Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Too long, didn’t read/listen?

#1 - Open Banking to Open Finance

The PSD2 and Open Banking regulations broke open the silos around an important part of banking: payment accounts. To have a full picture of a person’s financial status or for truly sophisticated financial services, however, more financial information and access need to be included.

Open Finance, like Open Banking, is built on the concept that data provided by customers should be controlled by them. It takes this idea and seeks to apply it far more widely.

UK’s financial regulator, the Financial Conduct Authority, considers that Open Finance will promote the development (or the improvement) of services to the benefit of consumers and businesses. It will do this by strengthening competition, customers’ financial capability and help improve inclusion for the disadvantaged or less affluent in society.

Open Finance has potential in the following areas:

Personal financial management dashboards

Automating switching and renewals

New advice and financial support services

More accurate creditworthiness assessments

..

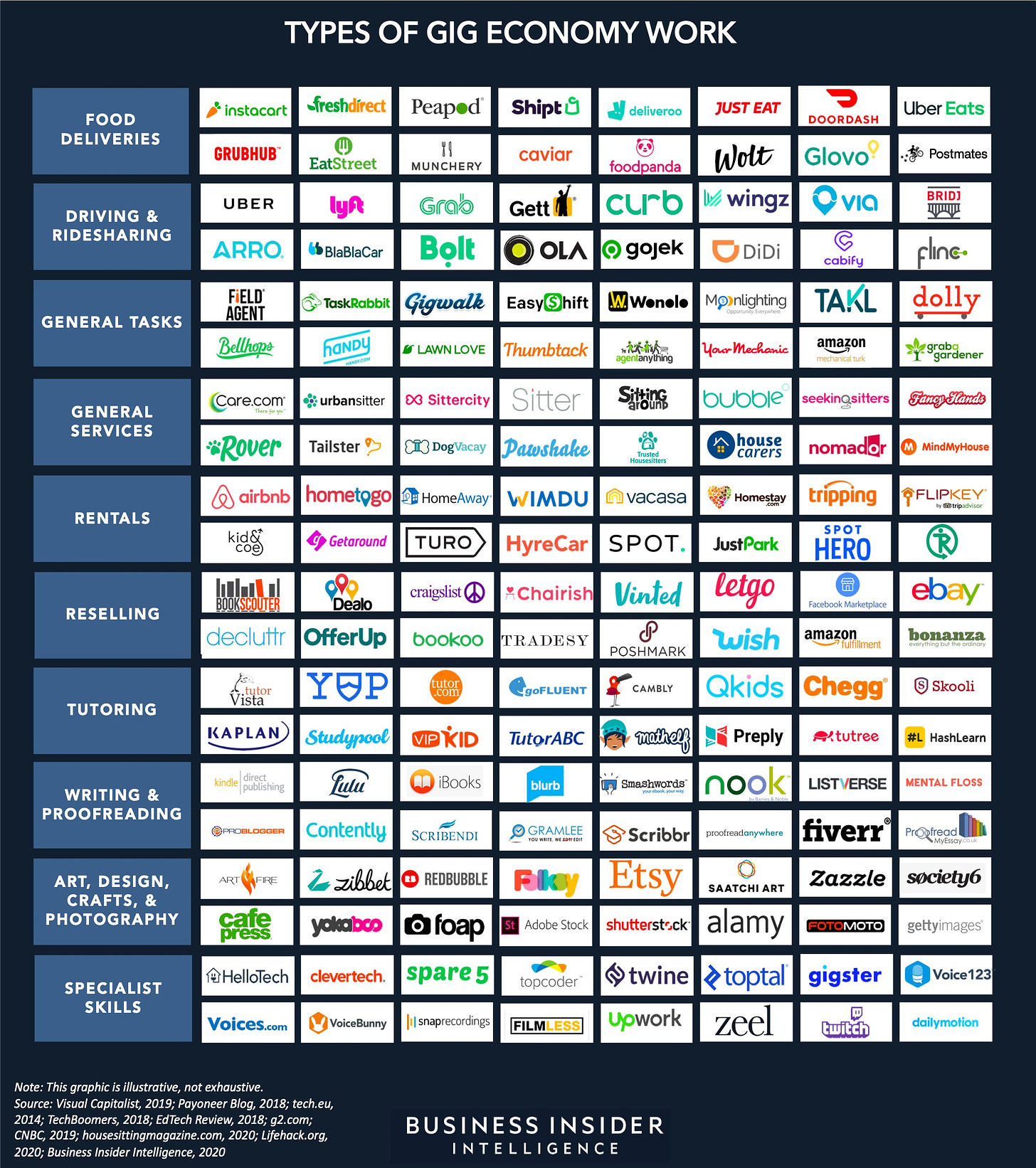

#2 - The Gig Economy Financial Services Ecosystem

Gig workers around the world are especially hit by the current crisis. They’ve always struggled to have access to many mainstream financial products and services because of their inconsistent cash flow and lack of substantial credit history.

Yet, Fintech for gig workers is the next big untapped market (estimated to be worth $455 billion by 2023). In fact, the combination of the large and underserved demographic and its struggles under the pandemic has led to a wave of innovation from across the financial services industry, resulting in an emerging and dynamic gig economy financial services ecosystem.

Nb: Just look at the figures. Half of the US population is expected to gig by 2028, and 50% of UK workers are expected to do gig work by the end of 2020

Some startups in this ecosystem:

Portify, a London fintech startup that offers an app and various financial products to help gig economy workers better manage their finances and in turn improve financial well-being

Zego, a pay-as-you-go insurance provider for delivery drivers

Tapoly, short term public liability cover for gig workers and the sharing economy

Anna (Absolutely no-nonsense accounting), Provides small businesses and freelancers with a business account and debit card, as well as invoicing and tax support

