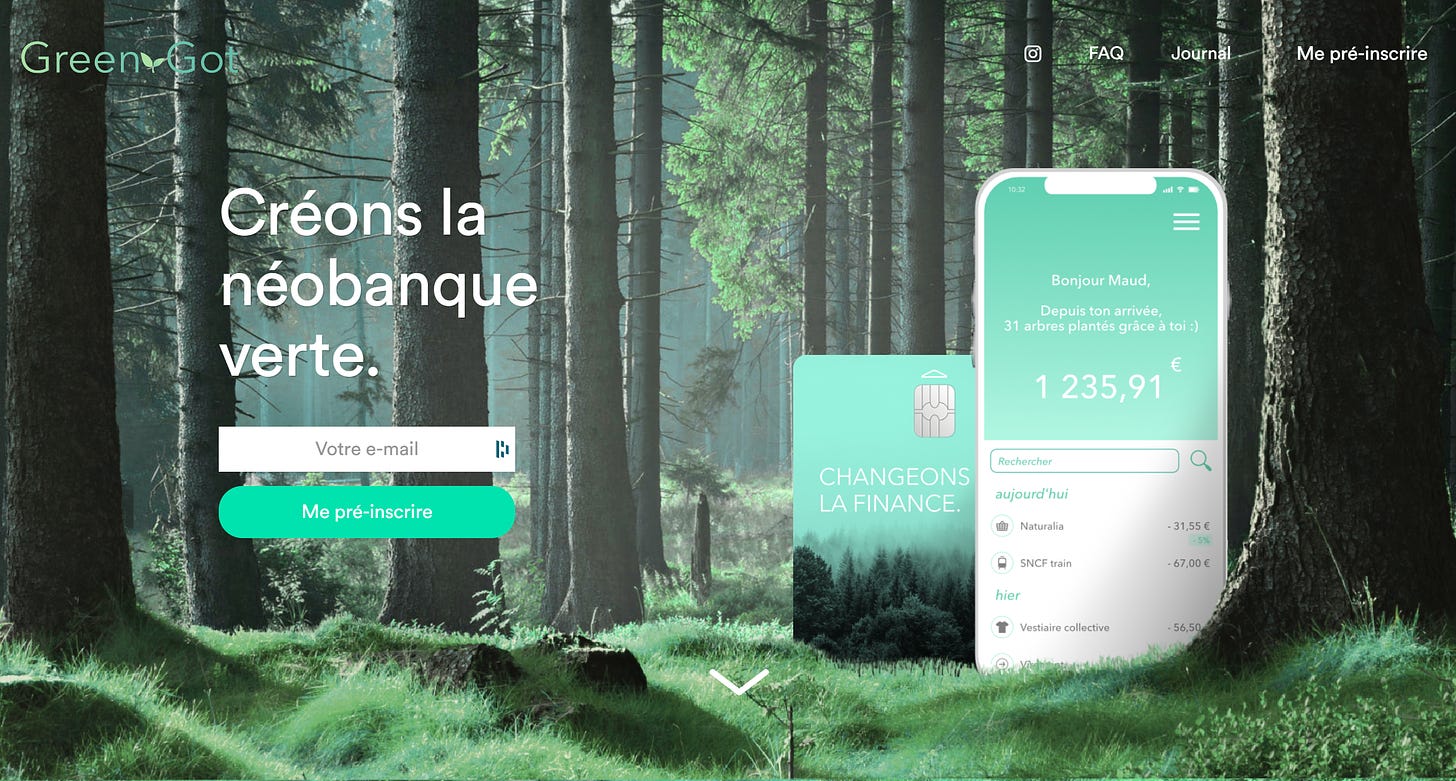

The analysis is about a neobank called Green-Got. It belongs to a new generation of verticalized neobanks (just like Kard for the teenagers) which is focused on a growing niche: those who want to reduce and offset their carbon footprint and finance environmental projects.

Here comes the memorandum ride, get in there!

Disclaimer: I’m not completely unaware of what’s happening from the inside as I spoke with Maud a month ago. Yet I have my own point of view on their business ✌️

Summer issues will be much lighter then regular ones. One hour tops!

The Memorandum

The company has not launched yet but has planned to be live by the end of the year.

Feel free to join the waiting list! (Already 4000 people waiting)

___________________(👎: Problem | 👍: Awesome | 🤔: Question) __________________

Need

Millennials are fighting for a more sustainable world, changing the way they live and what they consume. While traditional banks keep supporting fossil fuels industries.

This highlights a growing divergence between customer expectations (#1 in France being the environment) and incumbents actions. The young customers are looking for easy and efficient ways to have a positive impact on the planet. And as your bank account is (most probably) your first source of CO2 emissions, new players are here to help you reduce and offset your carbon footprint.

