Hi, this is Clément from HUB612👋

You may have noticed by now, each week I try to cast light on different topics related to Fintech & Insurtech through 1) Market Reviews 2) News of the week 3) Investment Memorandum.

I hope you find it usefull, Do let me know your thoughts by replying to this email :)

Too long, didn’t read/listen?

#1 - Wirecard hits UK Fintech but Baas is still Booming

64 min podcast

This has been largely discussed online over the past weeks/months, Wirecard filed for insolvency. Yet, this episode put a timeline on the event of this massive blow in the Fintech industry. Briefly :

Wirecard is a payment processor used by some of the wells know fintech in the UK (Former clients included Monzo, Revolut, .. // Current clients: Curve, Equals, Soldo, ..)

2008: German shareholder Association published two suggestion of Wirecard balance sheet irregularities ⇒ EY was appointed to conduct special risk audit

In 2011 through 2014, Wirecard raised more than 500 M and start buying up paiement companies ⇒ Wirecard gained interest by investors

2015: Financial Time began looking in the inconsistency of those group accounts

2017: Clean audit from EY

Oct 2019: FT published documents indicating that profits in Wirecard units were fraudulently inflated (+ EY didn't know they exist)

28 April 2020: KPMG audit report is published, the firm cannot verify Wirecard's third party profits (See more from Financial time)

June 5th, 2020: Police office search in Munich (criminal investigation over the CEO and 3 board members)

18th June: Wirecard was supposed to publish the audited results from 2019

=> 1.9Bn$ were missing

19th June: Wirecard CEO resigns

22nd June: declare a potential fraud

26th June: FCA close down Wirecard UK before Wirecard files for insolvency

And it continues! For a more detailed timeline, check => Fintech Insider Live

The podcast gives the microphone to Daljit Singh (Co-founder at Anna Money) and Emily Nicolle (COO at Curve) who were Wirecard clients. Here’s a summary of their thoughts:

This is a sudden and unexpected massive blow for the Fintech industry

Not to rely anymore on Wirecard, startups worked more than ever to redesign their product infrastructure, close deals with other partners to be able to provide the same service to their existing clients. Even today, Emily mentioned that their refund feature is not fully functional but this event pushed an entire product redesign

They played transparency, informing customers in a small language and reacting quickly

This will reshuffle the cards for the BaaS providers. Without this big player, there will be more competition among the challengers (Ayden, Checkout, .. ). This will be cool for the end-customers as better offers will be developed.

There will be increased costs of insurance around solvency and probably more audit costs in this industry.

The regulation is going to change. Payment is a web of multiple partners (an entanglement actually), regulation has to evolve in this complicated industry but should not hinder more innovation

#2 - Behavioural finance and gamification - FR

34min podcast

I recently e-met Solenne, a former private banker now (podcast) entrepreneur & startup advisor, and we talked a lot about our ongoing projects.

She recently launched Finscale, a podcast that sheds light on innovations in the world of Finance, Banking and Insurance. Go check this out :)

In this #5 podcast, we meet Tiphaine Saltini, CEO and co-founder of NeuroProfiler.

Neuroprofiler is a behavioural finance game that enables financial advisors to better assess the risk profile of their clients in order to respond to regulatory and know-your-customer issues

The whole value proposition is based on cognitive sciences (neuroscience, philosophy, sociology, .. ) => Understanding human to model his behaviour. It’s a new science, not so much popularized and not taught at all

When you invest, there is a bunch of cognitive bias that distract us from optimal solutions (we’re not rational)

Here a few biases in behavioural Finance:

Risk aversion

The value of a risky investment may be diminished in the eyes of an investor by the very presence of risk, which could result in losses. As a result, the investor will prefer the certainty of a smaller gain to a larger but random gain.

Retrospective bias

It is the tendency to rationalize an unforeseen event after the fact and consider it more likely or predictable than it was before it occurred. It can be summed up by the phrase "I knew it all along! "which expresses a subjective impression

Confirmation bias/selective memory

Confirmation bias is the tendency to focus on information that confirms a pre-existing thought. It refers to selective thinking, where someone tends to note and look for what confirms their beliefs, and to ignore, not look for, or underestimate the importance of what contradicts them.

Etc .. There a lot more bias!

A snack between two meetings

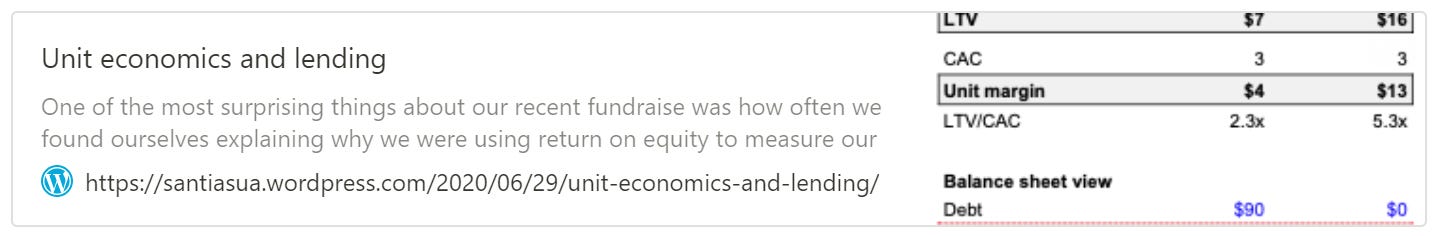

Unit economics and lending

3min read

How to get a full picture for a lending company or any company that has to use its own capital to transact?

This article gives you the right example to illustrate that LTV/CAC isn’t enough. Indeed, when looking at how much profit do you get for every dollar you put to work and how many dollars you need to get to a certain absolute level of profit, you realize that:

Lending companies need a lot of capital to scale

Valuations suck for lending companies

One metric suggested by the writer to get a better view of the business is Return on Equity (=Unit Margin / Equity). For an early-stage company, an appropriate ROE for your lending product is at least 25-35% (Meaning, for every dollar put to work in a loan it gets 25-35 cents back).

Demystifying the payments ecosystem

3 min read

Are you curious about what happens when you pay with a credit card to buy goods from a business?

In a few seconds, different players are involved from the capture and authorization to the clearing and settlement. It is a complicated task to map these players as their value proposition often overlaps with each other. Yet the writer perfectly summarised how payment is being processed.

On top of that, it is interesting to understand specific scenarii where, for instance, an item needs to be returned. You can wonder, where is the money?

More Reads

Did I miss something huge?

There is a lot happening out there in Banking, Fintech, Financings, Exits, M&A, ..

If there is something worth reading, Do let me know by replying to this email :)

See you next week 👋

If you enjoyed this, maybe I can tempt you with my Fintech newsletter. I write a weekly email full of market review, investment memorandum and news of the week :)

If you’ve enjoyed it please show some love to the thread on Twitter❤️

Previous issues

📧 I’m clement.parramon@hub612.com and @cparraam is my Twitter

Ps. If you like what I’m doing with Parram please feel free to share it on your social network of choice. Also, I’d appreciate it if you forwarded this newsletter to a friend you think might enjoy it✌🏻