WithJack, Monthly business insurance for freelancers, protecting against mistakes (for example a wedding photographer whose clients end up unhappy with the photos), clients who don’t pay and data breaches, among other things.

..

A snack between two meetings

Accountant 2.0

Last week, Open AI released (in beta) their new language generator GPT-3. This is for many, an incredible look at what the future can be. The AI language is extremely coherent, you basically prompt it something and it will generate a plausible answer.

Since the limited release, some have played with the API and successfully generated short stories, songs, press releases, technical manuals, and more .. The use cases keep increasing, just check twitter :)

Here I wanted to point out a Fintech application from Yash. He simply prompts “I put $20000 in cash into the business” and automatically, the language is turned into a python code that updates the balance sheet. Coooooool!

What’s the name of your Fintech again?

After its “Hi! My name is (what?)” series published in 2018, Gabrielle gives an updated approach of fintech & insurtech branding trends over the past decade.

Great read! It’s amusing to see similarities in branding. Here are a few things I noted:

Similar to baby names, startup names experience fashion trends. Following the hype for names ending with -eo or -ea in recent years (eg. Léo, Léa, Théo, Matéo, .. ) fintechs did the same (Leocare, Pleo, Bdeo, Tonteo, Libeo, .. )

Many vegetable names appeared for Insurtech and Fintech startups: Pumpkin (FR), Mangopay (FR), Leetchi (FR), Abricko (SP), Plum (UK), Lemonade (US), Kabbage (US), Goji (UK), Advocado (US), Lemonway (FR), Raisin (DE), ..

Happiness therapy. A lot of fintechs aim at making their users’ life easier. Hence, some of them embody this idea in their name: Happypal (FR), the Yapily (UK), the Lovys (FR-POR)

..

More Reads

Did I miss something huge?

There is a lot happening out there in Banking, Fintech, Financings, Exits, M&A, ..

If there is something worth reading, Do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :))

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

🖼️ Culture is the new asset | Investment Memorandum #6 MasterWorks

🏘️ I’m in love with the condo | Investment Memorandum #5 Matera

+ News of the week

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it ✌️