👍: I think it’s a great time to market as fissures have emerged since the global financial crisis between the banking system and an increasingly skeptical general public. Sustainability and green finance awareness are now spread around the world, and a wide range of projects has been launched

🤔: Transparency is the key is this new market. Green-washing can be pointed out if there a lack of explanations. Certain things (eg. the reforestation program) about the GreenGot offer are still unclear (logic we are pre-launch). Be careful about that!

👍: Green-Got’s commitment to social and environmental values differentiates it from major financial institutions that offer a “commodity” banking product.

Market

They are targeting the millennials as they are, in proportion, those who care the most about sustainability.

In Europe, there are 90M millennials and usually, the ARPA for a neobank is around €140, so roughly they are targeting a 10Bn market.

🤔: They aren’t the only neobank in this market, and some of them have a very distinct approach (in terms of marketing, value proposition, partnership, license, .. ). The product-market fit has to be proved.

👍: Incumbents are built on carbon assets investment strategies. Changing their investment strategies would take years. The time to market seems great, especially since fintech enablers are largely developed, allowing to reduce the go to market of those green neobanks.

Product

From what I learned, the Green-Got app will include:

Account Overview: The essential of banking in a quick snapshot

Impact Overview: Discover Green-Got’s latest benefits (possible brand partnership) & monitor your impact (an interesting model similar to Aspiration?)

Investment Dashboard: A dedicated section to manage savings.

🤔: It still not clear for me how the market will react to the investment features. Of course, green investments are now closing the gap in terms of ROI. But I’m still surprised to see greediness overtaking convictions

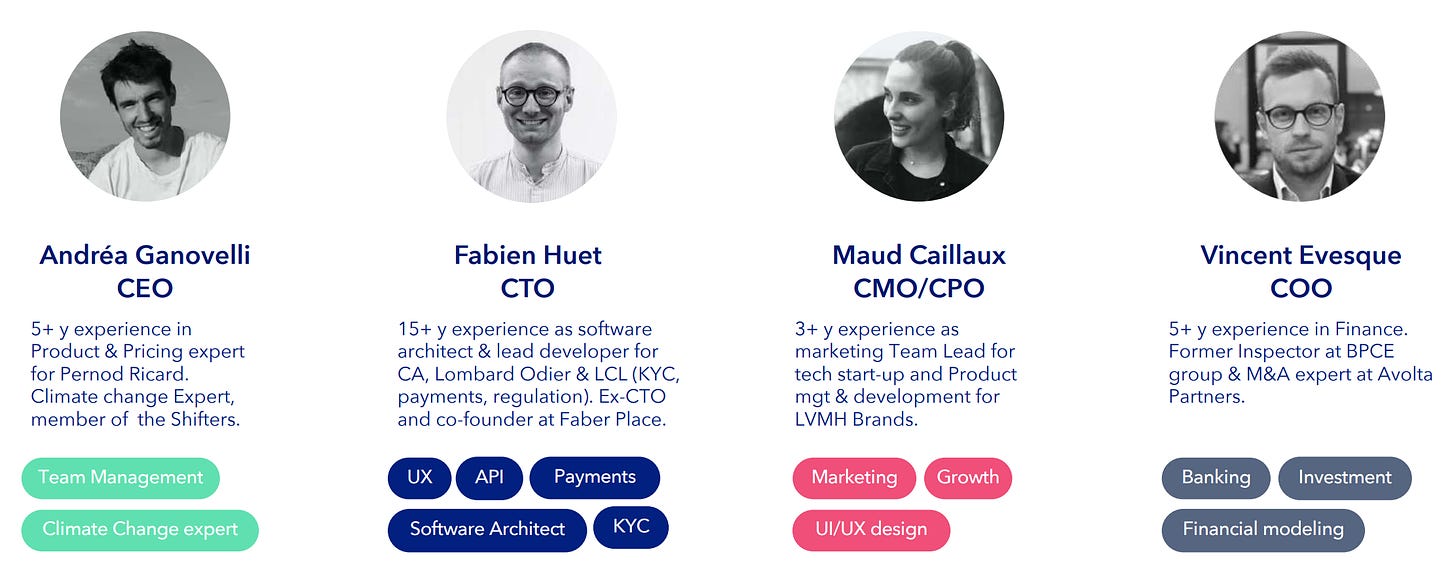

Team

👍: A great team sharing environmental concerns and finance, tech, and marketing expertise. Can’t wait to see it rolls

Competitors to watch closely

Of course, I’m most probably missing a lot of companies. Please, ping me to discover them. I’ll keep updating my Sustainable Finance Landscape :)

Would you invest in the company?

I’m interested in having your opinion about the company :) What do you see as an opportunity and what are the challenges?

Previous issues

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

🏘️ I’m in love with the condo | Investment Memorandum #5 Matera

+ News of the week

See you next week 👋

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️